When I talk about FinTech, I often reflect on the first time I encountered what I would, today, call a truly FinTech firm.

It was on March 30, 2005, and a newly formed firm presented at the Financial Services Club an idea. The idea was to connect people with money to people who needed money through a platform and an algorithm. It wasn’t called FinTech back then, this was an early nascent market, but the idea was tremendous and completely alien in 2005.People walked out at the end of the evening wondering what they had just heard. An idea of putting money into a start-up firm they had never heard of that would lend it out using an algorithm. It didn’t make sense, they thought.That company was Zopa, and the timing was key. In 2005, we saw the start of cloud services and APIs in banking emerge. Today, that is Open Banking and, almost fifteen years later, Zopa has been fairly successful in building a position in the UK personal lending market, so much so that they are

now applying for a full banking licence. They are joined by many other start-up banks in Britain, which is now home to more FinTech unicorns than almost anywhere else including Silicon Valley.According to a

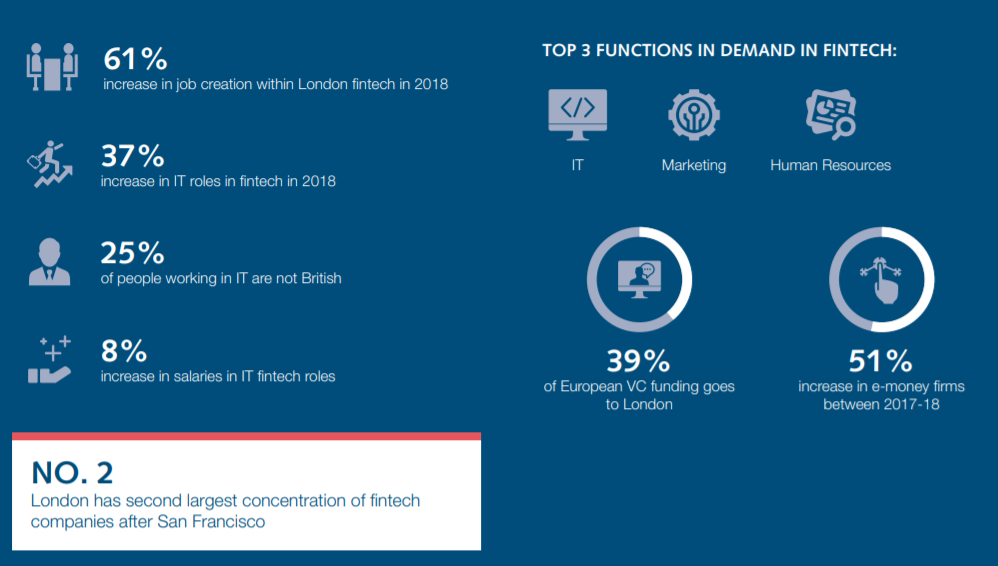

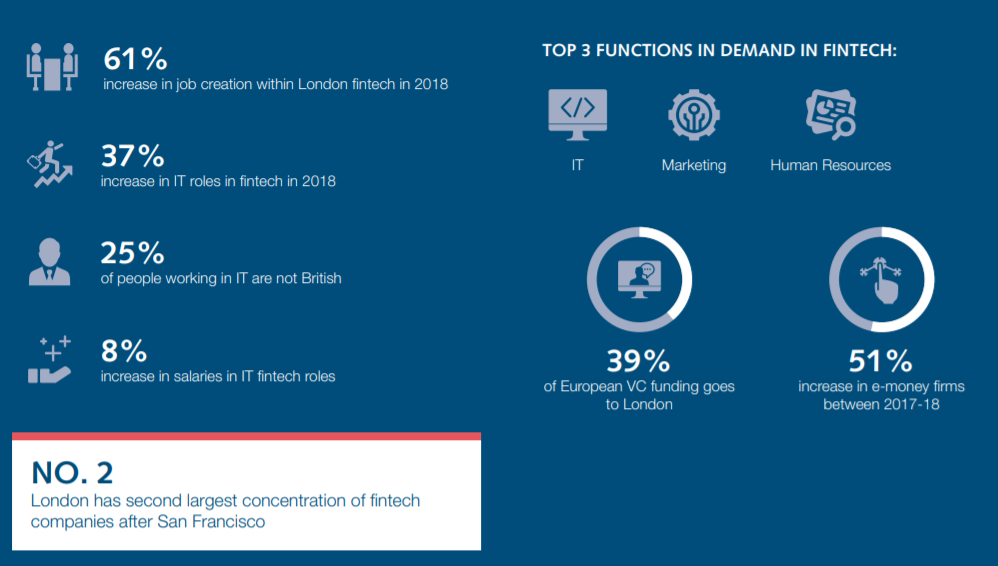

report released last week by Robert Walters and Vacancy Soft, London could soon overtake San Francisco as the fintech unicorn capital of the world. Of the world’s 29 fintech unicorns, 9 are based in San Francisco, while 7 are headquartered in London, and London’s fintech sector received more venture capital (VC) funding than any other EU city in 2018.

London’s top fintech unicorns include Monzo, Revolut, TransferWise, and OakNorth. Zopa is a centaur – a firm valued over $100 million – but should be worth more as they were the first in my world of FinTech.Why are they a first?Two major reasons. The first is that they were the first firm to come up with the idea of a financial platform that would support a marketplace of borrowers and savers. It was one of the first movers in the marketplace economy, before Airbnb or Uber, connecting the borrower (the customer) and the investor (the service provider).Today, I love this idea as that’s what the marketplace platforms are all about. Uber connects people who need journeys (the customer) with people who have cars (the service provider); Airbnb connects people who need a bed (the customer) with people who have rooms (the service provider); Facebook connects people who want news (the customer) with people who have stories to tell (the service provider).It is where the quotation used in most PowerPoints stepped in four years ago, via

TechCrunch:Uber, the world’s largest taxi company, owns no vehicles. Facebook, the world’s most popular media owner, creates no content. Alibaba, the most valuable retailer, has no inventory. And Airbnb, the world’s largest accommodation provider, owns no real estate. Something interesting is happening.This is what the platform marketplace economy of the 21st century is all about, and Zopa was there years before everyone else. How come it doesn’t dominate the world, therefore?I guess it’s because we feel differently about money than we do about journeys, beds and stories. When Zopa launched, the company had the ambition to be the ‘eBay for money’. And don’t get me wrong, it’s doing well, but it’s pale in comparison with what is happening in the USA.Whilst Zopa has enabled over £4 billion worth of connected money to be borrowed by half a million people, the US peer-to-peer lenders have exploded into a market that originates

two out of every five loans:Personal loans surged to a record this year and are the fastest-growing U.S. consumer-lending category, according to data from credit bureau

TransUnion. Outstanding balances rose about 18 percent in the first quarter to $120 billion. Fintech companies originated 36 percent of total personal loans in 2017 compared with less than 1 percent in 2010, Chicago-based TransUnion said.The thing is that the US model of peer-to-peer lending is not really peer-to-peer but institution-to-individual via a platform. That’s why it’s grown so big whilst Zopa has stayed true to their peer-to-peer origins.Interestingly, there is a strong connection between peer-to-peer, platform, marketplace and sharing. What is common to Uber (Lyft, Didi, Ola and the rest), Airbnb and Facebook (and Amazon, Google, WeChat, Alibaba/Alipay, etc) is connecting people who have things with people who need those things. They do this through algorithms, software and servers, by building platforms that enable a marketplace of customers to connect with service providers. Those service providers might provide physical things – rooms, cars, retail product, holidays – or virtual things – stories, news, answers, money – but the model is that same in nearly all cases. It’s connecting people who need things to the people who have those things.The more we consider that model in finance, the more I believe that the

development of cryptocurrencies, peer-to-peer models, robo advice and more becomes interesting. It doesn’t replace banking per se, as banking is all about money and trust and more than just connecting – that’s why Zopa has taken so long to take off – but it does change the banking model and reinforces the need for banks to be

curators of FinTech services.Meantime, I recently blogged about the idea of Facebook being

a central bank, but there is an interesting note that Facebook is looking to

raise $1 billion to launch their own stablecoin.

Now that’s a really interesting space to watch when you think of peer-to-peer, platform, marketplace and sharing. For example, I’ve talked about

the Chinese superapps WeChat and Alibaba, and noted that they don’t appear in the West. That’s because the regulator would block the idea of Facebook merging with Amazon and PayPal. However, if Facebook could embed a PayPal style service within their system using a stablecoin, then they could embed that into other commercial marketplaces on their platform, effectively giving an Amazon style service embedded within Facebook and completely frictionless commerce to operate as a result.Now that is interesting and if you want the real low-down on Facebook’s possibilities with a stablecoin,

Sarvesh Mathi’s analysis on Medium is really good.

POSTNOTE:Talking about BigTech, the BIS that draws up the Basel regulations has just produced a report on their invasion into finance:

BigTech and the changing structure of financial intermediation, BIS Working Paper Number 779, April 2019

London’s top fintech unicorns include Monzo, Revolut, TransferWise, and OakNorth. Zopa is a centaur – a firm valued over $100 million – but should be worth more as they were the first in my world of FinTech.Why are they a first?Two major reasons. The first is that they were the first firm to come up with the idea of a financial platform that would support a marketplace of borrowers and savers. It was one of the first movers in the marketplace economy, before Airbnb or Uber, connecting the borrower (the customer) and the investor (the service provider).Today, I love this idea as that’s what the marketplace platforms are all about. Uber connects people who need journeys (the customer) with people who have cars (the service provider); Airbnb connects people who need a bed (the customer) with people who have rooms (the service provider); Facebook connects people who want news (the customer) with people who have stories to tell (the service provider).It is where the quotation used in most PowerPoints stepped in four years ago, via TechCrunch:Uber, the world’s largest taxi company, owns no vehicles. Facebook, the world’s most popular media owner, creates no content. Alibaba, the most valuable retailer, has no inventory. And Airbnb, the world’s largest accommodation provider, owns no real estate. Something interesting is happening.This is what the platform marketplace economy of the 21st century is all about, and Zopa was there years before everyone else. How come it doesn’t dominate the world, therefore?I guess it’s because we feel differently about money than we do about journeys, beds and stories. When Zopa launched, the company had the ambition to be the ‘eBay for money’. And don’t get me wrong, it’s doing well, but it’s pale in comparison with what is happening in the USA.Whilst Zopa has enabled over £4 billion worth of connected money to be borrowed by half a million people, the US peer-to-peer lenders have exploded into a market that originates two out of every five loans:Personal loans surged to a record this year and are the fastest-growing U.S. consumer-lending category, according to data from credit bureau TransUnion. Outstanding balances rose about 18 percent in the first quarter to $120 billion. Fintech companies originated 36 percent of total personal loans in 2017 compared with less than 1 percent in 2010, Chicago-based TransUnion said.The thing is that the US model of peer-to-peer lending is not really peer-to-peer but institution-to-individual via a platform. That’s why it’s grown so big whilst Zopa has stayed true to their peer-to-peer origins.Interestingly, there is a strong connection between peer-to-peer, platform, marketplace and sharing. What is common to Uber (Lyft, Didi, Ola and the rest), Airbnb and Facebook (and Amazon, Google, WeChat, Alibaba/Alipay, etc) is connecting people who have things with people who need those things. They do this through algorithms, software and servers, by building platforms that enable a marketplace of customers to connect with service providers. Those service providers might provide physical things – rooms, cars, retail product, holidays – or virtual things – stories, news, answers, money – but the model is that same in nearly all cases. It’s connecting people who need things to the people who have those things.The more we consider that model in finance, the more I believe that the development of cryptocurrencies, peer-to-peer models, robo advice and more becomes interesting. It doesn’t replace banking per se, as banking is all about money and trust and more than just connecting – that’s why Zopa has taken so long to take off – but it does change the banking model and reinforces the need for banks to be curators of FinTech services.Meantime, I recently blogged about the idea of Facebook being a central bank, but there is an interesting note that Facebook is looking to raise $1 billion to launch their own stablecoin.

London’s top fintech unicorns include Monzo, Revolut, TransferWise, and OakNorth. Zopa is a centaur – a firm valued over $100 million – but should be worth more as they were the first in my world of FinTech.Why are they a first?Two major reasons. The first is that they were the first firm to come up with the idea of a financial platform that would support a marketplace of borrowers and savers. It was one of the first movers in the marketplace economy, before Airbnb or Uber, connecting the borrower (the customer) and the investor (the service provider).Today, I love this idea as that’s what the marketplace platforms are all about. Uber connects people who need journeys (the customer) with people who have cars (the service provider); Airbnb connects people who need a bed (the customer) with people who have rooms (the service provider); Facebook connects people who want news (the customer) with people who have stories to tell (the service provider).It is where the quotation used in most PowerPoints stepped in four years ago, via TechCrunch:Uber, the world’s largest taxi company, owns no vehicles. Facebook, the world’s most popular media owner, creates no content. Alibaba, the most valuable retailer, has no inventory. And Airbnb, the world’s largest accommodation provider, owns no real estate. Something interesting is happening.This is what the platform marketplace economy of the 21st century is all about, and Zopa was there years before everyone else. How come it doesn’t dominate the world, therefore?I guess it’s because we feel differently about money than we do about journeys, beds and stories. When Zopa launched, the company had the ambition to be the ‘eBay for money’. And don’t get me wrong, it’s doing well, but it’s pale in comparison with what is happening in the USA.Whilst Zopa has enabled over £4 billion worth of connected money to be borrowed by half a million people, the US peer-to-peer lenders have exploded into a market that originates two out of every five loans:Personal loans surged to a record this year and are the fastest-growing U.S. consumer-lending category, according to data from credit bureau TransUnion. Outstanding balances rose about 18 percent in the first quarter to $120 billion. Fintech companies originated 36 percent of total personal loans in 2017 compared with less than 1 percent in 2010, Chicago-based TransUnion said.The thing is that the US model of peer-to-peer lending is not really peer-to-peer but institution-to-individual via a platform. That’s why it’s grown so big whilst Zopa has stayed true to their peer-to-peer origins.Interestingly, there is a strong connection between peer-to-peer, platform, marketplace and sharing. What is common to Uber (Lyft, Didi, Ola and the rest), Airbnb and Facebook (and Amazon, Google, WeChat, Alibaba/Alipay, etc) is connecting people who have things with people who need those things. They do this through algorithms, software and servers, by building platforms that enable a marketplace of customers to connect with service providers. Those service providers might provide physical things – rooms, cars, retail product, holidays – or virtual things – stories, news, answers, money – but the model is that same in nearly all cases. It’s connecting people who need things to the people who have those things.The more we consider that model in finance, the more I believe that the development of cryptocurrencies, peer-to-peer models, robo advice and more becomes interesting. It doesn’t replace banking per se, as banking is all about money and trust and more than just connecting – that’s why Zopa has taken so long to take off – but it does change the banking model and reinforces the need for banks to be curators of FinTech services.Meantime, I recently blogged about the idea of Facebook being a central bank, but there is an interesting note that Facebook is looking to raise $1 billion to launch their own stablecoin. Now that’s a really interesting space to watch when you think of peer-to-peer, platform, marketplace and sharing. For example, I’ve talked about the Chinese superapps WeChat and Alibaba, and noted that they don’t appear in the West. That’s because the regulator would block the idea of Facebook merging with Amazon and PayPal. However, if Facebook could embed a PayPal style service within their system using a stablecoin, then they could embed that into other commercial marketplaces on their platform, effectively giving an Amazon style service embedded within Facebook and completely frictionless commerce to operate as a result.Now that is interesting and if you want the real low-down on Facebook’s possibilities with a stablecoin, Sarvesh Mathi’s analysis on Medium is really good. POSTNOTE:Talking about BigTech, the BIS that draws up the Basel regulations has just produced a report on their invasion into finance: BigTech and the changing structure of financial intermediation, BIS Working Paper Number 779, April 2019

Now that’s a really interesting space to watch when you think of peer-to-peer, platform, marketplace and sharing. For example, I’ve talked about the Chinese superapps WeChat and Alibaba, and noted that they don’t appear in the West. That’s because the regulator would block the idea of Facebook merging with Amazon and PayPal. However, if Facebook could embed a PayPal style service within their system using a stablecoin, then they could embed that into other commercial marketplaces on their platform, effectively giving an Amazon style service embedded within Facebook and completely frictionless commerce to operate as a result.Now that is interesting and if you want the real low-down on Facebook’s possibilities with a stablecoin, Sarvesh Mathi’s analysis on Medium is really good. POSTNOTE:Talking about BigTech, the BIS that draws up the Basel regulations has just produced a report on their invasion into finance: BigTech and the changing structure of financial intermediation, BIS Working Paper Number 779, April 2019