Written by: Justin Parker

Inflation poses a unique threat to every investor, regardless of market experience. As prices rise, the value of your hard-earned savings declines, directly impacting your purchasing power and overall financial well-being. In times of rising inflation—especially during periods of economic and political uncertainty—it becomes essential to proactively protect your portfolio. However, navigating these challenges requires more than just standard strategies. This is where Tidewater Financial’s expertise and tailored solutions can make all the difference.

In this post, we explore the dynamics of inflation, the impact of elections on financial markets, and strategies to hedge inflation risks. We’ll also examine the role bonds play in stabilizing portfolios, particularly during unpredictable periods. Finally, we’ll provide insights into why Tidewater Financial is the right partner to help protect and grow your wealth in today’s market environment.

Understanding Inflation and Its Impact on Investments

Inflation and Its Erosion of Wealth

At its core, inflation reduces the purchasing power of your money. For example, if inflation runs at 4% annually, a basket of goods costing $1,000 today would cost $1,040 in a year. This erosion impacts cash holdings and fixed-income investments, making it more challenging to preserve wealth.

While moderate inflation is often seen as a sign of economic growth, high or volatile inflation can disrupt market stability, corporate profits, and investor confidence. Left unchecked, inflation causes significant damage to long-term savings, leading to reduced purchasing power over time, especially for retirees and those dependent on fixed incomes.

Types of Inflation and What They Mean for Investors

How Inflation Affects Major Asset Classes in Your Portfolio

- Cash and Savings Accounts: While cash feels safe, its value can be diminished by inflation. If inflation is running at 5% per year and your savings account yields only 1%, your money loses 4% of its real value annually.

- Stocks and Equities: Stocks are often seen as a hedge against inflation, as companies can raise prices to offset increased production costs. However, not all stocks benefit equally.

- Real Estate Investments: Property values and rental income generally rise with inflation, but higher interest rates can make borrowing more expensive, slowing down the real estate market.

- Commodities: Commodities like gold, oil, and agricultural products often perform well during inflationary periods and offer diversification benefits.

- Bonds: Bonds with fixed interest payments tend to lose value during inflation, but municipal bonds, Treasury Inflation-Protected Securities (TIPS), and floating-rate bonds can be effective tools to protect against inflation risks.

The Impact of Presidential Elections on Inflation and Markets

Presidential elections can introduce significant volatility into financial markets. Elections often come with uncertainty about future economic policies, leading investors to reallocate their portfolios based on anticipated changes. Key areas of focus include:

- Fiscal Policy: Different administrations may take vastly different approaches to government spending and stimulus programs, impacting inflation.

- Monetary Policy Appointments: Presidents influence monetary policy through Federal Reserve appointments.

- Tax Policy: Changes in tax policy directly impact consumer spending and corporate profitability, influencing inflation trends.

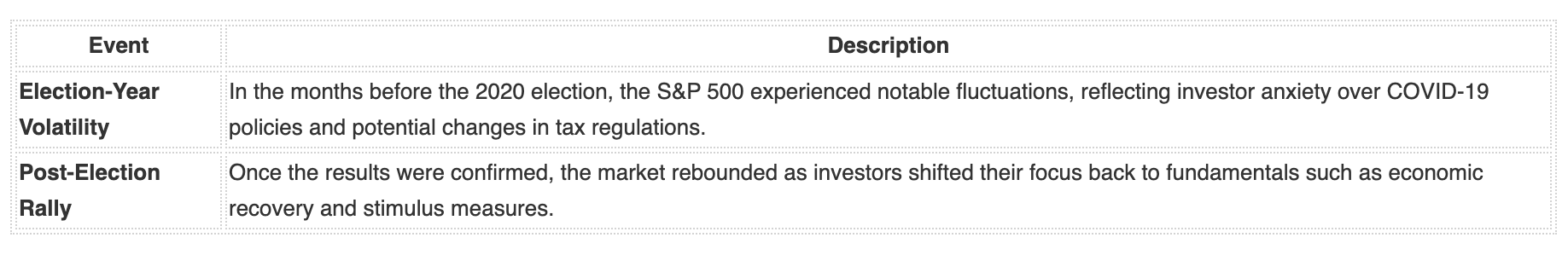

Historical Patterns of Market Behavior During Election Years

Historical trends show that markets generally experience a dip in performance during the months preceding an election but recover once the results are known. This behavior, known as an “election relief rally,” suggests that once uncertainty is removed—regardless of who wins—markets tend to stabilize and improve.

How Bonds Offer Potential Stability During Election Cycles

Bonds provide an excellent counterbalance to the volatility that often accompanies election years. They offer potential stability, regular income, and, in some cases, tax advantages, making them a valuable component of any portfolio.

Predictable Income Potential and Principal Protection

One of the primary benefits of bonds is their potentially predictable income stream. Bondholders receive fixed interest payments, known as coupon payments, on a regular schedule, providing a potentially reliable source of income regardless of market conditions.

Additionally, bonds offer principal protection if held to maturity. This means investors get back their original investment amount, which can be particularly appealing during uncertain times.

Municipal Bonds: A Tax-Efficient Investment Option

Municipal bonds are debt securities issued by state and local governments. They are especially attractive due to their tax-exempt status, allowing investors to receive interest income free from federal and often state taxes.

Given the possibility of higher taxes under a new administration, tax-exempt municipal bonds become an even more appealing option for investors seeking to minimize their tax burden. With rising government spending on infrastructure likely, municipal bonds are poised to play a significant role in financing new projects, offering opportunities for long-term investors.

The Benefits of Bonds During Times of Inflation and Uncertainty

When inflation rises, some investors may assume that bonds become unattractive since their fixed returns may struggle to keep pace with inflation. Several types of bonds, particularly municipal bonds, TIPS, and floating-rate bonds, provide valuable hedges against inflation. Bonds play an essential role in diversifying portfolios and reducing overall risk, especially during volatile periods.

Tax-Free Municipal Bonds: Stability and Income

Municipal bonds offer potential predictability, and potentially stable returns through interest payments that are often exempt from federal and state income taxes. This is a powerful advantage for high-net-worth investors seeking tax-efficient income, especially when inflation threatens to push them into higher tax brackets. Even in times of rising inflation, municipal bonds maintain their appeal as conservative, low-risk investments that help preserve wealth.

Because local and state governments back these bonds, they are less vulnerable to market volatility than stocks, making them an excellent choice during times of uncertainty. Investors often flock to municipal bonds during election years when shifts in government policy or economic strategies create instability in financial markets.

Treasury Inflation-Protected Securities (TIPS): Built-In Inflation Protection

TIPS are designed specifically to counteract inflation. Unlike traditional bonds, the principal value of TIPS adjusts based on inflation levels, ensuring your investment retains its purchasing power. Both the interest payments and the principal amount increase with inflation, providing a direct hedge in times of rising prices.

Investment-Grade Corporate Bonds: Stability with Growth Potential

Companies with strong financials often issue investment-grade corporate bonds, which offer higher yields than government bonds. These bonds can perform well in moderate inflationary environments, providing steady income along with the opportunity for capital appreciation.

In times of uncertainty—such as an election year or economic downturn—investors often shift their focus toward high-quality bonds that offer security, predictable income, and lower volatility compared to equities.

Building a Resilient Portfolio to Protect Against Inflation

Building a resilient portfolio is critical during inflationary periods. Inflation creates headwinds for many asset classes, so a strategic, diversified approach helps reduce risk and protect against potential losses. Below are several key steps for developing a robust portfolio.

Diversify Across Asset Classes

The goal of diversification is to spread risk across different types of assets so that gains in one area can offset losses in another. A well-diversified portfolio should include a mix of equities, bonds, real estate, and commodities, with each asset class playing a unique role. Stocks may provide growth, but adding fixed-income instruments and inflation-protected bonds helps balance risk during market downturns.

Include Inflation-Resistant Assets

Assets like real estate, commodities, and infrastructure investments tend to perform well during inflationary periods. For example, real estate values typically rise alongside inflation, and commodities like gold and oil become more attractive as prices increase. Investing in real estate investment trusts (REITs) or commodity ETFs allows investors to gain exposure to these assets without direct ownership.

Optimize for Tax Efficiency

Inflation can push investors into higher tax brackets, increasing the importance of tax-efficient income streams. This is where municipal bonds shine, providing tax-exempt income that preserves more of your returns. Portfolio optimization with Tidewater Financial ensures you receive the maximum benefit from tax-free investments.

Monitor and Adjust Your Portfolio Regularly

Inflationary environments require ongoing portfolio adjustments. What works during low inflation may not be effective in a high-inflation economy. It’s essential to review your portfolio periodically to ensure it remains aligned with market conditions and your financial goals.

Related: Why Fixed Income Is Still a Top Choice in Uncertain Markets