Written by: Eric Franco and Ajit Ketkar

Real estate stocks posted a sharp recovery this year, despite disparate effects of the pandemic on different property types. Improving trends in key US market segments show how investors can gain confidence in property stocks as a diversifying source of solid long-term returns and an effective hedge against inflation.

After a difficult 2020, real estate stocks powered back in 2021. The FTSE EPRA NAREIT Developed Index surged by 18.6% this year through November, in US dollar terms, outperforming the MSCI World Index, which advanced by 16.8%. This year’s gains follow the real estate index’s 8.8% decline in 2020, as the sector was punished by the effects of the COVID-19 pandemic.

While questions still hover over the sector, this year’s gains reflect growing evidence that the impact of the pandemic hasn’t been nearly as bad as feared. In the US, which accounts for 60% of the global real estate index, demand has fully recovered in most sub-sectors. In fact, vacancy rates are now very low in residential and industrial property, and even in the hard-hit retail sector (Display). Looking at the underlying trends can help us map the recovery drivers to watch during year three of the pandemic.

Work from Home and the Apartment Boom

The many changes in business and consumer behavior triggered by the pandemic are affecting real estate. Work-from-home (WFH) policies have become pervasive and are expected to persist even after COVID-19 is behind us.

What does that mean for US residential property? Last year, investors feared that fallout from the pandemic would quash demand for rental apartments. Surely, more people working from home would need more space, flock to the suburbs and boost demand for single-family homes. But market trends are rarely one-dimensional. In the end, an acute shortage in US housing supply in recent years was the more important market factor, fueling demand for rental apartments and single-family homes alike. What’s more, housing supply has been particularly tight in the affordable segment of the market, where buyers often opt for rental apartments as an alternative.

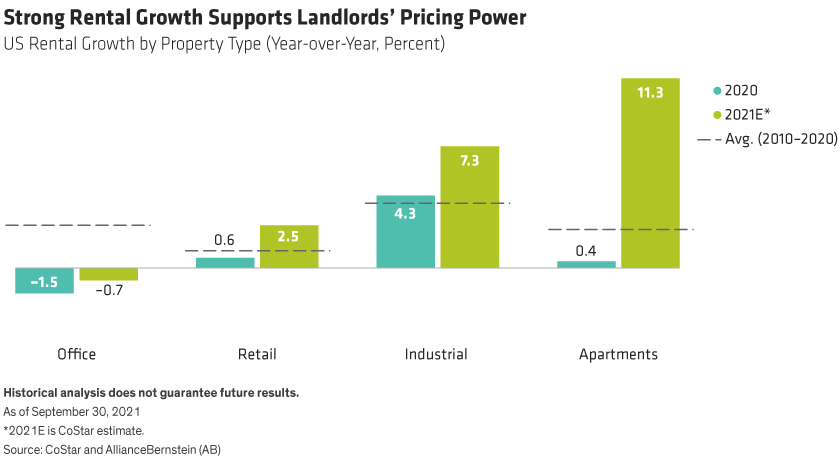

Demand for apartments is shifting. More Americans are moving from expensive US coastal cities to more affordable sunbelt cities in the south. These trends are supporting historically strong rental growth (Display) and occupancy rates in the US residential sector—and giving landlords more pricing power than expected when the pandemic began.

Empty Offices Threaten Landlord Earnings

For office owners, the WFH revolution has rattled a once-stable business. Yet even as millions of workers no longer commute to the office, the earnings of landlords haven’t yet been hit too hard because of long-term leases and the creditworthiness of large tenants. Actual physical utilization, however, remains well below pre-pandemic levels.

Will office occupancy pick up in the coming months? It’s hard to say, as ongoing waves of the coronavirus entrench the WFH culture and hamper many companies’ return-to-office plans. Clearly though, the US commercial real estate landscape is shifting dramatically. And future office demand is likely to weaken, especially in the large, expensive coastal markets. This process will take years to unfold.

Industrial Property Sees Surge in Demand

In contrast, the acceleration of e-commerce is already generating booming demand for industrial real estate companies, which provide logistics and warehouse facilities.

With supply chains disrupted, many businesses have been seeking to fortify inventories and reconfigure manufacturing and distribution to be closer to customers, pushing up demand for industrial facilities. The increasing popularity of e-commerce has also become a catalyst for last-mile logistics facilities positioned to serve the huge populations along the US coasts.

To be sure, parts of the US retail real estate market remain mired in uncertainty. And the lodging sector, which has enjoyed a recovery of leisure travel, is still suffering from extremely weak business travel. Revenues may not fully recover for years, though companies are creating operational efficiencies to adapt to the new environment.

A Diversified Inflation Hedge

But weakness in these areas shouldn’t overshadow the substantial pockets of strength within US real estate. In addition, property stocks provide access to real assets that tend to do well when inflation rises because real estate owners can charge higher inflation-adjusted rents for long-lived assets—land and existing buildings—that are already owned. Inflation also drives up the cost to develop new properties, which in turn constrains supply growth. Real estate landlords can then charge higher rents as property fundamentals tighten.

Investors should actively target real estate businesses with strong fundamentals while monitoring the knock-on effects of the pandemic. With a portfolio of diversified property stocks, we believe investors can benefit from a measure of inflation protection as well as attractive, diversifying return potential for the next stage of the recovery.