With US bond yields already well above recent lows, some US investors are sticking close to home to maintain their home-court yield advantage over other countries. That may seem reasonable. But the costs of forsaking a global approach can be high. A global strategy does a better job of providing the stability, income and diversification against riskier equities that investors expect from a core bond portfolio.

What to do about lower yields in other countries? An active manager who is running a global portfolio can avoid overconcentration in parts of the market where yields are low and move swiftly to seize opportunities in areas that offer higher potential returns. But there’s also another solution to the problem of lower rates abroad: hedge the currency exposure.

Currency hedging can be implemented cheaply and effectively with currency forwards and futures. In fact, the currency-forward markets are among the most liquid markets in the world, making transaction costs very small—on the order of one to two basis points to initiate a hedge from a developed-market currency into US dollars, then an eighth to a quarter of a basis point to roll it forward as needed.

So how does hedging help neutralize low rates? Simple: hedging out the currency exposure of a bond involves selling the cash rate of the currency you’re hedging from and buying the rate of the currency you’re hedging to. Depending on relative short-term interest rates, hedging can either raise or lower a bond’s yield.

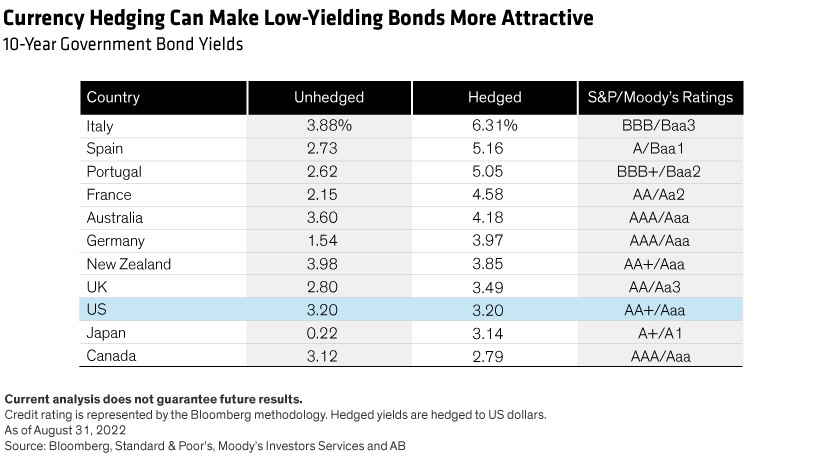

Today, short-term US interest rates are higher than those in most other developed countries. For such countries, simply hedging a non-US bond to US dollars can raise yields considerably. As the Display, above, illustrates, the yield on a 10-year German Bund jumps from 1.5% to 4.0%. A 10-year Japanese government bond rises from 0.2% to 3.1%.

Of course, exchange rates fluctuate often, so having an active manager who monitors the market and adjusts the hedges accordingly is critical.

Related: Three Reasons Why Investors Need to Source Income Efficiently