BACS released UK account switching statistics this week , and it makes for interesting reading.

The big winners in the first quarter of 2018 are Halifax, Nationwide and HSBC. The big losers are Co-operative Bank, Lloyds and Barclays.Why?Well, Halifax offers a great incentive to switch: £75 … nothing like a bribe is there? Nationwide is viewed as being independent, neutral and customer focused, as it is a mutual building society … oh, and it pays 5% interest on balances of up to £2,500 for the first 12 months; and HSBC’s figures includes First Direct and Marks & Spencer, so the UK’s #1 bank for customer service appears to be winning here. Which? rates First Direct as

way ahead of the rest when it comes to product and service … oh, and they offer a bribe of up to £150 to switch too.Interestingly, Which? also rated TSB high for service. This is the UK bank that had an IT meltdown that saw its Chief Executive hauled

in front of a Government panel in May and June, and reported many customers switching. That issue is not reported in this week’s figures, which show over 5,000 net defections in the first quarter

before the meltdown.But what intrigues me most is that we talk a lot about how difficult it is to persuade people to switch their main bank account. The statistic I use often is that people are more likely to switch their partner than their bank account. The average UK marriage lasts 12 years, whilst the average age of a bank account is 17 years. Maybe that’s changing. Half a million people switched accounts in the UK in the first quarter of 2018, up 7% on the year before.It is believed that the main cause of switching is the closure of branches. About 60 bank branches are shut down every month in the UK, and several towns are now branchless. There is an outcry about this, as some customers aren’t digital. Two-thirds of customers don’t use mobile banking in the UK and a third don’t use online banking. What are they meant to do?Some believe it’s all a con. As

The Guardian puts it:I recently got a letter from my bank telling me that they are shutting down local branches because “customers are turning to digital”, and they are thus “responding to changing customer preferences”. I am one of the customers they are referring to, but I never asked them to shut down the branches.There is a feedback loop going on here. In closing down their branches, or withdrawing their cash machines, they make it harder for me to use those services. I am much more likely to “choose” a digital option if the banks deliberately make it harder for me to choose a non-digital option.In behavioural economics this is referred to as “nudging”. If a powerful institution wants to make people choose a certain thing, the best strategy is to make it difficult to choose the alternative … Financial institutions are trying to nudge us towards a cashless society and digital banking. The true motive is corporate profit.Now I don’t agree with this view at all. Banks need to shut down cost overheads to be more efficient and effective. Equally,

most customer do prefer digital service. I hate it if I ever have to visit a bank branch. Not only do I find most branches a sad place, with the non-digital customers queuing for service – and yes, there are always queues in the branches I go to, whether it be Santander or RBS or HSBC or Barclays – and I only go there because some jerk has sent me a cheque and our banks don’t take remote cheque deposits today. Grrrrrrr.Interestingly, this article was shared on

LinkedIn and gathered most remarks of disagreement. Admittedly, it’s bankers responding so that’s no surprise, but a key comment was made: would customers pay to keep a physical access point to their bank?Related:

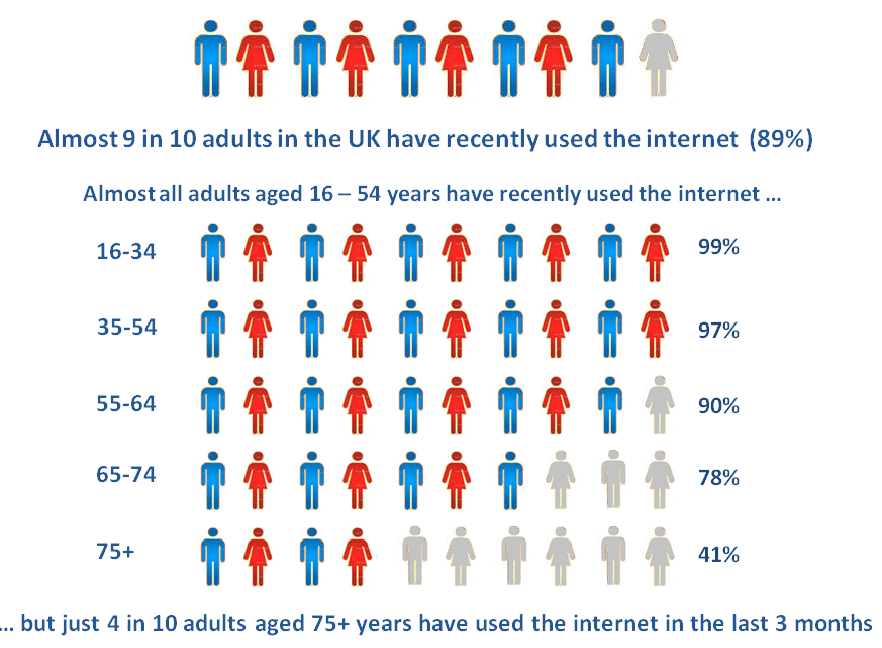

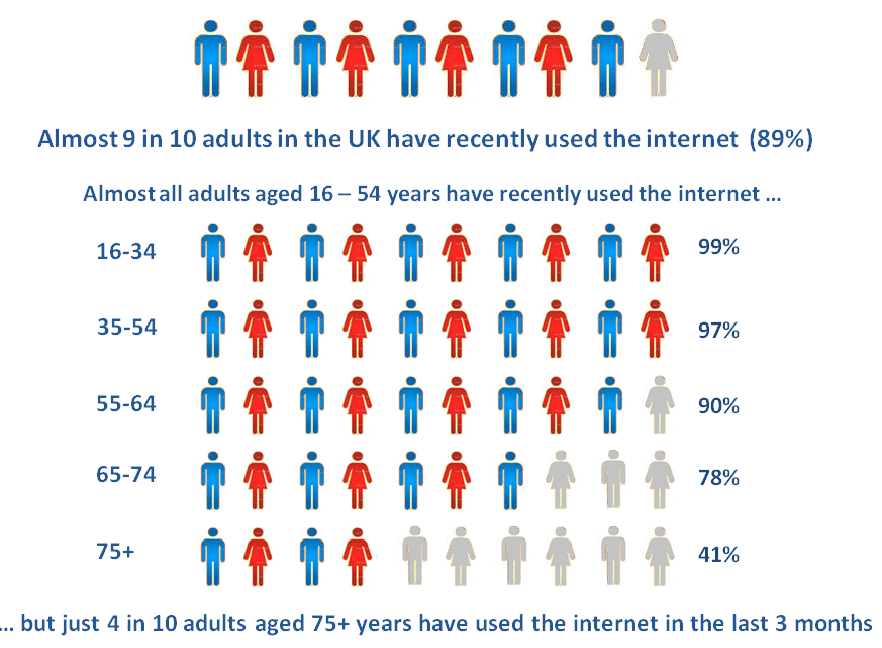

Digital Isn’t Built in a DayThis is a critical comment as most of the people who need physical access to their bank are the digitally dark. Digitally dark means they don’t use digital access, either because they don’t trust it, don’t understand it or don’t have the means to use it. In other words, the old, the less abled and the poor.

Source:

Office for National StatisticsThis is the danger in that, as we push for all customers to

be digitally engagedand force that movement through closure of physical access, we may be punishing segments of society that don’t get it. It’s a little bit like the poorest people are charged the most for making a payment; the digitally disengaged are the ones who will find it the hardest to do their finance.Times move on …

Source: Office for National StatisticsThis is the danger in that, as we push for all customers to be digitally engagedand force that movement through closure of physical access, we may be punishing segments of society that don’t get it. It’s a little bit like the poorest people are charged the most for making a payment; the digitally disengaged are the ones who will find it the hardest to do their finance.Times move on …

Source: Office for National StatisticsThis is the danger in that, as we push for all customers to be digitally engagedand force that movement through closure of physical access, we may be punishing segments of society that don’t get it. It’s a little bit like the poorest people are charged the most for making a payment; the digitally disengaged are the ones who will find it the hardest to do their finance.Times move on …