Written by: Christopher M. Brigati | Advisor Asset Management

Investors owning shares of municipal bond mutual funds could suffer share price erosion if portfolio managers are forced to sell bonds to raise funds.

In light of the developments that took place this past year in the municipal market, the following is an updated review of a previously produced piece. Underlying factors within the market have changed over the past decade which have contributed to periodic shocks to market liquidity. Investors with holdings in municipal bond mutual funds should be aware of the potentially negative risks to their investments.

Market liquidity has changed significantly following the 2008-2009 Financial Crisis:

- There are fewer dealers participating in the municipal market.

- Dealers are becoming less willing to provide liquidity.

- Going forward, the market may experience periods of illiquidity (as occurred during the initial phase of the 2020 COVID-19 pandemic).

- Mutual fund investors could suffer falling share prices because of forced selling by portfolio managers into an illiquid market.

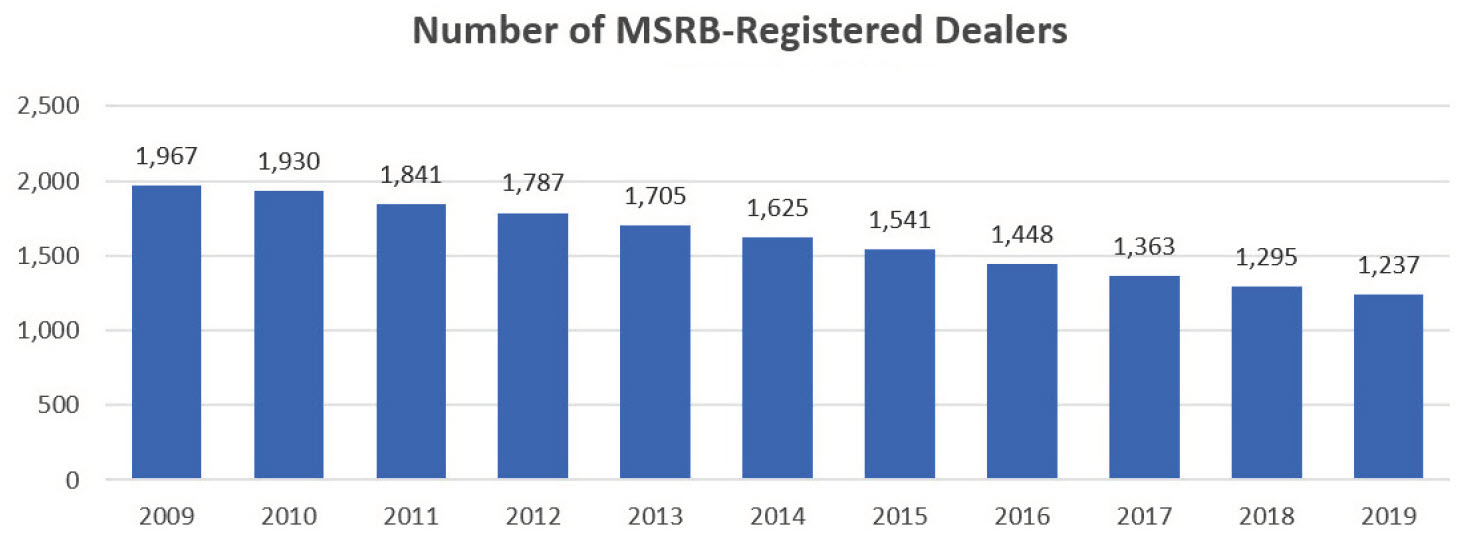

Number of Dealers

According to a Municipal Securities Rulemaking Board (MSRB) reports, the number of dealers engaging the municipal market has shrunk significantly since the financial crisis of 2008-2009. Specifically, the number of dealers dropped 37% from 1,967 MSRB-registered dealers to only 1,237 in 2019, a decline of 730 dealers. The question becomes, with fewer dealers in the market, does liquidity become compromised?

Source: MSRB, October 2020

Arguably, many of the dealers no longer registered with the MSRB (therefore no longer engaged in municipal trading) did not have a significant presence in the market. Additionally, some new entrants to the market have been more active than those that are no longer involved. In aggregate, it would appear that these two factors offset each other and do not significantly change the liquidity dynamic in the market.

Dealer Balance Sheets

One of the same MSRB reports indicates that as of 2018, dealer balance sheets are down by 67% since 2006. The latest report does not provide this detail, however as a market participant, it is noticeable that dealer participation in this regard has not improved. Decreased capital commitment that is dedicated to balance sheet is a direct reflection of a decrease in dealer willingness to provide liquidity. This decline can be attributed to a number of factors. First, changes to dealer capital commitment requirements and leverage ratios as a result of Dodd Frank initiatives have decreased the ability for dealers to carry larger balance sheets. Second, spread tightening has decreased dealer profitability. Naturally, if the amount of revenue dealers can generate from their balance sheet decreases, they become less willing to take the risk of owning paper.

Buy-Side Participation

Arguably, buy-side participants serving as de-facto liquidity providers in the market have increased significantly in recent years. Since such participants use anonymous electronic platforms or broker relationships, it is very difficult to identify verifiable data points. Anecdotally, however, we have observed an increase in certain patterns that indicate that buy-side accounts are providing liquidity. For example, MSRB Trace price prints indicate that bonds which have traded following the RFQ (request for quotation) process do not reappear as offerings or show corresponding prints indicating placement with customer accounts. Additionally, we have spoken directly to accounts which have indicated that they are active on such platforms in exactly this fashion.

This fact is meaningful as it provides evidence that buy-side accounts are filling the void vacated by dealers with regard to providing market liquidity. However, the devil is in the details. We concede that buy-side accounts are filling this void, but this dynamic is market dependent. As you may recall during the financial crisis, market liquidity virtually evaporated as sellers aggressively sought liquidity. Furthermore, more recently in March through April of 2020, as the COVID-19 crisis was impacting the domestic economy, liquidity disappeared as buy-side participants became net sellers in an aggressive manner. When buy-side accounts experienced fund withdrawals, they were not only precluded from providing liquidity, but they become net sellers themselves. In short, when the market is most volatile and in need of more liquidity, the market participants that had previously been engaged in such activity become virtually non-existent. This behavior contributes to the extreme market volatility as there are less participants able/willing to provide a backstop to a cratering market dynamic.

Mutual Fund Shareholders

Individuals that own shares in municipal bond mutual funds could suffer share price erosion if portfolio managers dealing with redemptions are forced to sell bonds to raise funds; as occurred in the Spring of 2020. Furthermore, this creates the potential for fund shareholders to have a taxable event impact their investment. Additionally, the construct of the portfolio becomes compromised as portfolio managers have to liquidate what holdings they can sell, as opposed to what holdings they would prefer to sell to maintain a well-constructed portfolio. Investors that own individual bonds would not be forced to participate in such sales since they can ride out liquidity events without being forced to sell.

In short, investors can avoid the negative implications of this scenario by building a custom bond portfolio for which they can control the purchase and sale decision-making process.

Related: The Election Results Are in, but What About Equity Returns?