Written by: Tim Benzel, CFA

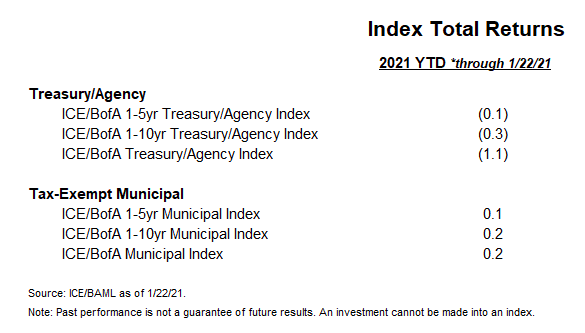

The municipal market has picked up in 2021 right where it left off in the fourth quarter of 2020: outperforming many other sectors of the investment grade market. Despite an increase in intermediate and long U.S. Treasury rates over the past few weeks as investors price in a higher probability of additional fiscal stimulus, municipal yields have hardly budged, leaving year-to-date returns for the sector slightly positive.

Why the outperformance? We would point to two key areas that are driving the market:

Technicals: The technical backdrop, meaning the supply of new municipal bond issues measured against the demand from investors, has been and continues to be quite positive. Year-to-date, municipalities have issued approximately $16 Billion of debt. When netting this issuance out against bond maturities and coupon payments, the “net” supply figure YTD totals $2B. According to Lipper, mutual fund inflows YTD have totaled $11B. Quite simply, there aren’t enough bonds to go around, causing investors to stomach rich valuations to get money put to work.

Fundamentals: Despite many questions around municipal credit quality since the pandemic driven recession began last year, municipalities have broadly performed well financially. In many cases, the loss of tax-revenue has been less than expected, and municipalities have done a solid job cutting expenses. In addition, as part of the recently introduced fiscal stimulus package from the Biden Administration, there are funds set aside for state and local government financial relief. While any final package is yet to be determined, Democrat control of the White House and Congress makes some type of support likely.

So where do we go from here?

Certain questions are arising now that we have more clarity around party control in Washington, namely around tax-policy. Will tax rates change? Will the SALT deduction cap be removed? Will advanced refunding transactions be allowed again? The answers to these questions have the potential meaningfully impact the municipal market, but unfortunately, we don’t have a clean read into the probability of outcomes yet. We do believe however, that any tax-policy changes will be a late-2021 or 2022 event, which will likely leave the current market dynamics in place for the next several months.