As someone who’s followed Alibaba, Alipay and Ant Financial – now Ant Group, btw – for a long time, I cannot let their IPO appear without comment. If you haven’t spotted it, here’s coverage in The Wall Street Journal:

Ant Group Co., the Chinese financial-technology giant controlled by billionaire Jack Ma, revealed how highly profitable its business has been as it gears up for what is likely to be a record-breaking initial public offering.

The owner of the popular payments and lifestyle app Alipay on Tuesday filed listing documents for IPOs on stock exchanges in Shanghai and Hong Kong, publicly disclosing for the first time detailed financial data showing the size and scale of its business.

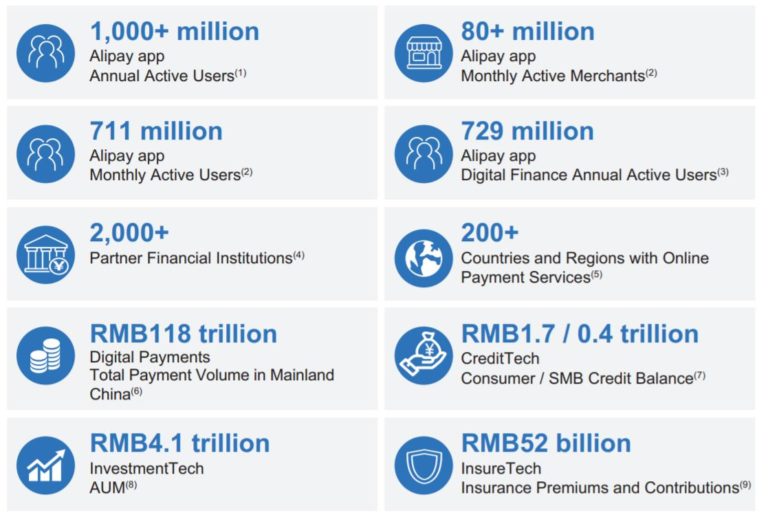

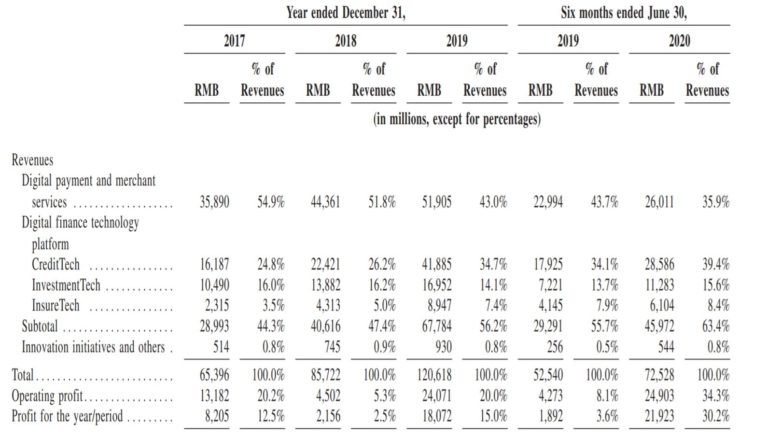

Ant said it made 21.2 billion yuan ($3 billion) in net profit for the six months to June 2020, on revenue of 72.5 billion yuan ($10.5 billion). That implied a net profit margin of around 30%, fairly high for a relatively young company that is growing rapidly.

The Hangzhou-headquartered company is aiming to go public as soon as this fall, and is targeting a market valuation above $200 billion, The Wall Street Journal previously reported. Ant said in one of its filings that the new shares it plans to sell would comprise at least 10% of the company’s share capital, implying that it could raise more than $20 billion.

If achieved, it would propel Ant into the ranks of China’s most valuable listed companies.

Buy!

OK, well, I’m not an investment expert but why wouldn’t you? It’s like the IPO of a PayPal, Stripe, Square, but bigger. It’s China after all. Except that Ant Group is Chinese but, in my view, like Amazon, PayPal and others, it’s a global group. Sure, they’re listing on the Shanghai and Hong Kong exchanges, but Ant Financial is a global company operating in many markets, and their value has tripled in just three years. In summer 2017, when I was writing Digital Human and the case study on Ant Financial (now Ant Group) that’s in that book (30,000 words), the firm was worth around $75 billion. That was a speculative valuation based upon an IPO that would appear that year. It didn’t.

The next time we talked about valuing Ant was in the summer of 2018. Then, folks said it would be worth around $150 billion. That would make it the tenth largest financial firm on Earth by valuation.

Ant valuation, Summer 2018

Now, we are talking about a sale of a 10% share of Ant Financial for a valuation of around $225 billion. To put that in context today JP Morgan Chase is worth around $305 billion; Bank of America is valued at $225 billion; and Wells Fargo just $101 billion; so, a $225 billion for a 10% sale of Ant Financial stock is significant. In fact, some say it’s worth more than Saudi Aramco, one of the highest valued firms in the world.

Source: Bloomberg, August 2020

Put it another way as, these days, I measure everything on a Jeff Bezos scale. Jeff’s value varies but he’s worth near $200 billion. That’s around the amount of money Apple has in cash, so Apple could buy one Jeff Bezos and, in this context, Ant Financial is just a bit more than Jeff Bezos … oh, if he hadn’t divorced.

But Ant Group – which I will shorten to Ant from now on, as it’s easier – is not a bank. It has a bank, MyBank, but it’s not a financial firm. It’s not an investment firm. It’s not a savings firm. It’s not even a payments company …

… it’s a technology provider.

It does all of these things – banking, investments, savings, payments, insurance and more – but it does these things driven by technology services. This is why the company rebranded from Ant Financial to Ant Group. It is also clear from the IPO registration filed with the Hong Kong Exchange this week.

Back in 2017, payment services delivered 55% of Ant’s revenues versus 45% from Technology Platforms. Today, that split has moved to near 35%:65%. My forecast is that by 2025, Ant will be 80% technology revenues versus 20% financial.

This is because Ant has deliberately moved to a platform provision of APIs, apps and analytics since the mid-2010s on a global basis. They provide the back and middle office services for many of the big and small banks in China, as well as mobile and platform services for leading financial firms of the world such as PayTM, Kakao Pay, Ascent Money and more.

That strategy was formalised just a few years ago but is showing strongly in the numbers now and into the future. So, maybe we should think of Ant Financial as more of an FIS than a PayPal or Square.

Interestingly, in this context, is the China-US trade frictions. Originally, Ant might have listed on Wall Street but has determined not to and the tensions are making things even more strained … even though these tensions have been bubbling for a while. For example, in 2018, Ant Financial wanted to expand its global operations by acquiring MoneyGram but the US Government blocked the acquisition, on the basis of US armed forces data being potentially abused by Chinese interference, amongst other reasons.

The result?

Ant Financial acquired the similar-to-but-not MoneyGram organisation Worldfirst, headquartered in the then more China-friendly UK, who dropped their US operations to allow the deal to go through.

It makes it interesting for me as the regulatory requirements of a global company with strong ties to the People’s Republic of China (PRC) get interesting. If the PRC promote Central-Bank Digital Currencies (CBDCs) and require Ant and Alipay to use such CBDCs as their preferred transaction mechanism: is that just for mainland China or worldwide? If China determines to sanction US firms and shutdown cross-border operations with tariffs, how does that affect Alipay and Ant transactions that move from RMB to USD to EUR and more? Currently, Alipay operates 27 currencies and it shouldn’t matter … but, just wondering how the US-China political equation might impact, after seeing what’s happened to Huawei and TikTok, has to be a factor.

These are the possible downside risks long-term that are noted in the filing but, based upon what I’ve seen so far of the way in which Ant Financial has progressed, they will be dealt with. However, like Apple and others, if you’re a global firm with big exposures in all geographies, if those geographies become fractious and full of friction, you tread very carefully.

The only other issue with the IPO is that influence of Jack Ma, Alibaba, the internal structure and the history. Even after the IPO, almost 90% of Ant Financial will be owned by internal interests that relate to individuals and employees within the Alibaba and Ant Group:

Source: Bloomberg

19 executives within Alibaba and Ant Financial will become make significant gains and some will be overnight billionaires: Jack Ma’s Ant Stake is worth $25.3 billion; Lucy Peng ($4.8 billion); Eric Jing ($2.9billion); Zhaoxi Lu ($2.2billion); Xiaofeng Shao ($2.2billion); Trudy Dai ($1.8billion); Eddie Wu ($1.8billion); Judy Tong ($1.7billion); Daniel Zhang ($1.7billion); Shuai Wang ($1.6billion); Yijie Peng ($1.6billion); Simon Hu ($1.5billion); Jian Wang ($1.5billion); Luyuan Fan ($1.4billion); Sara Yu ($1.3billion); Maggie Wu ($1.3billion); Jianhang Jin ($1.2billion); Li Cheng ($1.2b); and Ming Zeng ($1.1b).

Fair enough. Nothing wrong with that and I don’t have an issue with this, but some do. For example, the hangover stench of the way Ant Financial was spun off from Alibaba and out of the hands of Yahoo and other investors interests.

Nevertheless, I personally believe the firm is fantastic and reluctantly raise these questions purely for fairness and objectivity. I have no answers. My only answer is that if you’re not buying into a firm that tripled in value in three years, then are you missing out on a good opportunity?

Related: What Happens When Digital Fails?