Written by:: Tim Benzel, CFA

Twenty-twenty marked one of the more difficult years of our lifetimes as the Covid-19 pandemic wreaked havoc around the globe. However, despite the lives lost and the economic damage done, financial markets logged a solid year. Why? In one word: policy.

In March, during a time of tremendous uncertainty, financial markets froze, and many asset prices experienced sharp and rapid downside price movements as investors raced for cash. In response, policymakers acted quickly and aggressively to backstop the economic and market fallout by enacting massive fiscal and monetary policy relief programs. These programs had an immediate effect, and they remain a key component of the general market dynamic today.

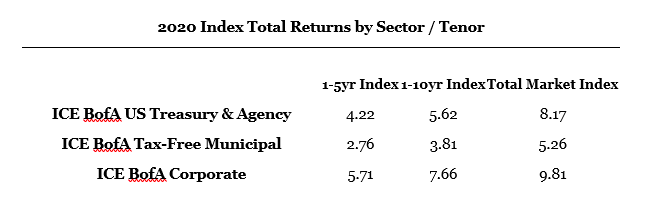

*Source: ICE/BofA Indices as of 12/31/20

Past performance is not indicative of future results.

We believe that actions by central banks, most notably the Federal Reserve, which included rate cuts, bond purchasing programs, credit market backstops and more, had the most profound impact. As we look forward to 2021, with equity markets at all-time highs and credit spreads near record tights, we believe continued aggressive monetary and fiscal policies should continue to support markets.

Municipals: The tax-free municipal market logged its seventh straight year of gains, with returns in the mid-single digits. Like most sectors of the bond market, municipal prices rebounded sharply in the second quarter after experiencing record price drops in March. Liquidity support provided by the Fed along with inflows into the municipal market created a solid technical environment. Fundamentally, many municipalities were and will continue to be negatively impacted by economic slowdown. However, we believe stories of imminent default are overblown, as municipalities have shown time and again that they have tremendous budget flexibility and will take the necessary steps to maintain strong credit profiles.

Taxables: Like municipals, the sudden need for liquidity created tremendous dislocations in the taxable bond market in March. As with past market disruptions, such as 9/11 and the financial crisis, the outbreak of COVID-19 drove immense fear and uncertainty, two things that financial markets loathe. Like munis, taxable sectors such as corporates experienced a strong price reversal as Fed programs, including a secondary market corporate purchase program, provided meaningful psychological support to investors. Fundamentals also benefitted from much lower borrowing yields, which encouraged prefunding of debt maturities, leading in turn to a thick cushion of cash on balance sheets.

Looking Ahead: The evolution of the virus and governments’ ability to implement large scale vaccination programs will likely shape the economic environment in the first half of 2021, determining which sectors, industries, companies and municipalities will be winners and losers. While pockets of short-term volatility are possible, the support from various central banks cannot be ignored, which makes any sort of significant retracement to March levels unlikely. The second half of the year should see a marked improvement in the economy, specifically for various service sectors, as lockdowns are ended and pent-up demand for travel and leisure is turned loose.

During this time, we believe the Fed will have a difficult task. With the economy likely on a more solid footing, attention will turn to the eventual unwinding of the support programs that have been put in place. Doing so without creating financial market disruption will be key, and as we saw in 2013 with the infamous “taper tantrum,” this will not be an easy task. Therefore, we believe the key downside risk to markets in 2021 is a communication error by the Fed or a pullback of fiscal support.

For bond investors specifically, riskier sectors of the market will likely be supported by the yield hunt from domestic and foreign investors, as sovereign bond yields trade at historically low levels. This makes strong credit research imperative. In our view, value can be added by finding bonds that are trading at reasonable valuations, are positioned to benefit from the global search for yield and are backed by credits with the fundamental strength to survive the next few quarters.

Most importantly, we wish all the best for you, your family and friends, and that you stay safe and remain in good health during this time.

Source: ICE BofA

Related: Could Chinese Bond Defaults Benefit Investors in the Long Run?