Written by: Adam Schrier | New York Life Investments

Last year was unique – with both bonds and stocks down, there weren’t many places to find reprieve from widespread market volatility. As a result, bonds prices fell below par. For short duration high yield, this has only happened approximately 25% of the time in the last 20 years. This creates total return potential beyond just income. In a yield environment where short term Treasuries are yielding over 5%, it is important for investors to consider total return when deciding on a fixed income allocation.

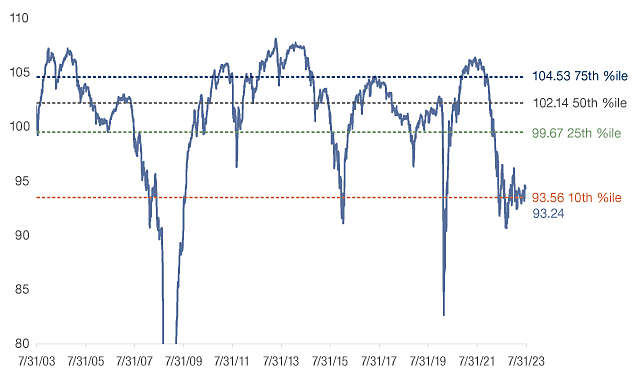

Short duration high yield, as represented by ICE BofA Cash Pay High Yield (1-5Y)(BB-B) Index, consists of relatively higher quality, seasoned bonds, or bonds that were issued at least a few years ago. Typically bonds with longer maturities have higher coupons than similar credits with shorter maturities. So as time passes and high yield bonds move their way into the shorter duration part of the market, their coupons will be high relative to their yield which results in a premium, or bonds trading above par. This is why the median short duration high yield price is 102.1. The current price is 93.2, right around the 10th percentile and almost 9 points below the median.

Figure 1: Current price opportunity: Price in 10th percentile

Source: FactSet, for the period 5/16/2003 – 5/16/2023. Short duration high yield represented by ICE BofA Cash Pay High Yield (1-5Y)(BB-B) Index. It is not possible to invest directly in an index. Past performance does not guarantee future results.

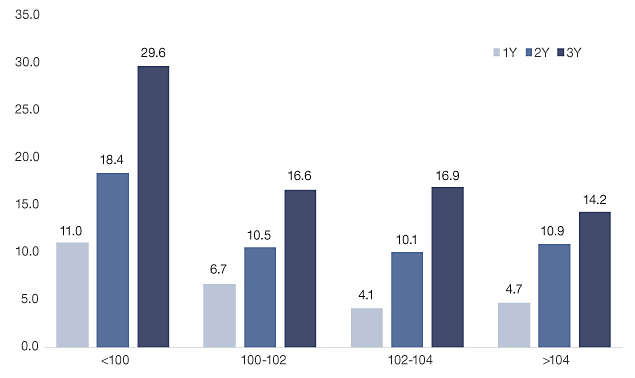

One of the ways bonds differ from stocks is that bonds have math on their side, due to coupons and maturities. As time passes a bond becomes closer and closer to its maturity. In simple terms, a bond will either mature, or it will default, and if default seems unlikely, it will be “pulled to par” meaning its price will appreciate towards par as it nears maturity. Since most bonds have not historically defaulted, investing when prices have been below par has led to attractive returns. With respect to short duration high yield, looking back 20 years, the median 1-year return from any price below par has been 12.0%. The median 2-year cumulative return is 18.4%. These results can be largely attributed to a strong pull to par effect because of short maturities, relatively high coupons, and the avoidance of the riskiest part of the market, CCC-rated bonds.

Figure 2: Higher median returns when prices are below par

Source: FactSet 3/31/03 - 3/31/23. Short Duration High Yield represented by ICE BofA High Yield 1-5 BB-B Index. It is not possible to invest directly in an index. Past performance does not guarantee future results.

When talking about high yield valuations and return potential, it is important to also discuss fundamentals. The 12-month default rate as per JP Morgan is 1.4% and expected to increase to around its long-term average. One reason we don’t expect abnormally high default rates is that there was a large amount of refinancing activity during 2020 and 2021 – issuers were able to lock in low interest costs which in turn led to record interest coverage ratios. Although the economy is certainly slowing down, high yield issuers are coming into this downturn from a position of strength.

During the pandemic, there was a massive wave of downgrades from investment grade into high yield, including three of the largest on record – Kraft Heinz, Ford, and Occidental Petroleum. Kraft Heinz has already become a “rising star”, getting upgraded back to investment grade and according to LCD News, Occidental Petroleum will likely become a “rising star” soon as Fitch just upgraded their rating of the issuer. So, companies are still able to improve their balance sheets and strengthen their financial position.

That said, many investors are looking for ways to increase the quality of their portfolios and we believe short duration high yield can accomplish that goal. For starters, last year the broad high yield market was down 11.2%, however short duration high yield was only down 5.5%.

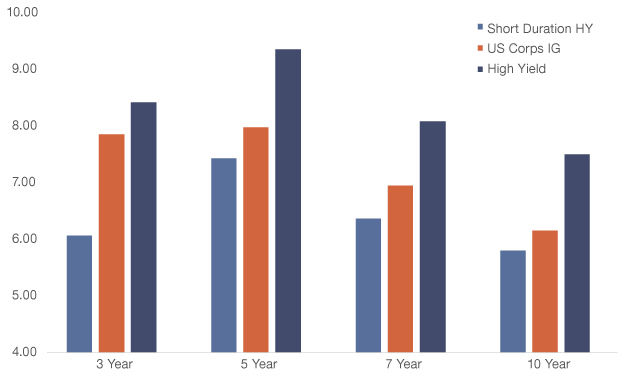

Additionally, high yield bonds that are closer to maturity are less sensitive to rate moves. Similarly, spread widening and tightening impacts prices of shorter duration bonds less than longer duration ones. For this reason, and the fact that the index excludes bonds with the most credit risk, CCCs, is why the asset class can be characterized as a lower volatility segment of high yield. Not only does it have less volatility than the broad high yield market, but it also has less volatility than investment grade corporate bonds.

Figure 3: Short duration high yield has had less volatility than investment grade corporates

Source: FactSet, as of 4/30/2023. Short duration high yield represented by ICE BofA Cash Pay High Yield (1-5Y)(BB-B) Index; US Corps IG represented by ICE BofA US Corporate Index; High yield represented by ICE BofA US High Yield Index. It is not possible to invest directly in an index. Past performance does not guarantee future results.

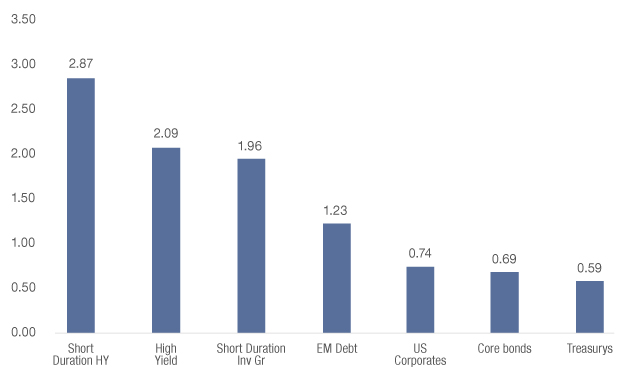

Short duration high yield can be considered an “all-weather approach” to high yield investing because of its lower volatility profile and higher quality bias – it has tended to be more resilient than the broad market. Historically, it has generated a particularly high yield given its shorter maturity profile and has had a greater yield per unit of duration than most other areas of fixed income, including short duration investment grade corporates, emerging market debt, and core bonds. Therefore, historically this asset class has been used through the cycle holding to generate income and provide diversification.

Figure 4: Competitive yield per unit of duration compared with other areas of fixed income

Source: FactSet as of 4/30/23. Short Duration High Yield represented by ICE BofA High Yield 1-5 BB-B Index. High Yield represented by ICE BofA U.S. High Yield. Short Duration Investment Grade represented by ICE BofA U.S. Corporate (1-5 Y). EM Debt represented by JP Morgan EMBI Global Diversified. U.S. Corporates represented by ICE BofA U.S. Corporate. Core bonds represented by Bloomberg U.S. Aggregate. Treasury represented by ICE BofA U.S. Treasury. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Finding income was a challenge for much of the recent past. We now find ourselves in a place where income is available – as of 5/23/23, T-bills are yielding over 5%! With investors looking to step out of cash while keeping a watchful eye on risk, it is time to look at fixed income through a total return lens. With deep discounts, favorable fundamentals and short maturities, high yield may present an attractive risk-adjusted return opportunity. In particular, given its rare discount, short duration high yield may be the right mix of quality and return potential that advisors are looking for in order to start shifting away from cash.

Related: Measurement Dashboards: Look at Multiple Data Points To Measure Your PR Impact and Investment