Money 2020 has just dropped an interesting report talking about FinTech 2.0 (although I’m already on FinTech 5.0). In fact 2.0 is a pretty old idea, as outlined in this blog from June 2016, so I think the context of the report is a bit off but the content is pretty good.

Here’s the Executive Summary:

Conversations with leaders in the industry have led us to think about the next generation of fintech: Fintech 2.0. The prior wave of financial technology focused primarily on digital distribution of existing products and services. Now, we will see how the industry shifts its activity and enables digitally native financial services to be fundamentally reimagined from the core out.

In this whitepaper we will take a look at the drivers setting the scene for the next era of fintech, and what we can expect to see over the next five years.

Key drivers for industry leaders and experts to monitor for are:

/ The Macro Environment: The world that financial technology resides in

/ Technology: The operational pieces of financial technology

/ Information: Dynamic data and algorithms driving decision making

/ Application: What financial technology is being used for

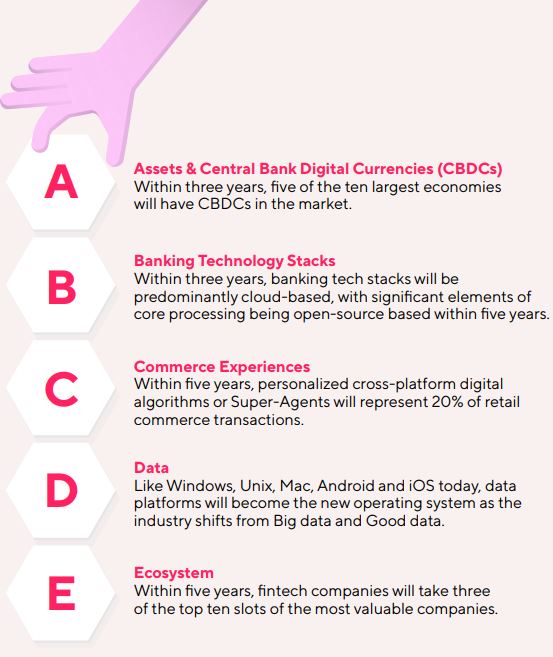

The key building blocks of FinTech 2.0 are:

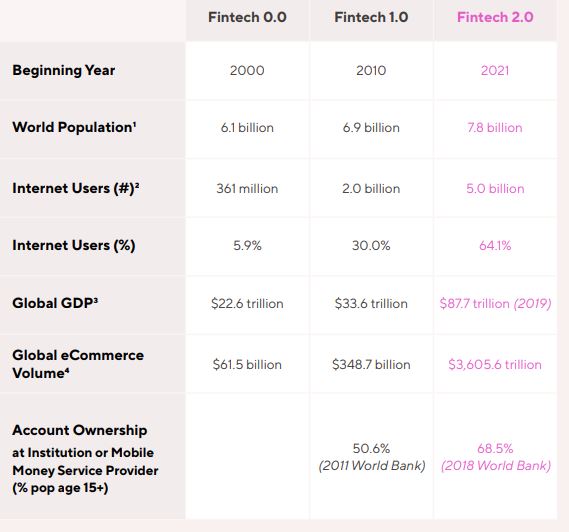

A lot of the drivers are the maturity of the network and connectivity:

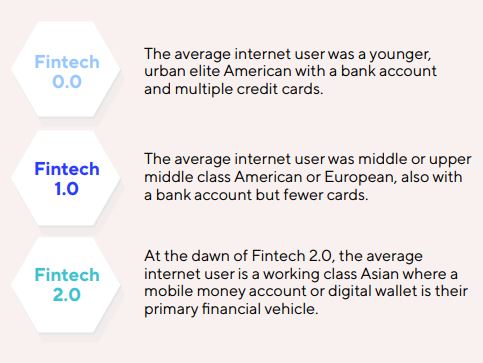

Resulting a new form of customer user:

You can find the full report here.

Related: What Does Cashless Really Mean?