This investment rose by over 50% in 18 months. Its decline will catch many by surprise.

The band Train is a favorite of my wife’s and mine. Like many people, it is difficult to think about certain concepts without instantly recalling a lyric from a band you like. It is as if it rings in your ear every time.

In this case, the Train lyric that keeps running in my head is “When everyone else is getting out of bed, I’m usually getting in it,” from their hit “If It’s Love.” Translated to investing: it’s a great time to be a contrarian.

In 2020, I can’t help but think that the obvious investor obsession with the stock market (up, down, up again, all in 5 months) obscures many other significant developments that keep popping up in related markets. It pays to be looking where the market is not currently looking, but probably will be soon. In this column, I try to point those out as I see them.

Hey, Soul Sister: where should I be looking for risk in my portfolio?

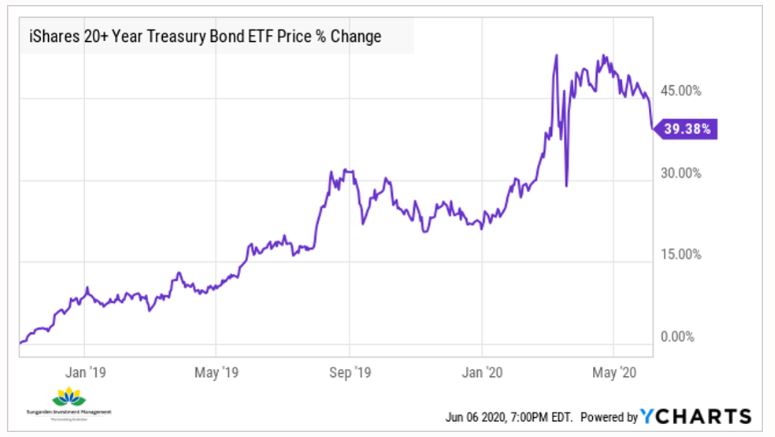

The latest risk involves the price of Long-Term U.S. Treasury Bonds (bonds maturing 20-30 years from now). As you can see in the chart below, their prices have had a very strong run since late 2018.

That price increase occurred because interest rates fell over this time. That drives the price of long-term bonds higher. It also can create a situation where the future return potential for long-term bonds is very, very, VERY low. In fact, those returns can be decidedly negative following a period like this.

The chart shows us that the price of TLT, the ETF that tracks long-term Treasury Bonds, rose by about 50% in 18 months. Think about that. 50%! In 18 months! What stock is that, you say? It’s is not a stock at all (unless you consider an ETF to be like a stock, since it trades on the stock exchange).

Why are falling long-term bond prices a problem?

For years, I have wondered why so many investors are under-educated about the risks of bonds. I think a lot of that has to do with the 40-year decline in interest rates. That made it so that long-term bond prices did not fall by significant amounts often. And, when they did, those price drops did not last very long.

The other factor is a bit more nefarious. My industry, the financial advisory business, has generally pitched bonds as the “only alternative” to stocks. It is as if there are only 2 assets: stocks and bonds. There are so many slices of each market (which I will not cover in this article, but have in many others).

This is a great time to look around and see what else is out there. And, once you realize how much there is outside of the typical asset allocation approach, the next step is to learn how to apply them to your particular situation.

For now, know this: long-term bonds appear overvalued, and poised for a price drop after a long run up. And, while there was a big drop earlier this year, prices snapped back very quickly. This is similar to the stock market’s up and down tussle in 2020.

The bond market is dealing with a lot of stuff right now

Long-term bonds now must deal with a combination of the Fed flooding the market with liquidity, and inflation threats from rising oil and food prices. And there is another factor that was not as evident a few months ago as it is now. That is, the economy may be rallying from the worst-case scenarios brought on by the pandemic.

What’s wrong with a recovering economy? For consumers, workers and perhaps stock market investors, not much. However, for over-priced long-term bonds, a rising economy could bring on a long-awaited return of inflation. Higher rates may be the cost of pulling the economy out of its hole.

What would catch investors by surprise: that their bond portfolio was at the root of their investment concerns. So, keep your eyes on this. Because shocks to the financial system tend to happen too fast to learn the rules on the fly.

Related: How Baby Boomers Should Handle A Tech-Dominated S&P 500 Index