Written by: Natalia Gurushina

Turkey’s current account showed a visible improvement in October. Mexico’s industrial production ended the year on a high(er) note.

China’s weekend announcement that it will boost the share of non-fossil fuels in primary energy consumption to 25% by 2030 was notable for a number of reasons. China’s earlier “green” push had been linked to slower growth, so the new – higher – target raises more questions about the future GDP trajectory. China’s green ambitions and the resulting shift in its commodity demand – in particular for oil (lower?) and metals (higher?) – will also have fundamental and market implications for wider Emerging Markets (EM) in the years to come. Details and the pace are important, and they might be announced as part of the 14th5-year plan.

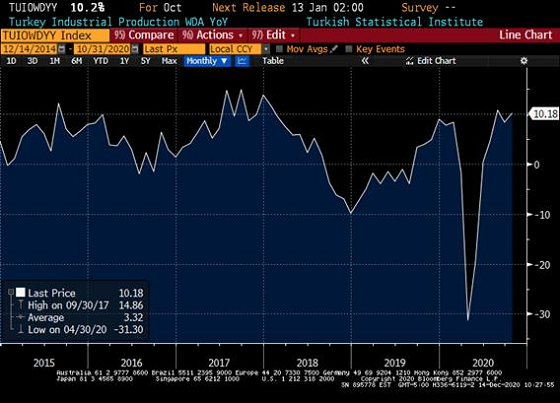

Turkey’s industrial production growth was back to double digits in October (10.2% year-on-year – see chart below), but this was probably the “last hurrah” before the policy U-turn aimed at curbing the government-led credit surge. Still, the sizable upside surprise can strengthen the expectation of another benchmark rate hike on December 24. The hike – even a modest one – will show that authorities mean business, especially as higher inflation pushed the real policy rate below 1%, eroding the much-needed policy cushion.

India’s inflation moderated more than expected in November, leading to suggestions that this opened up space for a small policy rate cut. Well, annual headline inflation indeed moderated from 7.61% to 6.93%, but it remained above the central bank’s target. Further, the deceleration was narrow-based (perishable food, fuels) and in part due to a favorable base effect, which are not typical reasons for policy easing.

Chart at a Glance: Turkey Industrial Growth – Current Pace Will Be Hard To Sustain