Written by: Monika Carlson

Building a bond portfolio these days isn’t easy. Interest rates have been volatile. Credit spreads are tight. And sweeping change in US fiscal, trade, and regulatory policy is underway. We think securitized assets deserve a closer look.

Mortgages and other securitized bonds may help to diversify portfolios that include a healthy mix of interest-rate and credit risk. They may also make it easier to capitalize on the policy and regulatory changes on the Trump administration’s to-do list.

Attractive—and Less Correlated—Return Potential

The short-duration nature of select mortgage debt and collateralized loan obligations (CLOs) may help to reduce correlation to other fixed-income assets, including government and investment-grade corporate debt.

This is important, because while the Federal Reserve seems likely to reduce rates again in 2025, we think the pace of easing may be slower and more uneven than might have been expected a few months ago—and rates may settle at a higher level than we’ve seen in recent cycles.

The Fed’s reticence is understandable: recent history has left policymakers and markets sensitive to any sign of rising prices. And some economists worry that lower marginal tax rates, tariffs and reduced immigration—all priorities of the new administration—could increase growth and push prices higher.

Average yields on select securitized assets are competitive with those on high-yield corporates, while their duration may be shorter. And residential mortgages in particular are exposed to US consumers at a time when household balance sheets are strong. Corporate fundamentals, while still solid, are starting to weaken.

What’s more, various types of mortgage-backed debt, including agency mortgage pass-through securities as well as credit risk transfer securities (CRTs) issued but not guaranteed by US government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac, have exhibited low correlation with high-yield corporate bonds (Display, left). Meanwhile, a blend of securitized assets has also exhibited low correlation to US government debt and investment-grade corporate securities (Display, right).

Securitized Assets Offer an Alternative to Cash

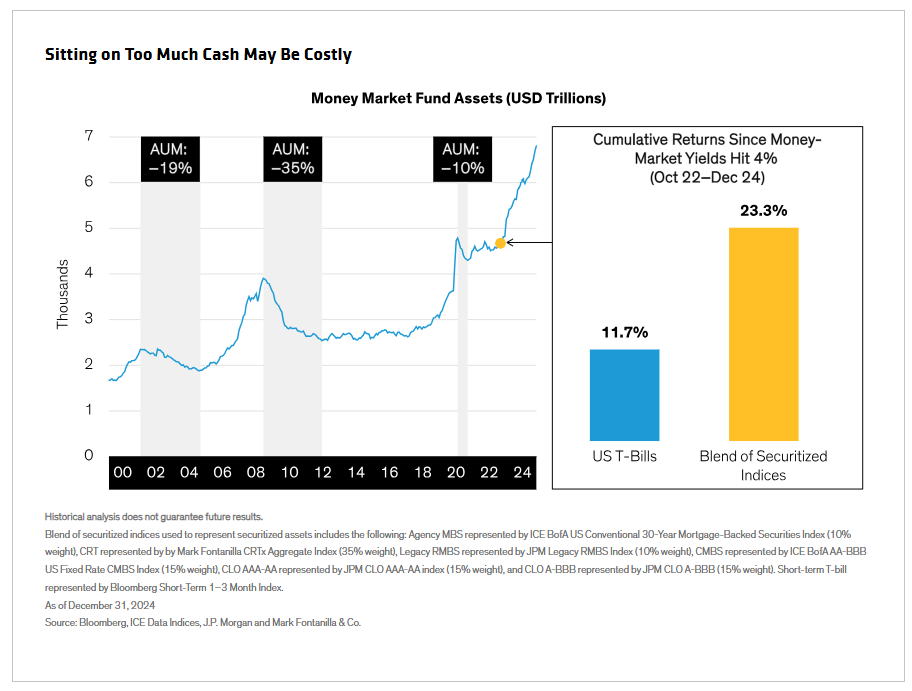

With the Fed now in easing mode, cash has lost some of its luster. We think securitized assets may be a good substitute for investors who want to reduce sizable cash holdings that many investors began building up in 2022 when short-term interest rates soared. By the end of 2024, money market fund assets had surged to nearly $7 billion.

For those still on the fence, it may be interesting to learn that a diverse blend of securitized indices returned 23.3% between October 2022 and December 2024. The Bloomberg 1-3 Month Treasury Bill Index—a common proxy for cash—delivered 11.7% over the same period (Display).

A Way to Capitalize on Deregulation

We think the Trump administration is likely to put its weight behind a less stringent regulatory framework. The Fed has already outlined plans to ease the capital requirements to which US banks were originally committed in the Basel III regulations, the latest proposal in a set of international banking rules designed to ensure that banks have sufficient capital and liquidity to withstand shocks and maintain financial system stability.

Less punitive rules would leave US banks with more capital to invest, and we believe a healthy share may find its way to high-quality securitized assets.

Potential GSE reform may also be on the table. While privatization of Fannie Mae and Freddie Mac—long a priority for Donald Trump’s Republican party—would likely take years, we wouldn’t be surprised to see the agencies begin building up capital ahead of a potential exit from conservatorship. If that happens, we expect CRT issuance to decline, potentially benefiting valuations.

Determining the Right Mix of Securitized Assets

So how might it all work in practice? Between April 1, 2020—shortly after the start of the COVID-19 pandemic—until the end of 2024, combining exposure to the Bloomberg US Aggregate Bond Index and a blend of securitized indices would have increased return while reducing volatility (Display, left). Substituting the Bloomberg US Corporate High Yield Index for the Aggregate (Display, right) would have produced a similar result.

The precise nature of such a blend will vary based on individual objective, risk tolerance and other factors. But we think a dynamic approach to all three assets is worth considering.

Investors today have plenty to think about. The path of growth and inflation are not crystal clear, and the potential for significant policy changes adds new wrinkles to the outlook. But in our view, these conditions make it a good time for investors to review their strategies. The way we see it, investors who are underweight securitized assets today may be missing out on attractive diversification and return potential.

Related: California Wildfires & Municipal Bonds: An Opportunity for Impact Investing