Written by: Scott Colyer | Advisor Asset Management

After finishing the worst year on record for bond performance in 2022, the first month of 2023 saw an about face in the corporate bond market. January was reported to be a record month for investment grade corporate bond ETF (exchange-traded fund) flows. Sure, corporate bond yields are the highest in nearly two decades but the record demand for corporate credit has caused a collapse in the spread that investors receive when buying a corporate bond versus a “risk free” Treasury note. The credit spread is the amount that an investor is being paid to take the corporate credit risk over the “risk free” alternative. In fact, this spread has contracted to levels generally only seen prior to major recessions.

Investors have been starved for yield for so long that the recent rise has lured many to purchase corporate bonds with little to no regard for the additional risk assumed for the extra yield gained. The problem with this rush to buy credit is that if the expected economic slowdown materializes then the companies that back these corporate bonds may find themselves with additional stress to their ability to repay their debts. That’s right, we are likely at the precipice where corporate credit outlooks are just beginning to deteriorate. Thus, as risk to corporate credit increases, the spread that an investor should be paid to take the risk should rise as well. Remember, that as yields move higher bond prices drop in value.

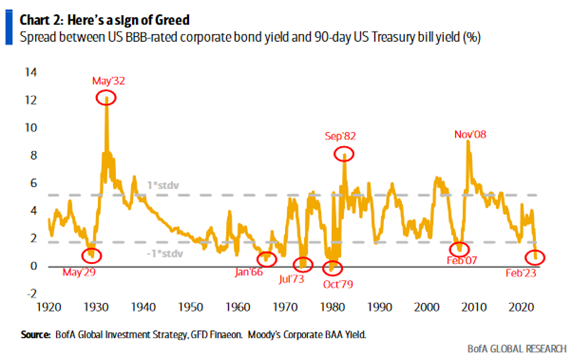

The credit rating agencies have been very clear that they expect the default rate to climb for lower quality corporate borrowers as the bite of higher interest rates take hold. On top of this, the Federal Reserve (Fed) has been very clear that they are not done raising rates and that they intend to keep rates above the rate of inflation for an extended period. The following chart shows the significance of the drop in corporate spreads as measured between BBB- rated corporate bond and 90-day U.S. Treasury yields.

Please note that the spreads have narrowed because of record demand rising to levels not seen since 2007. Prior occurrences of this magnitude also occurred in October 1979, July 1973, January 1966 and May 1929. Note what happens to these tight spreads over the following year or two. Without exception, these credit spreads reversed and moved up sharply reflecting the increased risk that investors demanded when credit metrics deteriorated. As the spread spiked, prices collapsed. This is not a desired outcome.

The same froth that caused credit spreads to contract in the investment grade (BBB) area of the bond market has also been present in the less-than-investment-grade (junk bond) market. High yield spreads are trading at historically tight levels offering the investor the least amount of corporate risk compensation in years. Given the fact that lower grade credit is typically affected even more abruptly during economic downturns, we believe that area of the market should also be avoided by investors who are being risk conscious.

The conclusion that we believe the astute investor should draw here is that commitment of new capital into the corporate bond market should be made with heightened care. The opportunities sought in credit should be made only when the investor clearly understands the risks they are taking and the additional compensation they are being paid to assume that risk.

We would generally suggest that for investors who either don’t understand credit risk or don’t have the time to determine proper spreads, it is likely best to leave the credit selection to professionals. Most ETFs are not managed but rather track indices. Markets where credit risk is priced and where history shows that trouble is likely brewing should be actively managed and monitored.

In conclusion, history is clear that when corporate credit spreads are as tight (narrow) as they are today, investors should look for better days ahead to take on significant credit risk. It is incredibly important for investors to be adequately paid for the risk they are taking versus what they think they are taking.

Related: Is Bank of England’s Wait-and-See Approach to Interest Rate Hikes Flawed?