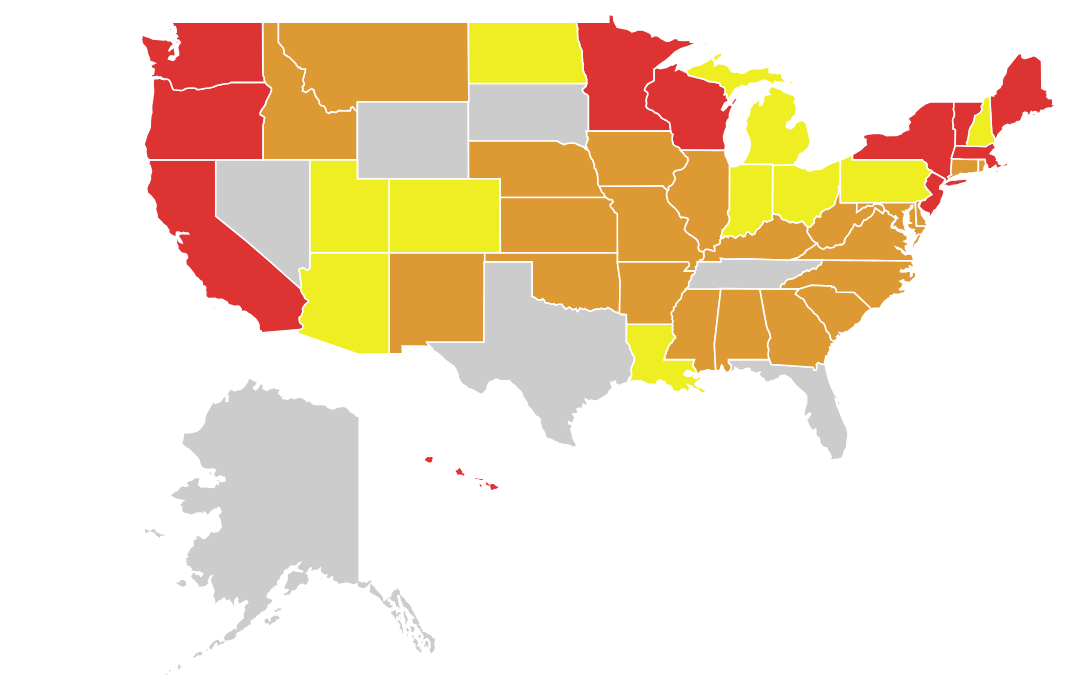

With income tax rates ranging from zero to a staggering 13.3%, the state you call home can significantly impact your financial health.

High earners, especially those residing in high-income-tax states like California and New York, are always on the lookout for investment opportunities that offer tax advantages.

Enter tax-free municipal bonds, or munis, a financial instrument that not only provides a steady income but also comes with the added benefit of being exempt from federal, and often state, taxes.

The Tax Landscape In The U.S.

First, let’s take a quick look at the state income tax landscape in the U.S.

In states with progressive tax systems, such as California, New York and Hawaii, the tax rate increases as your income rises. California leads the pack with a top rate of 13.3%, followed by Hawaii at 11% and New York at 10.9%. High earners in these states are subject to the nation’s highest tax rates, which can substantially reduce their take-home pay.

Top Marginal Individual Income Tax Rates By State

As of January 2023

Local income taxes are not included. New Hampshire taxes apply to interest and dividends income only. Washington applies to capital gains income of high-earners. Source: Tax Foundation, U.S. Global Investors

On the other end of the spectrum are states with flat tax rates, like North Carolina and Illinois, where everyone pays the same percentage of their income in taxes. These systems are simpler but can be less equitable, as the rate remains the same whether you earn $50,000 or $500,000.

There are currently eight states with no income tax at all: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming. While this can result in higher take-home pay, it’s worth noting that these states may have other forms of taxation, such as higher property or sales taxes, to compensate. (In Texas, for instance, property owners pay an average tax rate of 1.8%, according to Rocket Mortgage. By comparison, Hawaiians pay an average 0.28% on their property.)

Some states have unique tax structures. Interestingly, people in New Hampshire pay taxes only on dividends and interest income. Others like Iowa and Oklahoma offer exceptionally low starting tax rates, which gradually increase as income rises.

Why Tax-Free Municipal Bonds?

As many of you know, municipal bonds are debt securities issued by state and local governments to finance public projects, from schools to sewer systems. They offer a steady income stream, usually semi-annual interest payments, until the bond matures.

The most compelling feature of munis is their tax-free status. Let’s say you live in California and fall into the highest tax bracket. Investing in munis essentially increases your take-home pay since you’re not losing a chunk of your earnings to taxes.

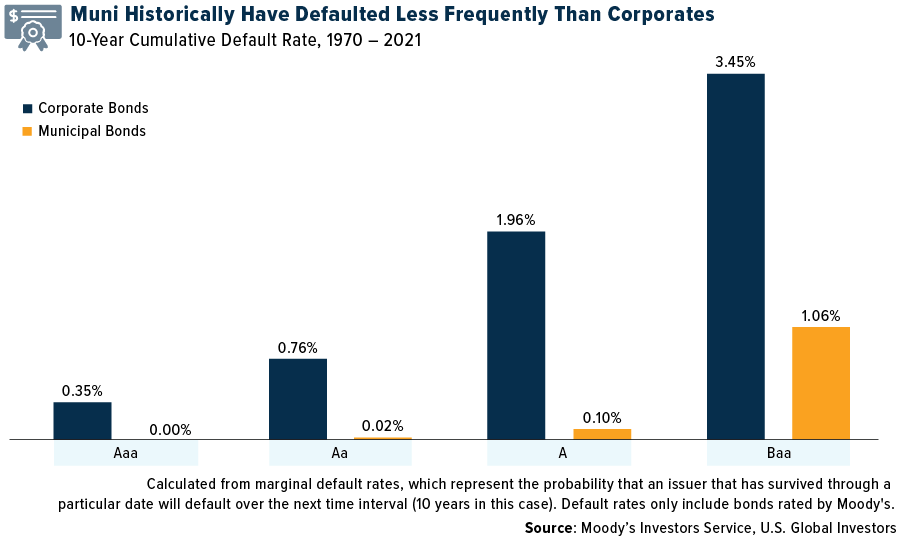

Munis are also generally considered lower risk compared to other investment options like stocks, potentially making them more attractive to conservative investors with a shorter investment horizon. And compared to corporate bonds, munis have historically defaulted far less frequently. Over the past 50 years, defaults among Aaa- and Aa-rated munis have been virtually non-existent, while corporates have seen a number of failures. The likelihood of default increases as credit ratings decline.

Introducing The Near-Term Tax Free Fund (NEARX)

If you’re interested in investing in municipal bonds but don’t know where to start, I believe the Near-Term Tax Free Fund (NEARX) could be an excellent option. Managed by our team at U.S. Global Investors, NEARX aims to provide tax-free income and preserve capital by investing in a diversified portfolio of tax-free municipal bonds.

NEARX primarily invests in high-quality, short-term municipal bonds, providing tax-free income. The fund offers a diversified portfolio, reducing the risk associated with investing in individual bonds. Like our other mutual funds, NEARX is managed by experienced professionals who make informed decisions based on thorough research.

I believe NEARX serves as an excellent vehicle for those looking to capitalize on these benefits. With its focus on quality, short-term munis and professional management, NEARX offers a convenient way to invest in this attractive asset class.

Related: Why September Could Offer Strategic Investment Opportunities Despite Historic Market Volatility