Written by: Marc Odo | Swan Global Investments

From Bleak to Dire (Updated May 2021)

Our outlook for bonds has moved from bleak to dire. Over the coming decade or two, bonds are unlikely to fulfill their dual role of income and capital preservation. Bond investors will be forced to choose between income or capital preservation, and there is a good chance they could end up with neither.

In the summer of 2019, Swan Global Investments published a well-received white paper, “The Bleak Future of Bonds.” The main thesis was the economic fundamentals are unfavorable for fixed income securities across the credit spectrum creating portfolio construction challenges for many advisors.

Less than a year later, the global economy was devastated by the coronavirus pandemic. Unfortunately for investors, the monetary and fiscal consequences of the pandemic have made the outlook for bonds even worse. The trends and concerns raised a year ago have been exacerbated by the pandemic. What was bleak two years ago is dire today.

This brief update revisits the main tenets of “The Bleak Future of Bonds” paper and provides updates to some key numbers in the aftermath of the COVID-19/coronavirus crisis and what this means for portfolio construction going forward.

Revisiting Bleak Bonds

The paper originally made the following key points:

- Treasuries: Following the Global Financial Crisis (GFC) of 2007-09, monetary policy was kept too loose for too long. Yields were suppressed, punishing savers and bond holders.

- Corporates: Low borrowing costs encouraged companies to leverage up their balance sheets. Credit quality in corporate bonds has been deteriorating and a worrisome bulge of issues are rated BBB, just one notch above “junk” status.

- High Yield & CLOs: The chase for yield lead to easy funding for non-investment grade issuers. Lending standards were loosened, and the complexity of Collateralized Loan Obligations (CLO) drew worrying comparisons to mortgage-backed securities (MBS) at the root of the GFC.

- Fiscal Outlook: As the baby boomer generation enters retirement, the fiscal situation of the United States is made worse by the “three D’s”: deficits, debt, and demographics. The country already spends more than it receives in revenues, and these trends are set to get much worse in the coming decade.

The Impact of COVID-19 – A Dire Future for Bond Markets

The COVID-19 pandemic has made the outlook for all these factors worse. If there was a doomsday clock predicting an eventual debt reckoning, the global pandemic moved the clock’s hands significantly closer to midnight. Since the onset of the COVID-19 Crisis, the bond market has gone through three major stages:

Source: U.S. Treasury, St. Louis Fed

Stage 1: Flight to Quality (Q1, 2020)

As the coronavirus crisis broke out of China and swept across the globe, the impact on the financial markets and the world economy was severe. In the U.S. the longest economic expansion and second-longest bull market came crashing to a halt.

The S&P 500 lost over a third of its value in just over a month. In a panic, investors rushed into “safe harbor” assets like cash and Treasuries.

Yields on 3-month Treasuries approached 0% and the 10-year yield fell below 1%. Liquidity and credit quality concerns slammed corporate and high yield debt and the spreads over Treasuries spiked.

Stage 2: Stabilization (Q2-Q3, 2020)

The massive fiscal and monetary stimulus had the desired effect. Markets rallied off their lows and by early August the S&P 500 had recovered all of its losses. This coincided with the yield on the 10-year Treasury bottoming at 0.52%.

As calm returned to the markets, the spreads of investment grade and high yield corporate bonds began to narrow. In absolute terms, corporate bonds were offering less yield than they were before the crisis.

The collapse in yields throughout 2020 painted the bond market into a corner. If yields remained low, investors wouldn’t be able to generate enough income to outpace inflation. If yields started rising, the prices of bonds would fall. The stage was now set for some realized pain in the bond market.

Stage 3: Duration Damage (Q4, 2020 to present)

Investors tend to think of bonds as the “safe” part of their portfolio. Some mistakenly believe bonds won’t lose value. But Finance 101 tells us if yields rise, bonds will lose value.

This is what happened in the fourth quarter of 2020 and the first quarter of 2021. The benchmark 10-year Treasury rose from 0.52% to almost 1.75% in just over six months. During the first three months of 2021 the Barclays US Aggregate Bond index lost 3.37% and the Barclays US Treasury Long-Term index was down 13.51%, its biggest loss in over four decades.

What caused this reversal?

How Government Response Turned the Outlook from Bleak to Dire

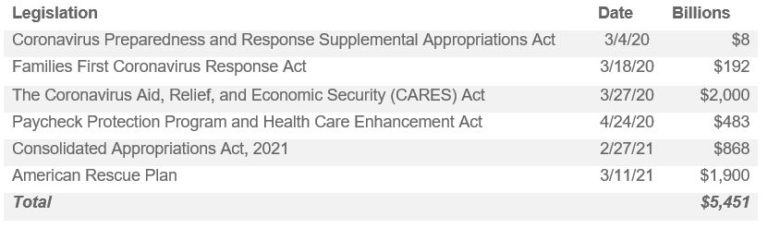

The government’s response to the Covid-19 pandemic was simple: throw money at it. And not just some money, but a truly unprecedented amount of money. Since 2020, almost $5.5 trillion in Federal government spending has been authorized to combat the impact of the pandemic:

Source: Peter G. Peterson Foundation

In addition to the trillions dedicated to the Covid responses, the new administration is proposing a massive expansion in government spending. The infrastructure plan carries a price tag of $2.3 trillion and an expansion of educational and family-support measures comes in at $1.8 trillion[1]. While it is unlikely these proposals will be adopted in their current form, it’s enough to make bond holders sweat.

This fiscal stimulus is only part of the equation; monetary stimulus is the other side of the coin. While the Federal Reserve has engaged in over a dozen major activities to bolster the economy, the one that stands out is a return of quantitative easing. Since the crisis began, the Federal Reserve has added $4 trillion to its balance sheet, going from $3.8trn to $7.8trn.

Simply put, no reasonable person should think such an extreme supply of debt can be issued without a corresponding impact on yields.

Bonds are Dead Money Going Forward

The outlook for bonds is indeed looking dire, pushing advisors to look beyond traditional allocation for risk management, returns, and income. For decades the standard shorthand for a balanced portfolio was the 60% equity/40% bond model. Conventional wisdom was that the most conservative investors should have most, if not all, of their assets in bonds/fixed income.

But based upon the facts outlined above, advisors and investors should anticipate a world where bonds increase portfolio risk, rather than mitigate risk.

Allocating a significant portion of one’s portfolio to assets that are unlikely to produce a positive real return is a fool’s errand. Advisors must seek out better ways to mitigate downside risk in their clients’ portfolios.

The Time Is Now for Hedged Equity

Our outlook for bonds remains bleak and the time is now for advisors to seek out alternative solutions for managing risk and addressing income needs.

Our philosophy has always been to remain “Always Invested, Always Hedged.” We have been actively managing risk since 1997, and we do it without any bonds. Through a variety of solutions, we seek to actively hedge our equity market exposure via the use of put options.

Hedging has served us well through previous market downturns, and we believe it may continue to do so in future bear markets.

Related: Surprising Kind of Junk Bonds Deliver Rising Rates Protection

[1] Wall Street Journal, May 9, 2021, “Infrastructure Talks Could Set the Course of Biden’s Spending Plans”