Written by: Jordan Jackson

Coming into 2023, the rallying cry from the asset management community was “Bonds are Back![1]”. There were several reasonable assumptions behind this call: 1. The Federal Reserve had already hiked rates by over 4% and had hinted at slowing the pace of rate rises, 2. The worst of inflation was behind us and would continue to decline this year, 3. Tighter monetary policy would eventually lead to a growth slowdown and stronger demand for fixed income instruments, and 4. The U.S. Aggregate Bond Index (U.S. Agg.) had finished its worst year on record and historically, core bonds tend to recover nicely following down years.

However, many fund managers and investors were caught offsides. While inflation has continued to decline, growth remains incredibly resilient. Moreover, the Fed has hiked rates another 1% and intends to keep rates elevated into 2024. Looking ahead, the path for interest rates appears even more uncertain and views are less consensus. Rather than be prescriptive on the trajectory of rates, it may be useful to identify economic scenarios that could play out over the next 12-24 months and assess the impact to U.S. Treasury bond returns.

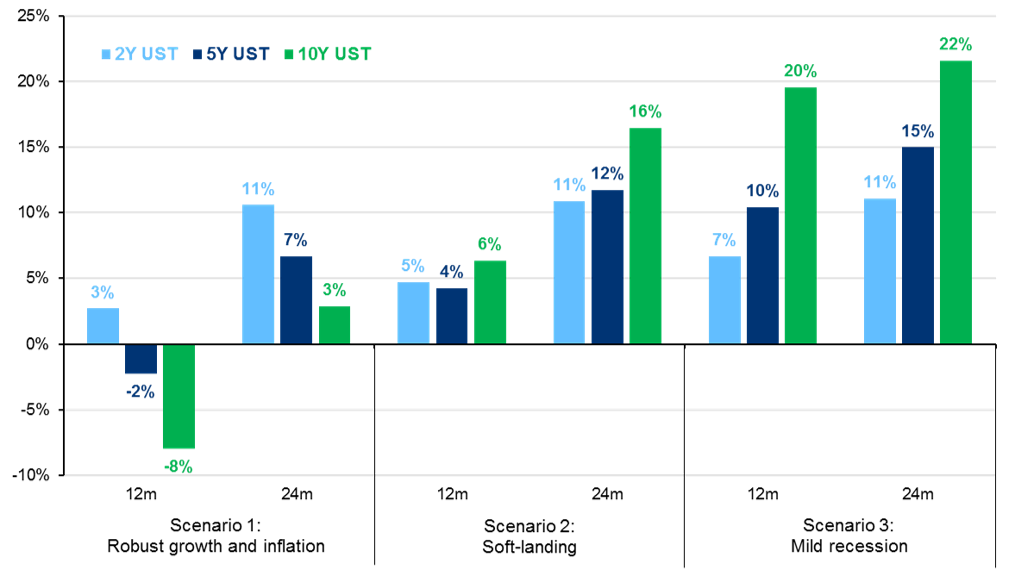

Scenario 1: Robust growth and inflation

Economic growth evades a slowdown and inflation sticks above 3% and potentially inflects higher. The Fed hikes rates two more time to 5.75-6.00%, but the market absorbs tighter monetary policy comfortably. The labor market remains healthy and real wage growth stays positive, supporting the U.S. consumer. As the outlook improves, stocks, yields, and the dollar rise. Long term rates move higher on the back of stronger growth and inflation and the curve steepens to flat at 6% in one years’ time. Thereafter, both growth and inflation normalize to a trend like pace over 2025 and the curve steepens.

Scenario 2: Soft-landing - Modest growth and inflation

Slowing inflation and a moderating labor market allow the Fed to pause rate hikes but remain restrictive through 1H24 before cutting rates very gradually. A resilient consumer and an overall healthy labor market enable the economy to narrowly avoid recession, although growth slows to a below-trend pace. Long term yields remain range bound for a period before gradually declining, reflecting receding inflation and gradual growth. The curve continues to steepen and is positively sloped by the end of 2025.

Scenario 3: Mild recession - Negative growth and disinflation

Monetary policy acts with long and variable lags, eventually pushing inflation closer to the Fed’s target, but also pushing the economy into recession. Banking sector woes result in slower credit growth, impacting businesses and consumers. However, the recession is mild due to a lack of cyclical excess in the economy and a structural labor shortage that limits the rise in unemployment. The Fed cuts rates to 3.5% by end of 2024 and to 2.5% by end of 2025. Long term yields fall to 3.00-3.25% over the next 12 months and then gradually move higher as growth begins to improve.

Cumulative total returns under different economic and interest rate scenarios

U.S. Treasury notes, %

Source: Bloomberg, Federal Reserve, J.P. Morgan Asset Management. Data are as of November 3, 2023.

Investment Implications

Naturally, these scenarios are not the only ones that could play out over the next couple of years. In our scenario analysis we highlight return impact across a variety of markets in a more severe recession and a stagflation environment. That said, we do view these as the most likely potential outcomes.

To be clear, we are skewed to the best-case scenario being a soft-landing, and worst-case a recession. Should either of those scenarios come to fruition, beginning to leg into duration with long-term yields near 5% seems appropriate. In the event consumers continue to spend beyond their means given a tight labor market and businesses continue to invest given government subsidies and enthusiasm around generative AI, this could lead to persistent above trend-growth and stickiness in inflation. In that scenario, investors will want to stay short duration as the Fed will likely continue to tighten monetary policy.

Overall, investors may be disappointed in the performance of their “safest” assets over the past three years. However, the reset in yields and the prospects for weaker economic fundamentals in the year ahead suggests reengaging actively managed fixed income will be critical for portfolios over the next market cycle.

[1] https://www.barrons.com/articles/bond-funds-investing-portfolio-income-generating-51672717225?reflink=desktopwebshare_permalink

09uo230811152453

Related: After Two Consecutive Pauses, What Is Next for the Federal Reserve?