Clients are becoming increasingly climate-aware and that's meaningful in advisor relationships because it can serve as a foundational piece and as a conversation starter, particularly with younger demographics that prioritize investing styles that align with their personal values.

Another plus for advisors is that while many clients know they want sustainability and climate-aware strategies in their portfolios, their knowledge base is still limited and largely revolves around climate's implications for equities. That's an opportunity for advisors to guide clients, helping them realize there are climate implications for assets beyond stocks.

In fact, climate risk is highly pertinent in the bond market, though many clients may not be aware of that. That's meaningful because, as advisors well know, 2021 is a minefield when it comes to fixed income allocations. However, that situation won't last forever and it pays to inform clients today why climate matters with bonds.

It's About Risk Mitigation

Acknowledging that government bond yields are low and although credit spreads are tight, many advisors positioning clients in corporate bonds – both investment-grade and high-yield. The climate risk conversation should happen prior to those moves being made or soon thereafter. A recent report by MSCI Research highlights why climate risk matters with corporate debt.

“With the 2021 UN Climate Change Conference (COP26) approaching, financial institutions are increasingly focused on gauging the risks related to climate change. We investigated how various climate scenarios could impact the credit risk of portfolios,” notes MSCI. “Our model-based analysis showed that, for a large sample of issuers of USD- and EUR-denominated bonds, about 16% of investment-grade issuers could experience a migration to high yield, while an additional 27% of the high-yield issuers could be downgraded under a 'Net-Zero 2050 (Average Extreme Weather)' scenario.”

This is important stuff because in today's low-yield environment, some advisors may feel as though their backs are against when it comes to getting income out of fixed income. Hence, the enthusiasm for corporate bonds and the related funds this year.

On the other hand, advisors also know how important probability of default (PD) is with corporate debt and while default rates are benign this year, climate-challenged issuers could see elevated defaults in the future.

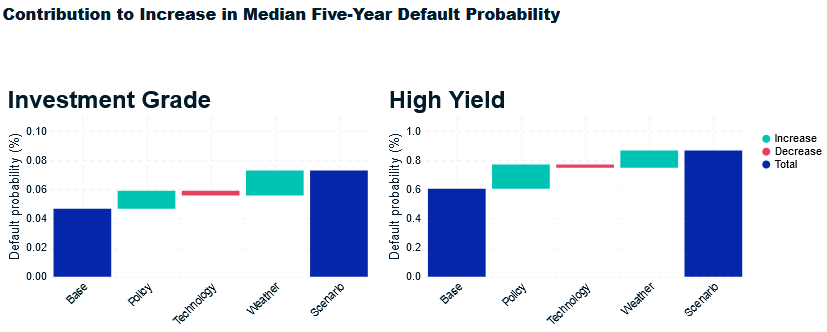

“For the sample of investment-grade (IG) and high-yield (HY) corporate-bond issuers we investigated, the changes in median PDs are relatively benign with increases of up to 0.03 percentage points for investment-grade issuers and 0.39 percentage points for high-yield issuers,” according to MSCI. “Policy risk has the largest contribution for the 'Net-Zero 2050 (Average Extreme Weather)' scenario, whereas extreme-weather risk is the main driver in the other two scenarios.”

Courtesy: MSCI

Fallen Angels Are Nice, But...

Recently in this space, we examined fallen angels, or those corporate bonds born with investment-grade ratings that are later downgraded to junk status. For those wanting more information on fallen angels, click on the link above, but long story short, that form of corporate debt historically performs well – better than traditional junk bonds – over long holding periods.

Thing is, advisors don't want to expose clients to bonds, or funds littered with such bonds, before they're downgraded. Said another way, no one wants to own a bond that looks vulnerable to downgrade because that's where the losses are incurred. Upside with fallen angels is usually accrued after markets price in that fallen angel status is coming. Data confirm that this is meaningful in the climate conversation.

“As investors increasingly incorporate climate change into their risk management, estimating its impact on credit portfolios becomes an important ingredient,” concludes MSCI. “Our analysis showed that default probabilities slightly increase on average; but more importantly, 16% of the investment-grade issuers could migrate to high yield, and an additional 27% of high-yield issuers could be downgraded, potentially putting downward pressure on portfolio returns.”

Bottom line: Not everyone has to be climate-enthusiastic in investing terms, but a little advisors homework on this front will go a long away with clients' fixed income allocations.

Related: For Client Bond Allocations, Fallen Angels Look Angelic