Written by: Tracey Nolte | Advisor Asset Management

“Lower for longer” has been Federal Open Market Committee’s (FOMC) mantra since they stepped into the market during the final weeks of March. Since that time and combined with a massive fiscal response, the Fed backstop provided liquidity and lending support, eventually leading to something akin to normal capital market operations. As both regular and atypical monetary policy responses worked to temper the adverse effects of a growing pandemic, it is now natural to consider what policy actions are next? What does the recovery look like? How long will it take? On Thursday during his Jackson Hole (virtual) presentation, Chair Powell gave us one possible answer: average inflation.

Focusing on this particular FOMC policy change may seem like ruminations from a neurotic monetary policy wonk. However, there are good reasons for which the FOMC works to improve their communications. There are better reasons which they work to improve their policies. FOMC policy is a primary component of current interest rates, interest rate expectations, growth expectations, and a key component in inflation expectations. As a result, FOMC policy heavily influences our capital market assumptions and these assumptions have a direct effect on credit exposure, sector allocation, expected growth/inflation, and portfolio strategy outcomes. It is imperative for the layperson and the financial professional alike to understand the FOMC’s rationale and keep it handy when executing investment strategy. In other words, don’t fight the Fed.

Grousing by the FOMC over the past decade as to how it was attempting to goose inflation expectations higher became a series of “show me the money” moments. To provide clarity in their communications regarding the focus on inflation, the FOMC began actively using the phrase “symmetric” to describe their thoughts regarding their 2% implied inflation target. For those interested in parsing such “Fed Speak,” Howard Schneider wrote in 2019 the word “symmetric” entered the Fed lexicon in a big way during 2018, being used 31 times in total, prior to which it had been used only twice.

Describing the inflation goal as “symmetric” meant the FOMC did not proscribe an explicit policy response. In other words, the FOMC implied that it was willing to not tighten policy automatically if inflation ran a little higher or a little lower than 2%. The “symmetric” description described a general framework implying the FOMC did not want kill the goose who lay the golden egg. The FOMC did not wish to be viewed as intransigent regarding the implied 2% inflation target nor did it wish to raise rates reflexively in response to burgeoning economic activity and its commiserate inflationary forces. In reality, it appears that describing the inflationary goal as “symmetric about the 2% level” was the foundation for the eventual change to average inflation targeting.

Two years ago following Chair Powell’s (then in-person) comments at Jackson Hole, he mentioned that the FOMC works to balance the two mistakes it fears making most: raising rates too much to slow growth too far, and not raising rates quick enough to temper the adverse effects of rising prices.

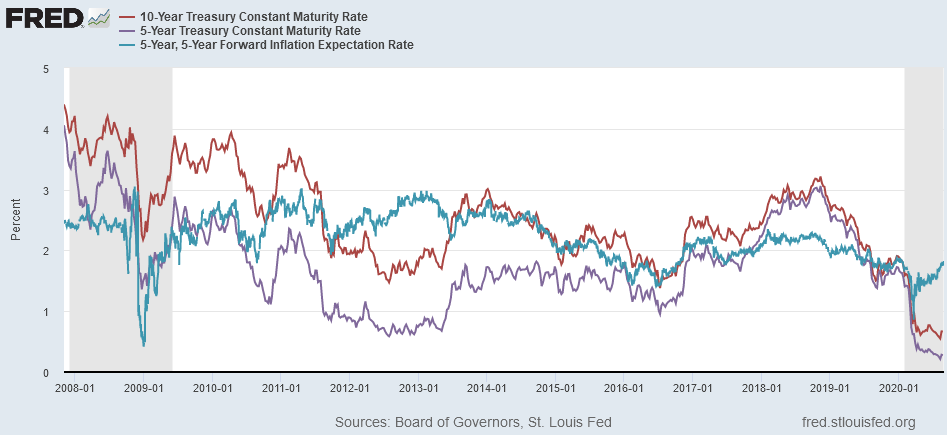

It may seem like ancient history now, but the context of what drove the policy change announced on Thursday appears partially rooted in the unwinding of the policy missteps which occurred in the months following Chair Powell’s comments in late 2018. Policy missteps at that time, you may recall, drove the FOMC to perhaps not kill the goose, but nearly smother it. At the time of Chair Powell’s Jackson Hole speech in 2018, the FOMC had certainly been clear that the goal of inflation was symmetric around the 2% level. At the same time however, rates in the capital markets were flashing concerns about future growth, and many analysts felt that the risk of inflation was clearly asymmetric to the downside given the lag in tighter monetary policy from the FOMC’s three rate hikes earlier that year.

In late 2018, had the FOMC instead used some measure of average inflation similar to what was announced on Thursday, it is realistic to think that they would have recognized, as the fixed income markets did at that time, the risks to inflation and growth which their prior restrictive policies had created. As a result, it is also likely the FOMC may have allowed inflation to catch up to their policy decisions before raising rates again and thereby avoiding the final two rate hikes of 2018, the subsequent yield curve inversions of the period, and the flight from risk which occurred during Q4 of that year. In turn, this may have also allowed the U.S. economy to avoid weakening growth in 2019 which the FOMC actively worked to reverse the entire year. In short, using average inflation as their gauge, the FOMC may have avoided their most recent policy mistake.

On Friday morning, the FOMC released supporting documents from their recent policy review. Quite notable in these releases was the supporting documentation expressing concern about 1) how inflation has persistently “fallen short of the Committee's 2% inflation goal” and 2) that the usefulness of the Phillips Curve as a guide to inflationary pressures does not adequately capture the link between employment and pricing, to whit; "(I)t has become clear that inflation is considerably less responsive to activity gaps (a 'flatter Phillips curve')." While not giving any details as to how they will calculate average inflation, the announcement of the policy change and the details which informed that policy review made clear the message that the FOMC wishes to avoid the mistake of raising rates too much, too far, and too soon. Average inflation targeting is an admission that the inflationary forces under which these now prior policies had been forged (beginning in the 1970s) have structurally changed enough to warrant a more dovish approach by the FOMC when a more robust recovery is finally underway. From an investor and a money manager perspective, this change is critical to how restrictive the FOMC will be perceived and how early, or late, they may implement restrictive monetary policy in the face of higher growth and higher inflation. Discounting this change will take time but it implies increasing inflation expectations and as a result, increasing the duration of growth the FOMC will allow in the face of higher inflation. The policy change also, therefore, implies underlying support for eventual higher rates.

Yields continued to rally in the hours following Chair Powell’s comments as markets also viewed them as largely supportive of higher rates in the future. The U.S. Treasury curve steepened throughout Thursday as well with the 10-year U.S. Treasury climbing 8 bps (basis points) and the 30-year up by 13 bps by late Thursday evening.

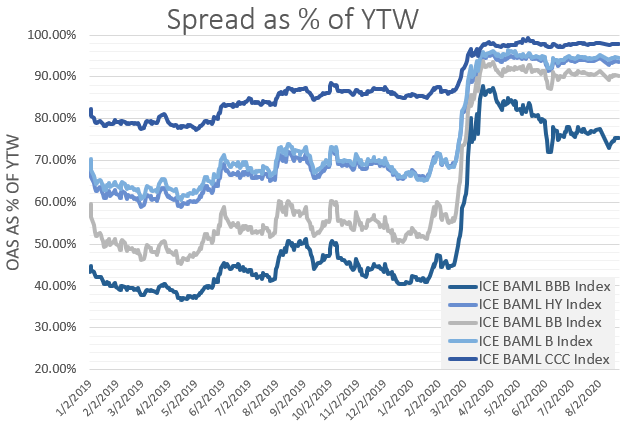

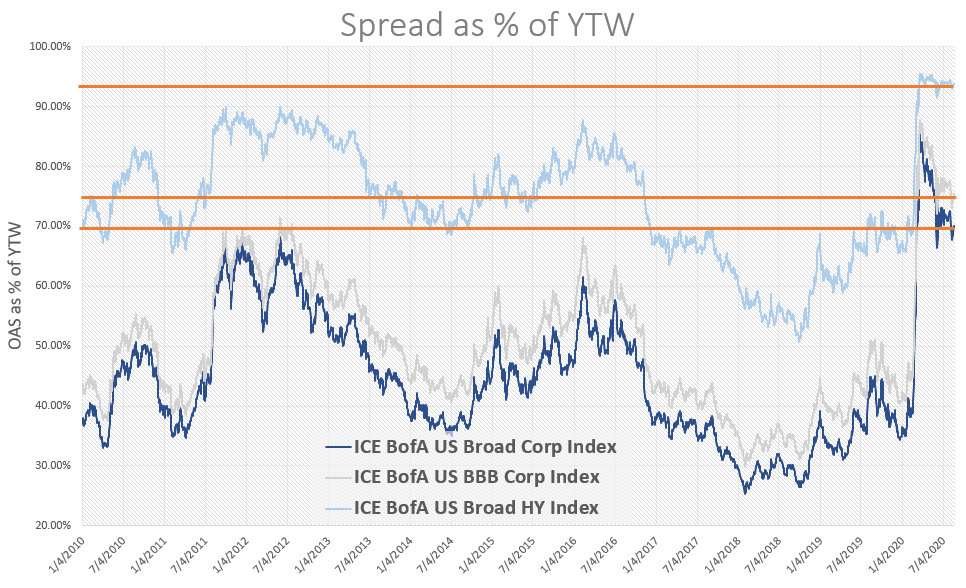

Moving through the pandemic recovery and current recession with rates as low as they are, the discounting of future risk in the capital markets is still being estimated. However, if rates remain lower for longer, credit risk becomes the place where an investor can find relative value by doing a little homework and where a professional asset management team can bring experience to bear. As the charts above illustrate, spread as a % of yield (the % of credit risk an investor is being compensated per 1% of yield), remains at levels which haven’t been seen in more than a decade.

Source: ICE BofAML Indices

Source: ICE BofAML Indices

For example, since 2010 an average of 50% of a generic BBB bond’s yield would be the compensation for credit risk (expressed as spread). Today that figure stands at 74%, but as the charts above show, it has been grinding lower since April. In our opinion, this value will continue to erode as 1) investors continue to sift through the rubble of the past six months and find value in the credit markets, 2) Treasury yields begin to recover as global economic outlook improves, and 3) the FOMC implies it will be on the sidelines for longer.

It is fair to ask if the historic low yields we witness today may in fact skew our opinion of what appears to be value in the market. We believe using low rates as a reason to not invest in the markets is like a Formula 1 team using the length of the pit straight as a reason for losing a race. All Formula 1 teams are subject to the same distance between pit entry and pit exit and length of the pit straight neither favors nor disadvantages any single team. It is the performance on the track, in the current environment which separates the winners from the losers.

Many fixed income investors cannot use “rates are too low” as a reason for sitting on the sidelines and waiting until rates are higher. Treasuries are certainly an alternative to credit selection, but they carry little to no income stream for shorter maturities and intermediate to longer maturities carry the bulk of their risk through duration or interest rate sensitivity. For investors looking to find value, investors who know the cost of waiting, and for investors who understand that risks can be moderated with appropriate and sometimes professional analysis, there is clearly value in the market today. The FOMC’s policy change further enforces our opinion that carefully investing now is more appropriate than waiting for some future time.

Related: What If? Reflections on a Potential Post-COVID New Normal