Written by: Jordan Jackson

The spike in yields through the first five months of this year has led to some very ugly returns in fixed income. The Bloomberg U.S. Aggregate Bond index is down -9.5% year-to-date; you’d have to go back to 1980 when the Federal Reserve (the Fed) lifted rates from 14% to 19%, for a drawdown of this magnitude. Generally, these painful periods in bonds markets have historically been in years when the Federal Reserve is, or communicating it will, tighten policy; 1980, 1994, 1999, 2013, and 2018 are all years the central bank was raising rates with the outlier being the 2013 taper tantrum. The silver lining? Bad years tend to be followed by really good years in bonds, as the Fed eases up and rate volatility comes down.

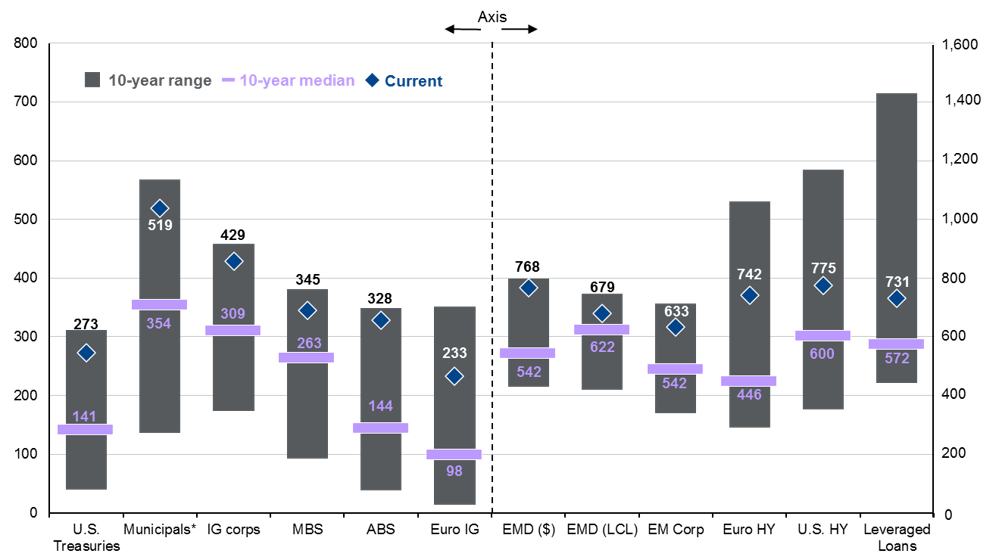

For bond investors, the move higher in Treasury rates and the widening in credit spreads has led to some of the most attractive yield levels in recent history. As shown, current yields across a host of different fixed income sectors are at the highest level relative to recent history and given the very tight relationship between current yields and subsequent performance, bond investors can expect decent returns from the income/coupon these assets will generate over the next few years.

Moreover, the move in yields now suggests bonds can provide a buffer in a market correction or an economic downturn. Consider this, the current yield on the nominal U.S. 10-year Treasury yield is around 2.80% while the pandemic low was 0.50% on March 9, 2020. If the yield were to drop back to 0.50%, the U.S. 10-year would post a price and total return of roughly 22% and 25%, respectively. To be clear, we are not calling for a recession, however, as recession risks remain elevated amidst an uncertain outlook, stepping back into bonds as a portfolio hedge against an economic downturn seems appropriate.

Yield-to-worst across fixed income sectors

Basis points, past 10 years

Source: Bloomberg, FactSet, J.P. Morgan Credit Research, J.P. Morgan Asset Management. Indices used are Bloomberg except for emerging market debt and leveraged loans: EMD ($): J.P. Morgan EMIGLOBAL Diversified Index; EMD (LCL): J.P. Morgan GBI-EM Global Diversified Index; EM Corp.: J.P. Morgan CEMBI Broad Diversified; Leveraged loans: JPM Leveraged Loan Index; Euro IG: Bloomberg Euro Aggregate Corporate Index; Euro HY: Bloomberg Pan-European High Yield Index. All sectors shown are yield-to-worst except for Municipals, which is based on the tax-equivalent yield-to-worst, and Leveraged loans, which are based on spread to 3Y takeout. EM (LCL) spread-to-worst is calculated using the index yield less the YTM on the 5-year U.S. Treasury bellwether index.

Guide to the Markets – U.S. Data are as of May 24, 2022.

Related: Active Management Could Be Difference Maker for Fixed Income Investors