Written by: Mark Stockwell

Many financial news outlets have picked up on a report published last week regarding the decrease in state sales tax revenues.

While it is true that sales taxes have been and will likely continue to be hit by the pandemic, we should be careful how we interpret the numbers that have been reported. The original report was produced by staff from the Tax Policy Center, which indicated that cumulative state sales tax receipts shrank by $6 Billion in May. The Center cites the impact of the pandemic as one of the reasons for the decline, but they also cite sales tax filing and payment extensions some states have provided to retailers to help sustain businesses through the economic dislocation.

As with the extension of numerous state personal income tax deadlines in April, in our view, we should not mistake a short-term deferral of tax receipts as an indicator of a decline in economic activity. This is what some journalists did last week when they stated that California was one of the states that had a decline of more than 30% in May. What they failed to mention was the detail in the Tax Policy Center report stating that California’s drop was caused in part by timing shifts and extensions of sales tax payment deadlines, not just stay at home orders and closing of businesses.

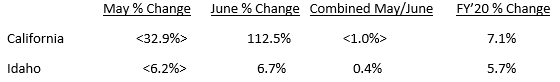

It is true that California had a steep drop in May sales taxes, especially compared to states like Idaho, that had more modest declines. But when comparing sales tax revenues of both states in May and June combined there is far less disparity in sales tax collections:

The swing in California’s sales tax revenues from a 32.9% decline in May to a 112.5% increase in June is a clear indication that monthly revenues reflect more than changes in economic activity. When comparing the combined May/June sales tax receipts, California and Idaho were closely aligned. California and Idaho both had strong sales tax growth, in the 6%-7% range, over the entire fiscal year ending June 30th, despite the declines in May.

The May sales tax drop included in the Tax Policy Center report has also been cited as a potential problem for sales tax bond issues. Again, we need to understand the sales tax base and credit metrics of each sales tax bond before we jump to conclusions. Despite potential revenue declines, we find many bonds backed by sales tax revenues still provide stable credit characteristics. When we invest in sales tax backed credits, we look for the following credit characteristics to reduce potential revenue volatility:

- Large, statewide or regional tax bases with a diverse set of taxpayers,

- Strong debt service coverage levels (typically pledged revenues provide at least 3x debt service),

- Additional bondholder protection from debt service reserve funds (usually equal to 1-year’s debt service)

- Bonds backed by muni organizations immune from budget or operating risks (such as transit operators).

We’ve reviewed each sales tax bond held in our portfolios and will continue to utilize robust standards to determine the eligibility of sales tax bonds for future purchases.

Related: What the Divergence Between the Economy and Market Means for Bond Investors

Sources: Bloomberg, California State Controller, Idaho Division of Financial Management, Tax Policy Center as of 7/17/20.