We know that rising bond yields can be painful in the short term as prices fall. But in the long run, rising rates are good for bond investors. Here’s why: the income bonds generate in the form of coupon payments gets reinvested at new and higher rates.

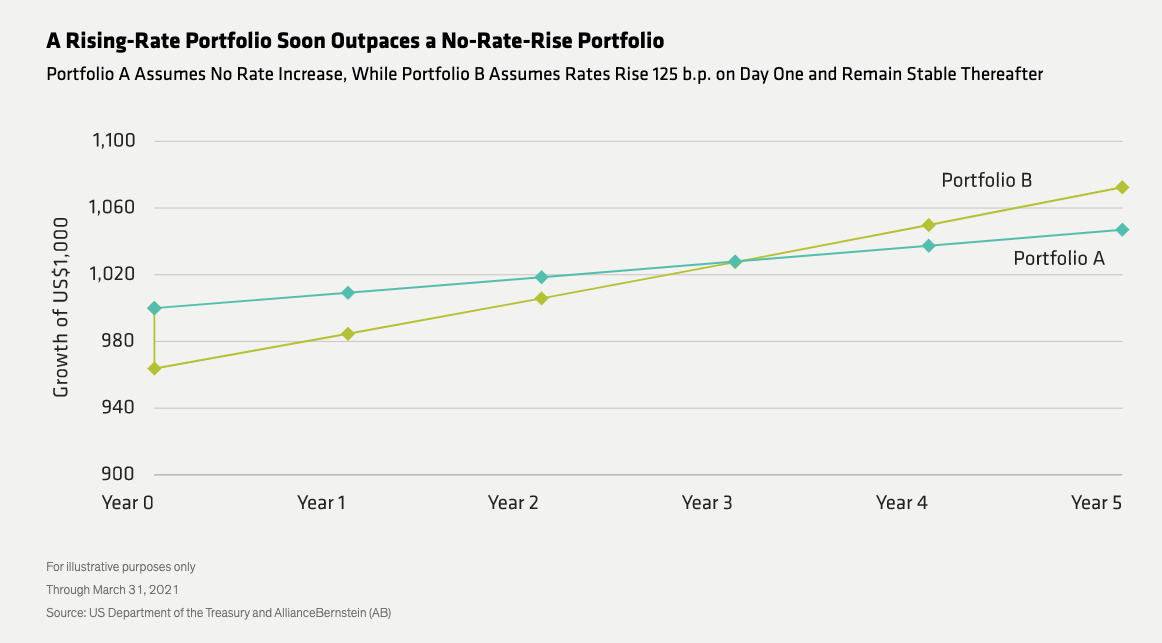

To see what the actual impact of rising rates might be on a bond portfolio, we modeled a simple portfolio of Treasury bonds and “shocked” it by assuming a sudden 125-basis-point rise in rates. What would its immediate performance look like? And then, how would the following years unfold?

At first, the portfolio sees an initial price loss—an undeniably painful experience. Even so, the portfolio still generates income, and investors who stay the course can reinvest that income at a higher yield. This helps to make up for the price loss and eventually offsets it altogether; in less than two years, our portfolio is back in the black.

In year three, the portfolio catches up to where it would have been had rates never risen. And thereafter, it’s worth more and is growing faster. From here on, you’re better off.

Here’s our rule of thumb: as long as the duration of your portfolio is shorter than the investment horizon, rising rates will benefit you—no matter how large the rate increase.

Related: With Some Help from the Hill, Munis Could Be Back in Style