Caught in the COVID-19 economic downdraft, the municipal market suffered unprecedented volatility in March. Since then, however, demand for higher-grade municipal bonds has soared, driving the Bloomberg Barclays AAA Municipal Index up 11% between its March 23 low and May 31.

But many mid-grade municipal issues—such as BBB-rated bonds—have lagged this rally, even as other higher-risk assets, such as corporate debt and equities, have enjoyed strong comebacks. Tax-aware investors should sit up and take notice.

For Mid-Grade Credits, Reality Is Better than Perception

To our minds, one ingredient in mid-grade bonds’ lagging performance is perception. The pandemic continues to fuel dire news of state and local budget shortfalls. That leaves most muni investors sour on taking credit risk for now.

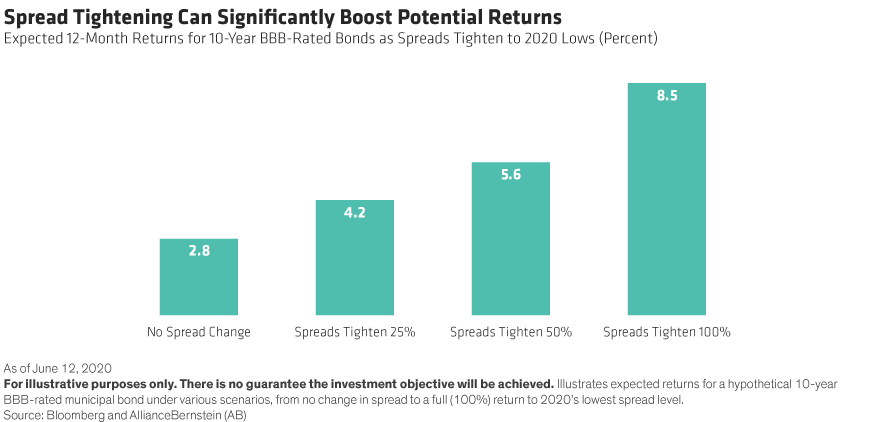

As the herd flocked to higher-quality issues, spreads for BBB-rated munis widened 85 basis points, or 139%, from March through May. Even high-yield issues were left in the cold. Their spreads widened 191 basis points—a 101% jump. At these levels, we believe mid-grade credits offer compelling return potential over the next year, based on several spread-tightening scenarios and other factors (Display).

Even if spreads hold steady, such highs encourage active investors to find value by letting research—not fear—lead their decisions. Fear sparks expectations that are almost always dislocated from reality. Active muni investors look beyond perception and at the underlying fundamentals of each credit.

Fundamentals Healthier for Mid-Grade Credits

Many mid-grade issuers are well positioned to weather the pandemic. Even so, a selective, research-driven approach is more important than ever, as fear lingers in some regions and sectors, while normalcy emerges in others.

We’re finding mid-grade opportunities in airports, toll roads and hospitals. These sectors fell out of favor recently, but still have underlying strengths, such as healthy cash reserves and federal support.

Los Angeles International Airport, for example, has nearly 500 days of available funds to use. Many toll roads—like Texas’s Harris County Toll Road Authority—have several years of cash to last them. Some goes to debt service, but the rest creates a big buffer to cover expenses while air and road travel ramps up to normal.

Hospitals, which received substantial Coronavirus, Aid, Relief, and Economic Security (CARES) Act aid, currently can cover 60% to 70% of cost spikes from COVID-19 patients. But elective surgeries—hospitals’ largest revenue generator—have also bounced back faster than expected, with some at 80% of volume compared to this time last year.

Municipal Issuers Are Resilient

The coronavirus panic spawned multiple challenges for most states and local municipalities. But municipal issuers have been resilient in stressful times due to inherent qualities like reliable revenue streams, low debt and the fact that they provide essential services.

Resiliency also comes from their authority, including the power to raise taxes and cut costs to address crises. And most states and municipalities are much better financially prepared to navigate the COVID-19 environment than they were before the 2008 financial crisis.

These and other truths are why municipal bond defaults have been remarkably low over the years. Since 1970, the cumulative default rate for all municipal bonds is just 0.1%.

Potential Mid-Grade Snapback Ahead

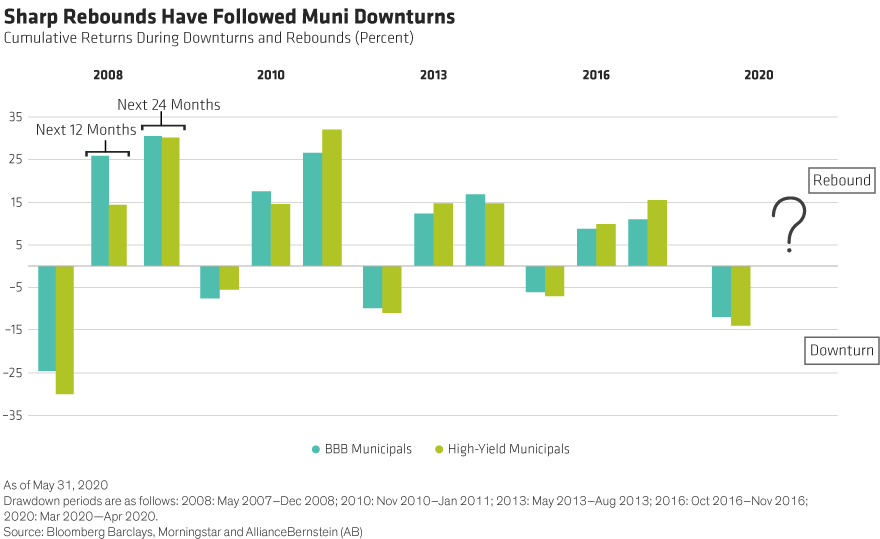

Time after time, rallies have followed downturns. Why would today be different? We’re optimistic that it won’t be. Mid-grade and high-yield muni credits have rallied significantly after sharp sell-offs during the 2008 financial crisis, the 2010 drop, the 2013 taper tantrum and the 2016 election (Display).

We expect mid-grade credits to follow a similar path in the post-COVID-19 recovery. They are especially likely to rally given how low higher-grade yields have become. Where will yield-starved municipal bond investors turn when the 10-year AAA muni bond yield is just 0.9%? We believe they’ll snap up mid-grade credits, whose yields look very tempting in comparison.

But that’s not all. Annual summer redemptions may also contribute to a potential mid-grade rebound. Most muni bonds mature between June and August, creating a summer “redemption season.” This summer, about $168 billion will be returned to investors through coupon payments and as bonds mature or are called, according to Citi. With expected new issuance at just $116 billion, that leaves $52 billion in net cash for investors to reinvest.

Moreover, since March, state and local governments have received a tremendous level of support from Congress and the Federal Reserve, either in direct CARES Act stimulus or generous liquidity backstops to keep the market vibrant.

As the economy awakens, local conditions are improving. So too are the underlying credit fundamentals for many mid-grade municipal issuers. With the higher yield and snapback potential of mid-grade municipal bonds, muni investors may find them to be an opportunity worth exploring.

Related: How Target-Date Funds Can Use Equities for Stability

Daryl Clements is a Portfolio Manager of Municipal Bonds at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams, and are subject to revision over time.