Written by: Gary Ashton

Moody’s Analytics reported in last week’s market outlook that corporate bond issuance reached record highs for August at $156 billion for investment-grade debt and $56 billion for high yield debt. Companies used most of these net proceeds to refinance existing loans and bond debt. The report goes on to say that in 2020, US$-denominated corporate bond issuance will soar higher by 49.6% for IG to $1.96 trillion, while high-yield supply may rise 17.5% to $508 billion.

The record bond issuance comes at a time when the market is growing increasingly concerned about the quality of US corporate debt. According to Moody's Investors Service, the US trailing 12-month high-yield default rate jumped to 8.4% in July 2020 from 3.1% the year before and may average 11.4% during 2020’s final quarter. Credits hardest hit are in sectors most impacted by the global Covid-19 crisis such as travel and entertainment as well as energy. A default rate north of 11% is a worry, but investors must also remember that the US high yield default rate reached a high of nearly 15% during the Great Financial Crisis of 2008-2009.

Using ETFs to Gain Credit Exposure

There are several ETFs available for investors interested in high yield credit. One of the most well-known is the iShares iBoxx $ High Yield Corporate Bond ETF (AMEX: HYG). Another is the SPDR Barclays High Yield Bond ETF (AMEX: JNK).

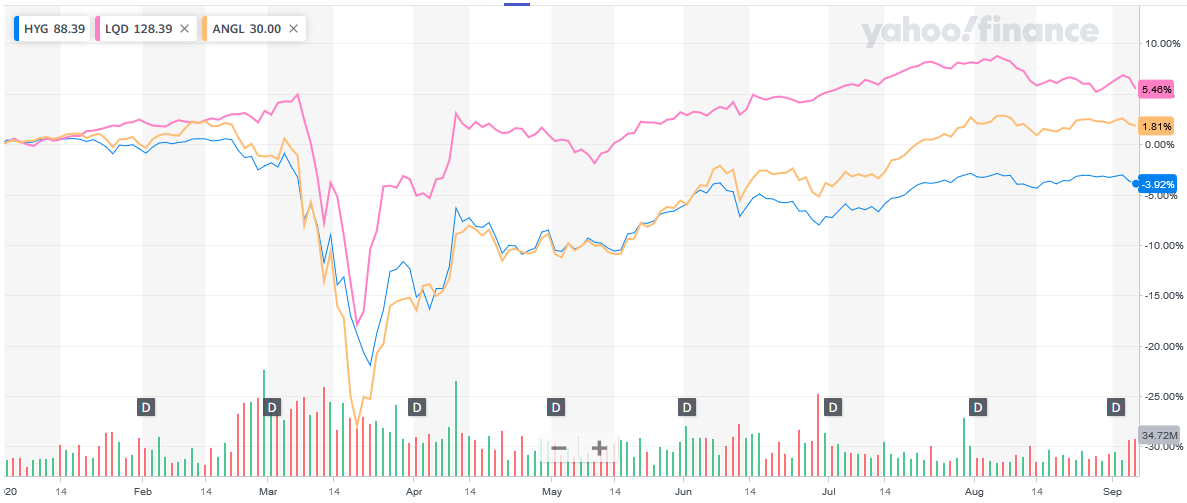

Other credit related ETFs include the iShares iBoxx $ Investment Grade Corporate Bond ETF (AMEX: LQD), which seeks to track the investment results of an index composed of US dollar-denominated, investment-grade corporate bonds. Analysts consider investment-grade debt to be a lower default risk relative to high yield debt. Investors can also look at the VanEck Vectors Fallen Angel High Yield Bond ETF (AMEX: ANGL), which seeks to replicate the price and yield performance of the BofA Merrill Lynch US Fallen Angel High Yield Index. This index contains bonds that have only recently lost an investment-grade credit rating.

In 2020, investment grade credit investments are performing best with a 5.5% return in the LQD ETF, followed next by names recently downgraded to junk, as reflected in the ANGL ETF with a 1.8% return. So far in 2020, high yield investors are not fairing so well with the HYG ETF costing investors 3.92%. If Moody’s default expectations turn out to be too conservative, then investors could expect this ETF to perform better from 2021 onwards.

In March 2020, the US Federal Reserve starting to buy corporate bonds to inject liquidity and support the stability of the financial system. The Fed decided to buy not only investment-grade bonds but also bonds that rating agencies recently downgraded to junk. In the market, such bonds are known as fallen angels because they “fell” in credit quality from investment grade to high yield. The VanEck Vectors Fallen Angel High Yield Bond ETF is an investment vehicle retail investor can use to capture this asset class.

Related: Will the U.S. Retail Sector Stage a Comeback in 2020?

DISCLOSURE: The views and opinions expressed in this article are those of the contributor, and do not represent the views of Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.