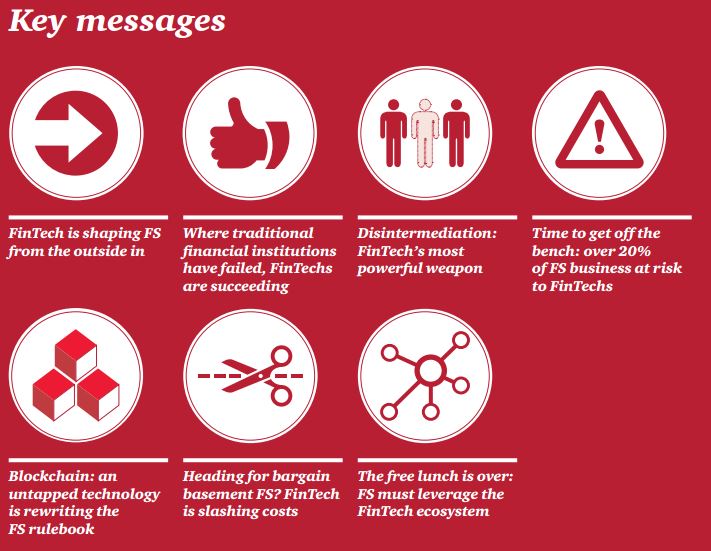

After sharing my favourite white papers about blockchain and fintech a month ago , I got a bit of a deluge of offers of more papers, so here’s this month’s update. If you don’t like to read about them though, you can always listen to this excellent podcast interview with Chris Skinner, author of ValueWeb , by the Radio Free HPC Team.Anyways, if you prefer reading, here are this month’s entries in the Blockchain news: Blurred lines: How FinTech is shaping Financial Services by Price Waterhouse Coopers (PwC), March 2016 [36 pages]Good update on Fintech and includes a section on blockchain.  An Introduction to Bitcoin and Blockchain Technology by Kaye Scholer, February 2016 [13 pages]A good introduction to the subject, for those who want a basic primer to give to managementAbstract: Bitcoin technology began to enter the public discourse in 2011, largely through its association as an anonymous payment system used on illicit and underground websites. As with most innovations that are first described in tabloid format, the story mischaracterized the technology and failed to identify the most important and varied potentials of what Bitcoin and its associated “Blockchain” technology promise. This primer will attempt to reboot your introduction to Bitcoin and convey some of the reasons why many in the financial and technology sectors are excited about its promise. A glossary of common terms appears at the end of this primer. Digital Assets on Public Blockchains White Paper by the BitFury Group, March 2016 [37 pages]This paper puts in perspective why everyone is so excited about the possibilities of blockchain.Abstract: Digital asset management is one of promising applications of blockchain technology. Blockchains could provide principal disintermediation between digital asset issuers, application developers and consumers and decouple tasks related to asset management, such as issuance, transaction processing, securing users’ funds and establishing users’ identities. This paper outlines basic components of blockchain-based asset ledgers, as well as their use cases for financial services and for emerging Internet of Things and consumer-to-consumer markets. We describe existing and prospective deployment models for asset ledgers, including multi-asset blockchains, colored coin and metacoin protocols. This paper focuses primarily on Bitcoin-based services and, to a lesser degree, on public blockchains in general. Sharing ledgers for sharing economies: an exploration of mutual distributed ledgers (aka blockchain technology) by Professor Michael Mainelli and Mike Smith of Z/yen Group for the EY Global Financial Services Institute, November 2015 [47 pages]I cannot leave out a paper written by one of the foremost authorities on what is happening here.Abstract: Mutual distributed ledgers (MDLs) have the potential to transform the way people and organizations handle identity, transaction and debt information. MDL technology provides an electronic public transaction record of integrity without central ownership. The ability to have a globally available, verifiable and untamperable source of data provides anyone wishing to provide trusted third party services, i.e., most financial services firms, the ability to do so cheaply and robustly. Blockchain technology is a form of MDL. The InterChainZ project was a consortium research project to share learning on MDLs during the summer of 2015. The study found that InterChainZ showcased several distributed ledger configurations and numerous variants, exploring how they might work in a set of agreed “use cases.” The outputs were a series of functioning, interlinked MDLs along with software, explanatory materials and website information. The research consortium concluded that MDLs incorporating trusted third parties for some functions had significant potential in financial services, such as know-your-customer (KYC), antimoney-laundering (AML), insurance, credit and wholesale financial services. Blockchain: understanding the potential by Barclays Bank’s Simon Taylor, July 2015 [5 pages]I’ve just put this in because Simon’s a mate.Abstract: Bitcoin, heralded by many as the single biggest breakthrough since the arrival of the internet, has proved to be something of a moving target since its launch in 2009. However, it continues to be the focus of significant investment and innovation with the industry predicting that more than $1 billion in venture capital funding will have been invested in bitcoin and its future by the end of 2015. Recent developments include BitPesa, a Nairobibased start-up focusing on bitcoin remittances, which raised over $1 million earlier this year and Earthport, which agreed a partnership with Ripple Labs allowing real-time cross-border bank payments But, it is becoming increasingly clear that bitcoin is part of an even bigger story: financial institutions, including Barclays, are now considering how the technology underpinning digital currency – commonly called ‘the blockchain’ or ‘blockchain’ – could in itself revolutionise finance. While many of these potential applications are medium term the development cycles in the industry mean that now is the time for companies to begin asking how this technology could benefit them. Blockchain Technology and Applications from a Financial Perspective by Unicredit, February 2016 [34 pages]Nice overview of financial use cases including payments, KYC, trade finance, clearing and settlementAbstract: This article aims at presenting potential financial industry blockchain applications leveraging UniCredit laboratory experience. Proposed vision promotes cross-effort and collaborative relationship amid financial institutions and fintech startups as blockchain initiatives’ critical success factors. Wide adoption of blockchain technology has the potential of reshaping the current financial services technical infrastructure. The change is expected to bring with it benefits to the existing business processes through removal of intermediaries, flat data structures that will reduce the lags of reconciliations among different local ledgers, compressed confirmation times and near real-time settlement of transactions. Moreover, there are underlying technical aspects of the blockchain which will provide data and transaction immutability, resiliency against cyber-attacks and fault tolerance. Formerly, blockchain technology is introduced from both a technological and a functional point of view. Then, financial use cases are proposed, showing financial industry impacts and benefits. The role of distributed consensus ledgers in the future of digital payments by Accenture, September 2015 [20 pages]It’s a good insight into the specific use case of payments.Abstract: The global rise of Bitcoin has introduced the world to cryptocurrencies, distributed consensus ledgers (DCLs) and blockchains. DCL technology has the potential to enhance efficiency, trust, transparency, reach and innovation in the financial markets. And while there are many other use cases – including in securities and capital markets – payments is one of the areas where DCL may prove most valuable. There are clear reasons why DCLs can make a difference in the digital payments space compared to existing technology. They enable democratic, distributed, evenly-balanced control to be exercised in situations where it’s currently not possible or easy, such as international payments. DCLs also go beyond the capabilities of existing technology by providing transparency where it has previously been difficult to achieve, such as in anti-money laundering (AML).It is also worth pointing to this research note by Larry Tabb on the subject, Blockchain Clearing and Settlement: Crossing the Chasm .Finally, I really liked this note as it talks specifically about one of my favourite Fintech hubs: Tel Aviv. Israel A Hotspot for Blockchain Innovation by Deloitte, February 2016 [33 pages]Interesting to see a review of a City getting plaudits for its many Fintech and now Blockchain capabilitiesAbstract: For more than a decade Israel in general, and the city of Tel Aviv in particular, has positioned itself as a global leader for innovation and of the faster growing hotspots for technology. Israel is mostly known for its rich ecosystem and ability to produce disruptive and cutting-edge innovations. The Israeli technology industry has turned into an economic success story by both local and international standards. Israel has the highest concentration of technical companies outside of Silicon Valley and the highest number of NASDAQ-listed technology companies, after the U.S. and China. Also, Israel’s technology industry accounts for 15.7% of the country’s GDP.

An Introduction to Bitcoin and Blockchain Technology by Kaye Scholer, February 2016 [13 pages]A good introduction to the subject, for those who want a basic primer to give to managementAbstract: Bitcoin technology began to enter the public discourse in 2011, largely through its association as an anonymous payment system used on illicit and underground websites. As with most innovations that are first described in tabloid format, the story mischaracterized the technology and failed to identify the most important and varied potentials of what Bitcoin and its associated “Blockchain” technology promise. This primer will attempt to reboot your introduction to Bitcoin and convey some of the reasons why many in the financial and technology sectors are excited about its promise. A glossary of common terms appears at the end of this primer. Digital Assets on Public Blockchains White Paper by the BitFury Group, March 2016 [37 pages]This paper puts in perspective why everyone is so excited about the possibilities of blockchain.Abstract: Digital asset management is one of promising applications of blockchain technology. Blockchains could provide principal disintermediation between digital asset issuers, application developers and consumers and decouple tasks related to asset management, such as issuance, transaction processing, securing users’ funds and establishing users’ identities. This paper outlines basic components of blockchain-based asset ledgers, as well as their use cases for financial services and for emerging Internet of Things and consumer-to-consumer markets. We describe existing and prospective deployment models for asset ledgers, including multi-asset blockchains, colored coin and metacoin protocols. This paper focuses primarily on Bitcoin-based services and, to a lesser degree, on public blockchains in general. Sharing ledgers for sharing economies: an exploration of mutual distributed ledgers (aka blockchain technology) by Professor Michael Mainelli and Mike Smith of Z/yen Group for the EY Global Financial Services Institute, November 2015 [47 pages]I cannot leave out a paper written by one of the foremost authorities on what is happening here.Abstract: Mutual distributed ledgers (MDLs) have the potential to transform the way people and organizations handle identity, transaction and debt information. MDL technology provides an electronic public transaction record of integrity without central ownership. The ability to have a globally available, verifiable and untamperable source of data provides anyone wishing to provide trusted third party services, i.e., most financial services firms, the ability to do so cheaply and robustly. Blockchain technology is a form of MDL. The InterChainZ project was a consortium research project to share learning on MDLs during the summer of 2015. The study found that InterChainZ showcased several distributed ledger configurations and numerous variants, exploring how they might work in a set of agreed “use cases.” The outputs were a series of functioning, interlinked MDLs along with software, explanatory materials and website information. The research consortium concluded that MDLs incorporating trusted third parties for some functions had significant potential in financial services, such as know-your-customer (KYC), antimoney-laundering (AML), insurance, credit and wholesale financial services. Blockchain: understanding the potential by Barclays Bank’s Simon Taylor, July 2015 [5 pages]I’ve just put this in because Simon’s a mate.Abstract: Bitcoin, heralded by many as the single biggest breakthrough since the arrival of the internet, has proved to be something of a moving target since its launch in 2009. However, it continues to be the focus of significant investment and innovation with the industry predicting that more than $1 billion in venture capital funding will have been invested in bitcoin and its future by the end of 2015. Recent developments include BitPesa, a Nairobibased start-up focusing on bitcoin remittances, which raised over $1 million earlier this year and Earthport, which agreed a partnership with Ripple Labs allowing real-time cross-border bank payments But, it is becoming increasingly clear that bitcoin is part of an even bigger story: financial institutions, including Barclays, are now considering how the technology underpinning digital currency – commonly called ‘the blockchain’ or ‘blockchain’ – could in itself revolutionise finance. While many of these potential applications are medium term the development cycles in the industry mean that now is the time for companies to begin asking how this technology could benefit them. Blockchain Technology and Applications from a Financial Perspective by Unicredit, February 2016 [34 pages]Nice overview of financial use cases including payments, KYC, trade finance, clearing and settlementAbstract: This article aims at presenting potential financial industry blockchain applications leveraging UniCredit laboratory experience. Proposed vision promotes cross-effort and collaborative relationship amid financial institutions and fintech startups as blockchain initiatives’ critical success factors. Wide adoption of blockchain technology has the potential of reshaping the current financial services technical infrastructure. The change is expected to bring with it benefits to the existing business processes through removal of intermediaries, flat data structures that will reduce the lags of reconciliations among different local ledgers, compressed confirmation times and near real-time settlement of transactions. Moreover, there are underlying technical aspects of the blockchain which will provide data and transaction immutability, resiliency against cyber-attacks and fault tolerance. Formerly, blockchain technology is introduced from both a technological and a functional point of view. Then, financial use cases are proposed, showing financial industry impacts and benefits. The role of distributed consensus ledgers in the future of digital payments by Accenture, September 2015 [20 pages]It’s a good insight into the specific use case of payments.Abstract: The global rise of Bitcoin has introduced the world to cryptocurrencies, distributed consensus ledgers (DCLs) and blockchains. DCL technology has the potential to enhance efficiency, trust, transparency, reach and innovation in the financial markets. And while there are many other use cases – including in securities and capital markets – payments is one of the areas where DCL may prove most valuable. There are clear reasons why DCLs can make a difference in the digital payments space compared to existing technology. They enable democratic, distributed, evenly-balanced control to be exercised in situations where it’s currently not possible or easy, such as international payments. DCLs also go beyond the capabilities of existing technology by providing transparency where it has previously been difficult to achieve, such as in anti-money laundering (AML).It is also worth pointing to this research note by Larry Tabb on the subject, Blockchain Clearing and Settlement: Crossing the Chasm .Finally, I really liked this note as it talks specifically about one of my favourite Fintech hubs: Tel Aviv. Israel A Hotspot for Blockchain Innovation by Deloitte, February 2016 [33 pages]Interesting to see a review of a City getting plaudits for its many Fintech and now Blockchain capabilitiesAbstract: For more than a decade Israel in general, and the city of Tel Aviv in particular, has positioned itself as a global leader for innovation and of the faster growing hotspots for technology. Israel is mostly known for its rich ecosystem and ability to produce disruptive and cutting-edge innovations. The Israeli technology industry has turned into an economic success story by both local and international standards. Israel has the highest concentration of technical companies outside of Silicon Valley and the highest number of NASDAQ-listed technology companies, after the U.S. and China. Also, Israel’s technology industry accounts for 15.7% of the country’s GDP.