Written by: David Stonehouse | AGF

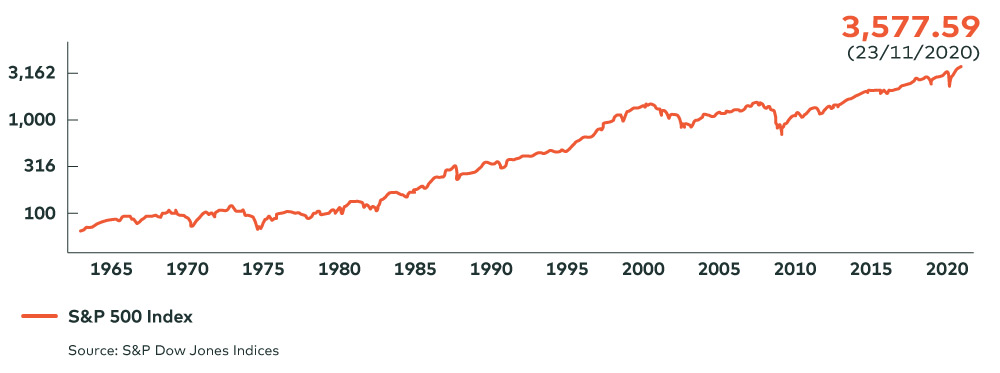

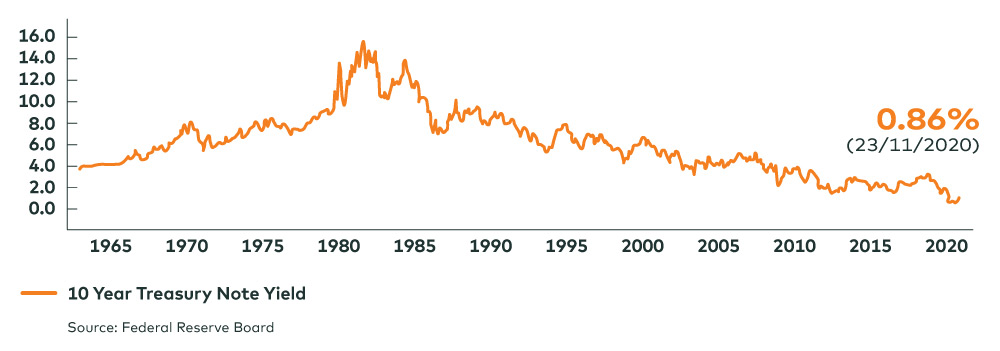

Long bond yields are rising, and equity investors might well be getting worried. The yield on 10-year Treasury notes rose by about 20 basis points (bps, or 1/100ths of a percent) in the first week of 2021, a remarkable increase that followed a 40 bp rise over the previous five months. Real yields are still in negative territory, but they have also risen. As we discussed in previous posts, a cyclical bear bond market is likely underway, and we might well be seeing more signs of that right now.

Why might this concern stock investors? Well, in theory at least, equity valuations should go down if rates rise, for a few apparently valid reasons. As yields rise, bonds should become more competitive for investor dollars. in addition, the discount rate applied in cash flow analyses will rise, lowering stock valuations. Furthermore, for companies, interest expenses go up and take a bigger bite out of earnings. More generally, economic activity should slow as rates rise and the cost of borrowing goes up. Given all those factors, one would think rising rates would be a big negative for equities.

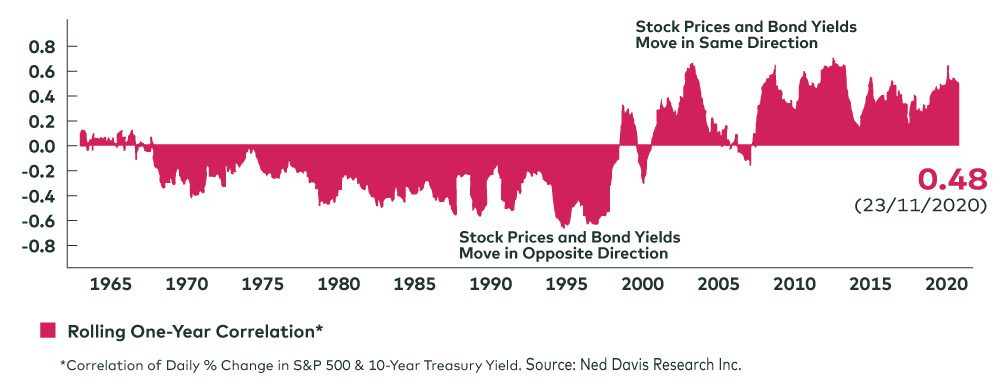

Bond Yield/Equity Price Correlations

Source: Ned Davis Research, 2020

Yet the fact is, sometimes they are not, as has generally been the case for the past 20-plus years. Indeed, based on our reading of the historical data, rising rates in recent years have on average been good for stocks. Since about 1998, there have been only a handful of significant periods during which real bond yields and stock prices had a negative correlation (that is, rates went up while stocks went down, or vice versa). Two of those occurred during downturns – the mini-recession of the early 2000s and the Great Recession of 2007-2009 – and even then relatively briefly. For most of the rest of the past two decades, equity prices have been positively correlated with rates, tending to rise when yields rise and falling when they fall.

One can look at this phenomenon as the financial-market corollary of Gibson’s Paradox, the gold-standard-era observation that consumer prices rise as interest rates rise, which contradicts Keynesian economic theory. Whatever you call it, however, the evidence is clear. And it comes in several forms, including measures of stock market sentiment. For instance, if rising yields were indeed a threat to stock valuations, you would expect volatility – a classic indicator of investor fears – to be positively correlated with rates. But it’s not. The so-called “fear gauge,” the CBOE volatility index, or VIX for short, has in fact been negatively correlated with rates. Rising yields, then, tend to make equity investors feel better.

Why? In a low-growth economic environment, it could be that stock investors embrace rising yields as an indication that the risk of deflation is abating. Or – and this is perhaps particularly applicable to the current environment – they see higher rates as a sign that things are getting better in the world. After all, yields tend to fall in response to a perception of rising downside risk, which is obviously a negative for stocks.

We noted above that this correlation between rates and stock prices holds, but within certain limits. How close are rates now to those limits? Not very. Research by Renaissance Macro suggests that stocks and rates begin to move in different directions only when the 10-year Treasury yield approaches 4%. And even when 10-year yields have been in the 3%-5% range, six-month forward equity returns have turned negative only when rates approached the top decile of three-year movement. At about 1% now, the 10-year yield clearly has plenty of room to rise before any kind of correlation inversion should kick in.

What about sudden increases in rates? Our analysis suggests that when real yields move rapidly up by relatively modest amounts (40 bps or less), the stock market response is largely benign. We looked back over the past 20 years and found that 10-year Treasury yields have risen by more than 15 bps in a month a total of 45 times. During those months, the S&P 500 index was negative only 11 times, and in six of those periods, 10-year yields were already above 4%. The correlation works both ways, as well. Over the same 20 years, the S&P 500 has fallen by more than 3% in 31 months – and in 26 of those, yields were also falling. Of the remaining five months, two occurred near the end of the 2018 Federal Reserve hiking cycle, and three were during the Great Financial Crisis.

We can also look to credit performance during periods of rising real rates, since what’s true for credit is generally true for stocks. What we find is that credit spreads (a positive) tend to tighten when real rates (i.e., nominal rates adjusted for inflation) are changing mildly, either negative or positive. It is only when rates change by approximately 40 bps or more in a short period that credit suffers.

What appears to matter to stock markets more than yields is monetary policy. If central banks are loosening money supply, or easing rates, or simply not changing anything, then stocks tend to do well. And when both monetary and fiscal policy are accommodative, stocks tend to do very well indeed. This is not to say that a sudden, sharp increase in yields could not cause a problem for equity valuations, especially if such an increase causes the Fed to change tack and begin tightening.

Barring such an event, however, it is hard to see much reason for equity investors to be concerned about rising yields given their current low levels and relatively modest trajectory. There might even be reason for optimism. If more accommodative fiscal policies – in the United States in particular – meet already-accommodative monetary policies, stocks could experience a further tailwind in 2021, as long as the pace of rising yields remains moderate.

David Stonehouse, Senior Vice-President and Head of North American and Specialty Investments, AGF Investments Inc. is a regular contributor to AGF Perspectives.

To learn more about our fixed income capabilities, please click here

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies.

The commentaries contained herein are provided as a general source of information based on information available as of February 1, 2021 and should not be considered as investment advice or an offer or solicitations to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Investors are expected to obtain professional investment advice.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is a registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

™ The “AGF” logo is a trademark of AGF Management Limited and used under licence.