Written by: Daryl Clements and Jason Mertz

The prospect of rising interest rates understandably has many municipal bond investors concerned. But rising rates aren’t necessarily bad for munis. In fact, higher yields should be welcome news, since they mean more income. The key is to stay flexible.

When rates are rising, investors need portfolio protection. But it’s no time to sit idly in cash and wait things out. Every day spent on the sidelines means income and opportunities lost. A passive, set-it-and-forget-it investing approach isn’t ideal either. Buy-and-hold laddered portfolios tend to lock in low yields that disappoint if the market begins to offer more.

In contrast, active muni portfolio returns have beat their passive cohorts 94% of the time, with an average outperformance of 1.9% over rolling two-year periods from 2009 to 2021. That’s because active muni investors can respond quickly as conditions shift.

Municipal Action Plan: Prepare to Flex

Truly active managers shine in challenging investment environments, especially when they are given a flexible mandate. Here’s the plan we believe investors should expect from their active managers today:

1. Shorten your portfolio duration target. As a rule, a portfolio with a shorter average duration will be less sensitive to rising interest rates than a portfolio with a longer duration. Just don’t shorten too much, or you’ll lose out on income.

2. Vary your maturity structure. There’s no single path to achieving your portfolio’s duration target. A ladder may make sense in some environments, while concentrating in a narrow range of maturities or “barbelling” holdings of short and long bonds may make sense in others. In today’s environment, a barbell structure will likely lead to better outcomes for investors.

3. Consider municipal credit. Not only do mid-grade and high-yield credits offer more income, but they tend to be less sensitive to rate increases. In fact, historically, municipal credit has outperformed when rates rise. And credit risk isn’t a prevailing concern today, given the health of municipal finances.

4. Look outside the muni market for opportunities. Should municipal bonds become expensive relative to taxable bonds, the most flexible managers can invest part of the portfolio in Treasuries or investment-grade corporates to maximize after-tax income and return. Later, as muni valuations become more attractive, the manager can sell the taxable bonds at a gain and reinvest in munis at higher yields.

5. Choose an effective inflation-protection strategy. Today’s muni investors should guard against surging inflation—realized or expected. Treasury inflation-protected securities (TIPS) aren’t the only tool muni investors can deploy to this end. Inflation-linked municipals and Consumer Price Index (CPI) swaps can also help investors mitigate inflation risk while remaining tax efficient.

6. Harvest your losses for broader benefits. Even underperforming muni bonds can spell opportunity. With tax-loss harvesting, active investors can deliberately sell at a loss to offset taxes on gains elsewhere in a portfolio. Besides lowering the tax bill, it also can boost performance as the savings can be reinvested in the market at higher yields. If tax-loss harvesting provides a significant benefit, why don’t more managers actively do it? It’s not easy for managers to see and act on all the opportunities across tens of thousands of holdings in real time. Add in the variability of managing thousands of unique SMA portfolios daily, and it usually leads to managers becoming complacent. Too often it comes to a year-end dash to rack them up, often at the client’s request.

This was the industry challenge behind the genesis of AB’s AbbieOptimizer. This technology-based portfolio engine systematically scours for beneficial tax-loss scenarios across thousands of municipal bond portfolios daily. By methodically analyzing factors such as tax hurdle, relative value and transaction costs, AbbieOptimizer helps generate more tax savings.

Muni Yields Aren’t Likely to Rise Much Anyway

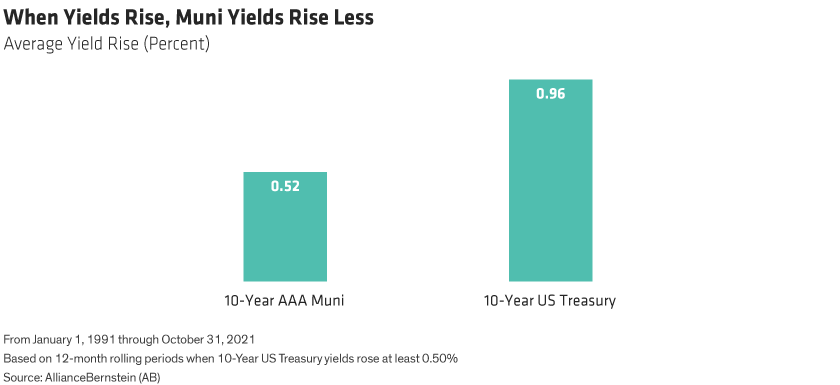

Lastly, rising rates may be less worrisome than expected, at least as far as muni investors are concerned. That’s because, thanks to their tax exemption, muni yields are less volatile than Treasury yields and tend to rise much less. In fact, historically, muni yields rose on average about half as much as Treasury yields, when Treasury yields rose by at least half a percent (Display).

The Best Defense Is a Good Offense

The best defense in this environment? Tune in and take advantage. As the pandemic winds down, state and local economies are rebounding, and municipal bond issuers are in excellent financial shape. Municipal bond managers who are alert and ready for action can find both shelter and compelling opportunities. Investors should expect nothing less.