Written by: Steve Hussey and Jørgen Kjærsgaard

For European banks’ stockholders, 2020 was a year to forget. But bank bondholders enjoyed positive returns and may overcome COVID-19 challenges again in 2021, backed by solid balance sheets and supportive regulatory conditions.

The impact of the coronavirus has piled further pressure on European bank equity. Already struggling with weak growth and low interest rates, COVID-19 triggered further loan loss provisions, smaller profits and constraints on dividends. Yet some of those factors have improved the position of bank bondholders, for several reasons.

Balance Sheets Strengthen Going Into 2021

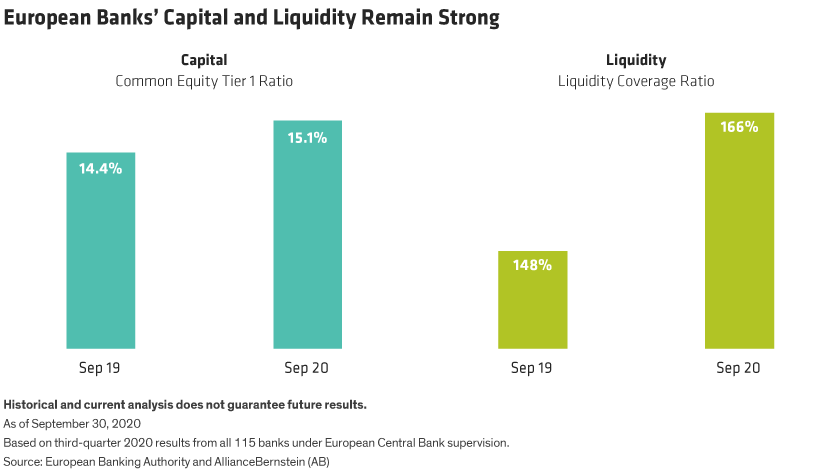

Banks are mostly entering 2021 in a relatively strong position. In 2020 they were typically able to reinforce already strong balance sheets in two ways.

Firstly, restrictions on dividend payouts and share buybacks in 2020 by the European Central Bank (ECB) and Bank of England (BoE) prevented banks from distributing capital. While dividend payouts will be permitted in 2021, they likely will be capped to a small percentage of profits.

Secondly, regulators gave banks substantial latitude to maintain lending to businesses without incurring supervisory interventions. This “regulatory forbearance” helps banks grow their assets without incurring a penalty through higher capital requirements.

Bank liquidity is relatively high too (Display, below). During the crisis, customers have been spending less and saving more. The ECB has helped with cheap funding as well, by extending its targeted longer-term refinancing operations (TLTRO) aimed at supporting the euro-area economy. And aside from government-supported lending, loan growth has generally lagged deposit growth—so excess deposits have been recycled as liquid assets.

Asset Quality May Fall—but from a High Level

Many businesses across the eurozone are still facing a tough year. The main risk is that they may struggle to service their debt if government and central bank support ends during 2021. In this scenario unemployment would likely rise, and default rates would increase for small to medium enterprises, especially in hard-hit sectors like hospitality, tourism and retail. Ultimately, the banking sector would be negatively affected by a deterioration in loan defaults.

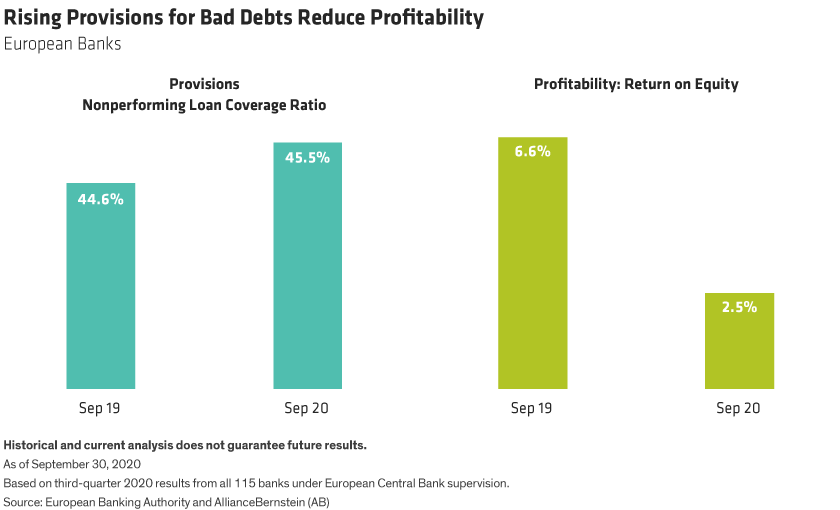

But even if this erodes the quality of banks’ loan books, their starting point is solid. Nonperforming loans (NPLs) are at historically low levels and provisions for potential losses have been increased. Crucially for investors in banks’ Additional Tier 1 bonds (AT1s) contingent convertible debt (CoCos), our research suggests that most banks now have enough capital to absorb potential losses—well above provisioning levels—without triggering the conversion to equity or write-off.

Low Profits Are a Problem—but Mostly for Stockholders

The last five years have been a nightmare for European banks’ stockholders. Tougher global regulation forced lenders to increase capital while a low-growth, low-interest-rate environment squeezed profits and return on equity. The year 2020 and the coronavirus have capped a bleak period (Display, below).

In effect, value has been transferred from stockholders to bondholders, whose principal and interest payments are better protected as regulatory actions bolstered balance sheets.

Even so, bank profits are ultimately important for bondholders too. And fortunately, profitability is not a lost cause. COVID-19 has accelerated bank efforts to upgrade systems, digitize operations and enhance efficiency and profitability. Meanwhile, the ECB supports merger and acquisition activity that should help drive down costs and create a more consolidated, stronger banking sector. So for bondholders, earnings should still be good enough to prevent an erosion of capital that would threaten their investments.

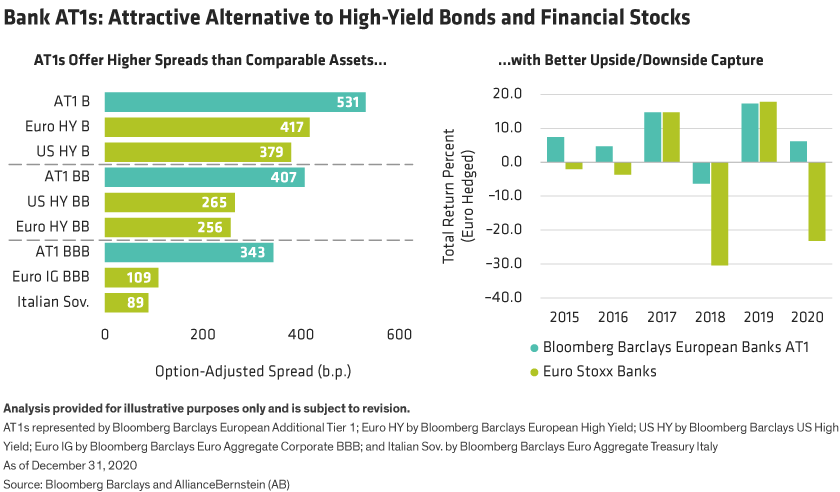

AT1 Valuations Are Still Compelling

Despite a strong rally in 2020, AT1 valuations are still attractive, in our view, both in absolute terms and relative to comparable asset classes (Display, below).

AT1s offer wider spreads than other similarly rated fixed-income investments at each point on the credit quality spectrum—from BBB down to B. And within financial credit, spreads between AT1 and Tier 2 debt have widened from a record low 146 basis points (b.p.) in February 2020 to 261 b.p. by the end of 2020. This leaves plenty of room for spread compression as the virus recedes and markets normalize, in our view.

What’s more, AT1s have also shown better risk/reward characteristics than bank equity during up and down markets (Display above, right). AT1s’ high and predictable coupon (currently 6.1% on average) has been much more supportive than bank stocks’ dividends. And AT1 prices are more influenced by banks’ capital strength, which has been improving, whilst stocks are highly geared to less reliable earnings.

Bank Capital Remains Key to Euro-Area Recovery

Trends that supported AT1s in recent years should persist through the recovery, in our view. Regulators are keen to ensure that the banking sector has adequate capital to sustain lending to euro-area businesses and underpin economic recovery. Countercyclical buffer requirements are also likely to remain low to help free up bank capital, promote lending and lower the minimum capital that banks must hold to pay the AT1 interest coupon. That requirement reduces the risk of missed payments (coupon skip) for investors.

Regulators also want to give banks more time to comply with new and more onerous capital requirements (TLAC/MREL), reducing pressure to issue senior or subordinated bonds. As a result, we expect AT1 net supply to remain low, as most banks already comply with current minimum regulatory standards. Meanwhile we think AT1s’ high yields are likely to attract increasing demand as the virus recedes and economies rebound.

Be Selective in AT1s

The AT1 market has rallied since March 2020 lows and some bonds’ valuations may be less appealing, especially since the volatility of those securities may be quite high, as they were in 2020. Thorough research can identify names that offer compelling risk/reward characteristics and pockets of unrecognized value. For example, select smaller banks may be merger or acquisition targets and could see their spreads compress in line with the stronger acquiring banks’ bonds. Some Spanish and Italian banks still offer good value, in our view, as do legacy Tier 1 issues, which are set to be called now that regulation has been clarified.

Bank bonds have benefited from a powerful tide through the pandemic. With many of the supporting trends still advancing, bondholders should keep faith in European banks.

Related: The US Recovery Reveals Hidden Value in Smaller Stocks