Written by: Daryl Clements

As the US economy reopens, investor optimism has sown concern about rising interest rates and higher inflation. Yields for the bellwether 10-year US Treasury have already climbed to levels last seen in January of 2020.

Rising interest rates haven’t impacted municipal bond yields as much, though. Average yields on 10-year AAA muni bonds rose less than half that of Treasuries year to date and hover just below 1%. Municipals have outperformed as a result, with the Bloomberg Barclays Municipal Bond Index returning 0.68% versus (3.25)% for the Bloomberg Barclays US Treasury Index for the year through May 7, 2021.

Net inflows into muni bonds have been at a record pace and positive for 50 of the last 51 weeks, according to Morningstar. Considering the broader risk-on sentiment across other asset classes, $43.5 billion in muni inflows year to date is remarkable and speaks to the sector’s persistent appeal.

Unpacking Muni Momentum: Current and Lasting Drivers

Although not immune from rising yields, municipals remain attractive due to a combination of prevailing tailwinds and long-term fundamental strengths.

Supply and demand dynamics are especially favorable and should help support muni prices in the near term. And even though new issuance is higher now than it was at this point last year, the continued strong demand is more than able to take down supply.

Demand should further intensify as federal stimulus permeates just about every corner of the muni world. Starting with last year’s Coronavirus Aid, Relief, and Economic Security Act (or CARES Act), some $150 billion in aid reached state and local governments, along with considerable funding for hospitals, education, transportation and airports. This was followed by the Fed’s $500 billion municipal lending facility and the more recent American Rescue Plan, which provides another $513 billion to states, local and tribal governments, territories, school districts and public transportation systems.

For many issuers, this extraordinary aid eclipses pandemic-induced budget deficits and further eases concerns of widespread impairment among investment-grade municipal bonds.

Now, a record infrastructure bill—the American Jobs Plan—is on the table. Much of it will be funded by new tax laws, which would be another tailwind for munis. The Biden administration’s proposed hike in the corporate rate to 28% (from 21%) and higher taxes for individuals earning more than $400,000 would further strengthen demand for municipal bonds. The administration has also supported proposals to bring back the ability of municipalities to issue tax-exempt bonds to advance refund higher-cost debt. This would lower their borrowing costs, but it also would likely increase tax-exempt supply, which could weigh on muni prices.

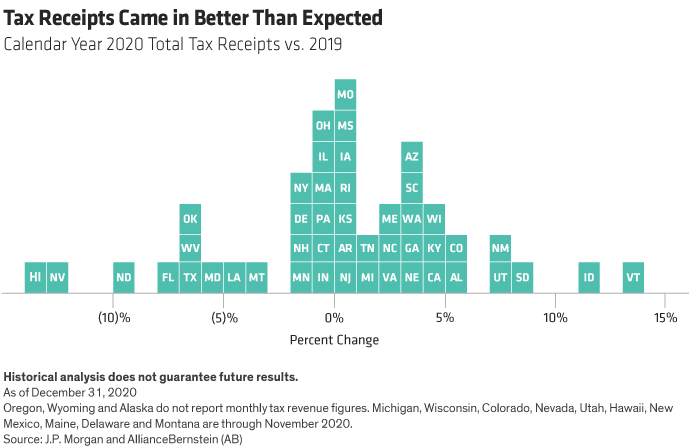

The massive federal backing—combined with better-than-anticipated tax collections—now forms an intensely brightening revenue picture for most state and local governments. Apocalyptic revenue shortfalls predicted during the COVID-19 crisis never materialized. On average, 2020 state tax receipts were down only one-tenth of one percent relative to 2019’s, with most states showing year-over-year gains (Display).

Back to Muni Fundamentals: Low Defaults, Strong Defense

Current conditions are one of several pillars underpinning munis’ strong appeal, along with time-tested attributes that support them well in any environment.

Muni credit ratings were under pressure during 2020, but likely without lasting effect. And since ratings changes can be lagging indicators, they tend to open doors to value opportunities for active investors.

Resilience is also rooted in muni issuers’ wide power to tax and generate revenues, as well as in the essentiality of their services. Therefore, defaults are historically rare, with an average 10-year cumulative default rate of just 0.16% since 1970, according to Moody’s.

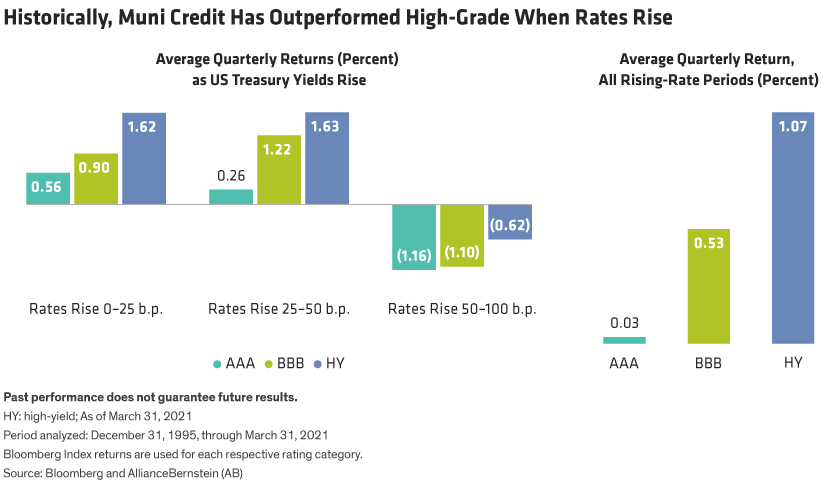

Muni bonds cover a wide range of maturities and quality, giving investors room to maneuver as conditions change. With interest rates rising, we see opportunities in midgrade credit and high-yield, which can help provide portfolio protection. Historically, when yields are rising, municipal credit has outperformed high-grade bonds. (Display).

As Inflation Rises, Investors Should Take Action

Rising inflation often goes hand in hand with rising yields and is just as concerning to tax-aware investors. Investors who have moved to the sidelines to wait for rates to settle should take heed. Not only does stepping out of the market mean missed opportunities, but idle cash is quickly squeezed by inflation.

Investors have to be strategic, not static, and use the many alternatives available to them. We believe an inflationary backdrop calls for diversifying into vehicles that complement muni bonds, such as Consumer Price Index swaps. Even though bonds lose value as rates rise, the potential gain from the swaps helps to offset losses across a portfolio. And higher yields quickly compensate investors for the pain of rising rates. That’s why investors should actively weigh the impact of rising rates on current returns against the greater income potential they’ll offer down the road.

Municipal bonds have borne less of the brunt of the current rising-rate environment, but we don’t expect them to deliver returns comparable to those of the past two calendar years. However, current conditions are favorable and muni fundamentals are sound. So even if rates continue to rise, munis can still offer compelling opportunities for active investors willing to stay flexible.

Related: Hedged Bond ETFs Can Beat Another Favored Rising Rates Play