Where should you focus your wealth management practice now to ensure your future success – your growth, your valuation and your lifestyle? Four unstoppable industry trends provide the challenge and the following pages offer the strategy.

Trend 1: Organic wealth management growth is stalled – primarily because of aging clients who own ¾ of industry assets.

Opportunity: Retain Generation 1 clients – effectively and efficiently.

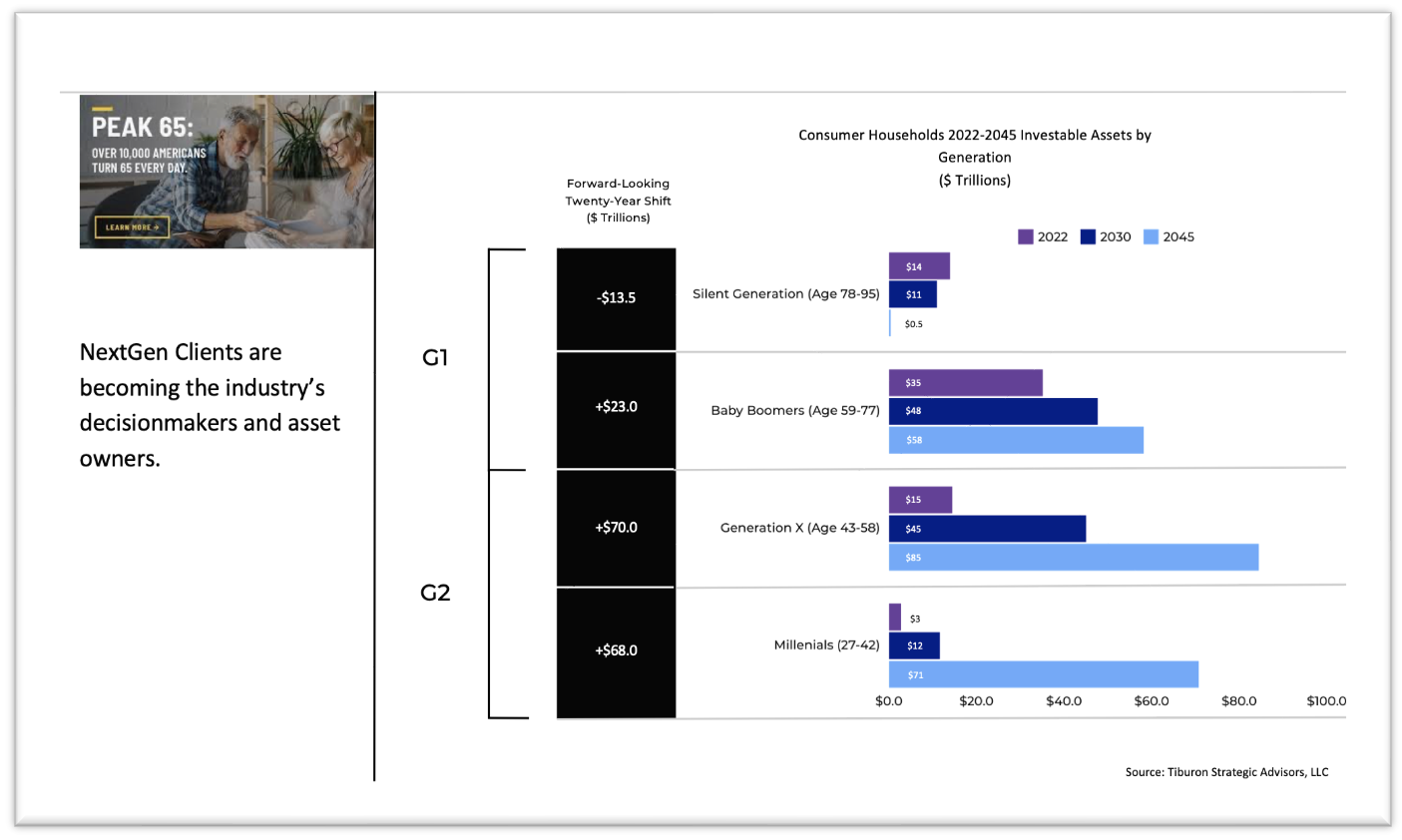

Trend 2: Future organic growth is dependent on the ability of financial advisors and their firms to engage with NextGen clients – primarily Gen X and Millennials…who are learning and have different habits, preferences and concerns.

Opportunity: Engage Generation 2 – as well as unengaged Generation 1 survivors.

Trend 3: Engaging Gen X and Millennials means doing right by G1 and leaning into their needs for protection, longevity planning and care while they’re living the experience.

Opportunity: Grow the practice by including products and capabilities that protect clients.

Trend 4: There’s urgency to guard clients and their families from the more challenging stages of retirement – especially when faced with physical and/or cognitive health issues. There’s also urgency to protect advisory firms whose clients can no longer make good financial decisions.

Opportunity: Protect aging clients, their families – as well as you and your practice.

Advisor 2030 – more detail:

Organic growth of wealth management increasingly means providing services in support of healthy, independent and dignified longevity planning. The traditional head of house Gen One (G1) client is being replaced by G1 spouses/partners and adult G2 children focused on maximizing independence and minimizing financial trade-offs – creating urgency around engaging these G2 clients to retain current assets and earn the right to consolidate households for growth. Advisors and firms leaning in to these trends can earn significant market share and organic growth.

Trend 1

Organic wealth management growth is stalled – primarily because of the long-awaited aging Baby Boomer cohort.

Welcome to PEAK65 in 2024 more Americans will turn 65 than in any other year. Together with The Silent Generation, Boomers own 74% of investable assets and generate an even greater percentage of wealth management industry profits. Their focus on saving and investing primarily for retirement has made these clients relatively low maintenance – until now. The complexity of “retirement” increases demands on advisors and firms to provide a broader array of services at a scale not supported by most advisory practice staffing. We estimate the typical full service advisory practice has capacity to deliver a full array of retirement services to only 1/3 of its current clientele.

Trend 2

Future organic growth is dependent on the ability of financial advisors and their firms to engage with NextGen clients – primarily Gen X and Millennials.

Advisory firm revenues depend on aging clients yet most financial advisors are not connected to the spouses, partners and family of those clients. The illustration below aligns the revenue of a top advisory practice with the ages of its clients. Clients older than 80 generate more than 2X the revenue of clients younger than 60. Without significant growth of the Gen X and Millennial cohorts, this practice will continue to experience net outflows, lower revenues and reduced valuation.

Trend 3

Engaging Gen X and Millennials means doing right by G1 and leaning into their needs for protection, longevity planning and care while they’re living the experience.

Retirement is a family affair, particularly as G1 heads of household have to engage their successor decision makers in G1 and G2. This transition – often through a health event – presents an opportunity for advisors to engage with clients’ families. G1’s longevity planning is revealed, with new awareness of the value of planning for the younger relatives. Advisors who can leverage this awareness can earn Gen 2 clients.

Of note, one of the industry’s largest advisory firms reports that advisors who provide protection products to clients earn 100% more annual revenue growth and 4x the net asset flows of advisors who do not use those products.

Trend 4

There’s urgency to protect clients and their families during the more challenging stages of retirement – especially when faced with physical and/or cognitive health issues. There’s also urgency to protect advisory firms who have clients that can no longer make good financial decisions.

Solving only for the financial needs of retirement overlooks the need to include health, healthcare, caregiving and other aspects of longevity planning. These needs converge as aging clients lose physical and cognitive ability to live safely. Families may have financial resources but are unprepared to provide the needed actions and support, such as providing alternative care or living options.

Given the unprecedented longevity of Americans, many families are simultaneously providing financial or caregiving support – or both – to aging relatives who are increasingly vulnerable to conditions preventing them from aging in place.

Advisors need to head off the inevitable impact of more difficult aging stages which, without remediation, lead to the loss of G1 assets and pre-empt the potential for engagement with G2 and G3. There is also a significant potential risk to the advisors and firms who have clients that lose their cognitive ability to make sound financial decisions, which leads to increased investment errors as well as more serious financial fraud and elder financial abuse.