Written by: Tim Benzel

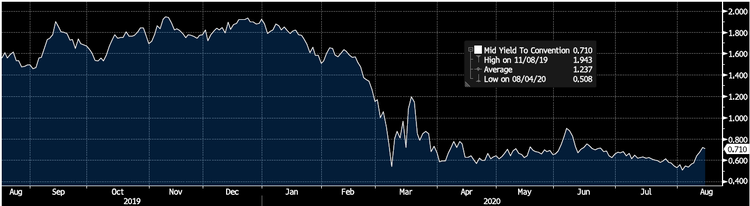

A side effect from the Covid-19 crisis has been a dramatic decline in sovereign bond yields, globally and here in the U.S. With the economy mired in a deep recession, inflation generally at low levels, and the Federal Reserve indicating that it expects to keep short-term interest rates set at near zero indefinitely, it is no surprise that long-term rates have fallen as well. In fact, the yield on the closely watched 10-year U.S. Treasury Note recently hit a record low: 0.51%.

10-year U.S. Treasury Note Yield (1-year History)

Source: Bloomberg Finance L.P. as of 8/14/20. Used with permission of Bloomberg Finance L.P.

And thanks to support programs put in place by the Fed to ensure the smooth functioning of capital markets after a March “freeze,” yields on other high-quality fixed income sectors, such as corporates and municipals, have declined as well. Google’s parent company, Alphabet, made news on August 3rd when it issued 10-year bonds with a coupon (think yield) of 1.10%. Last week, AA-rated Los Angeles County MTA issued sales tax-backed bonds with a tax-exempt yield of 0.77% for the 2030 maturity.

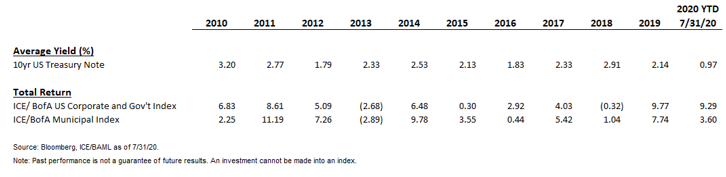

Given the current environment, we have, understandably, received many questions about the state of the markets, the absolute value of investment grade bonds at these yield levels, and what investors may expect returns to be moving forward. Fortunately, we don’t have to travel back in history very far to analyze returns in low yield environments. In the decade following the great financial crisis of 2008, the Federal Reserve set the Fed Funds Rate at the zero bound for years. It wasn’t until December 2015 that the Fed raised rates, and even then it was only a 0.25% increase. Long-term bond yields were also quite low throughout this time, with the 10-year Treasury breaking below 1.5% at times during 2012, 2016 and 2019.

As shown in the table, low rates don’t necessarily equate to negative future returns. For tax-exempt municipals, returns have only been negative one year in the past decade. For a mix of corporate and government bonds, returns have been in the red in just two years.

It is important to remember that total returns for bond investors are dictated by many factors in addition to the level of interest rates, including credit spread changes and individual sector and security dynamics. For us, the ability to actively trade portfolios and to look to take advantage of various market opportunities is key.

Moving forward, our expectation is for yields to generally remain at low levels, as the various Fed programs in place are a powerful force in keeping yields low. Domestic bond markets are also well supported by overseas investors looking to escape low, or in many cases, negative yields in their markets.

However, 2013 is an interesting case study. It was then that the Fed hinted at removing the extraordinary monetary stimulus employed at the time (low rates combined with quantitative easing). This set off the famous “taper tantrum,” which caused a spike in rates and a widening of credit spreads in most sectors. Given the widespread dependence on the Fed today, any such hint of the removal of monetary stimulus would likely spook markets again. As such, we are watching closely for signals that would cause the Fed to back-off. Inflation would be the most likely factor, and we are not seeing any hints of meaningful upward inflationary pressures currently.

We would also remind clients that we have a variety of strategy and duration options designed to meet a variety of client objectives. Should you wish to discuss your portfolio and strategy in this environment, please do not hesitate to reach out.

Related: The 2Q20 Corporate Earnings Season Not as Bad as Feared