Written by: Ken Frey, VP, Corporate Credit Analyst

The corporate 3Q20 earnings season was better than expected and 2021 could see further improvement. Not the kind of news that makes it to the front page and sells newspapers, especially with the election and COVID stories spilling lots of ink. But an improving earnings trend is a good sign for the corporate bond market next year, even if the news is on the back page.

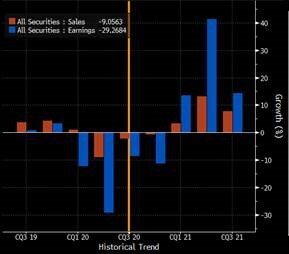

S&P 500 Revenue and Earning’s Growth by Quarter – Historical and Projections

*Source: Bloomberg as of 11/13/20. Past performance is not indicative of future results. There can be no assurance that projections shown will be realized.

With most all corporations having reported Q3 results, analysts now predict revenues were down about 2% and earnings down about 9% for the quarter, far better the 2Q20, which appears to be the trough. While 4Q20 earning’s growth is anticipated to be slightly worse, 2021 is shaping up for a snap back as the economy continues to heal and quarterly comparisons become easier.*

Company creditworthiness could also improve with better earnings, but COVID left its mark as corporations’ income fell and debts rose in 2020 year to date. We anticipate debt issuance could be up as much as 60% this year. The good news is that not all the new issuance was used to fund losses, dividends or buybacks. Much of the new debt was used to extend short term debt and build up a thick cushion of cash on the balance sheets. With interest rates so low and the future still uncertain, it may be wise to borrow and protect liquidity.**

The anticipation for improving creditworthiness is not the only factor impacting the corporate bond market: technicals and valuations are also drivers. In the US corporate bond market, there are now far more buyers than sellers. There is a large swell of foreign demand from Europe and Japan as their interest rates are so low and hedging costs are quite reasonable. And in the US, corporate bonds yields are now just about as cheap as they have even been relative to very low yielding treasuries. Finally, the Federal Reserve has the back of the corporate bond market though its Secondary Market Corporate Credit Facility (SMCCF).*** That’s a lot of buyers pushing up valuations.

While corporate credit spreads may not be as generous as we would like, for investors looking for quality, liquidity and good relative value to treasuries, investment grade corporates are a newsworthy story, even if on the back page.

Sources: *Bloomberg as of 11/13/20, **Citigroup as of 11/13/20, ***The Federal Reserve as of 7/14/2020.

Related: The Effect of Municipal Market Liquidity on Mutual Fund Holdings