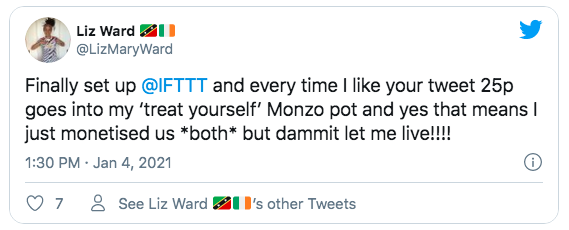

I saw this tweet the other day

And it made me realise a number of things.

First, pots. Pots of money. Pots for savings. A pot for saving for a holiday, and then another for saving for a car, and another for saving for our wedding, and another for saving for the birth of a child and so on.

I hate pots.

Pots reminds me of jars.

Jars was a thing that Intelligent Finance came up with twenty years ago. The spawn of Halifax Bank of Scotland, it was a disaster imho. Far too technical, based upon a product view and not a customer view, complicated and clunky, it really didn’t work.

But this idea of pots and jars is interesting. We think that customers categorise their lives into spaces. They separate their day-to-day from their long-term. They believe in throwing money into different things and thinking about it.

They don’t.

The tweet from Liz is nice. It shows that Monzo has taken Intelligent Finance’s idea to a new level. We can now link our pots (jars) to our social media. Amazing. Great. In fact, maybe IFTTT was Intelligent Finance’s Thinking Totally Ticked*.

If you read her thread, it is all about someone who doesn’t manage their finances well and wants to save for different things, including me-things. By linking Monzo to Twitter, she puts 25 pence (or cents or pesos) into her savings account every time she likes a tweet. That’s great and innovative … but is it the point? Is that the future?

For me, it makes me realise that I need to engage more with GenZ and Millennials and see how they think, work and behave. Not now, but after this pandemic finishes. The reason being that, for me, I’ve never been disciplined about money. I’ve never organised my life into pots and jars. I’ve never been that organised. Have you?

My life, rather, is disorganised into what I need to do right now versus what I can do later. My life is about urgent things to do versus things to ignore. My life is about right here, right now; not tomorrow or next week.

This is why I don’t like pots, jars, piggy banks or any other form of quirky, clunky, junky thing. What I really want to know is how much do I need to pay this day, this week, this month to live and to survive. How much do I have to survive? How long can I live financially before I crash and burn?

Maybe I’m unique, but I’ve never been in a position to think of pots, jars, cups, bags and Tupperware, I purely think in terms of: do I have enough money to get by? and, if I want to save for things, can I afford to do that?

I guess it’s a bit like life insurance. You know you’re going to die one day, so you should cover that event, but: is it worth it? It’s a hard sell. The same is true with most savings and investments.

It brings us back to a core issue: most people are just getting by day-to-day.

We can see this through this crisis and the way in which many have not been able to deal with it. They didn’t have the savings or, if they did, the savings were wiped out overnight.

As for those who think about jars and pots?

* Nope, it means If This, Then That, a programming thing

Related: Five 2021 Technology Predictions