An interesting report came out this week saying that UK consumers would access mobile banking apps more often than branches in the next two years.

It got covered on the BBC, Sky News and lots of other media, but I was thinking in the next two years? It just shows how far behind the curve the FinTech commentators are, with our predictions of radical change to banking, when customers are nowhere near that level of

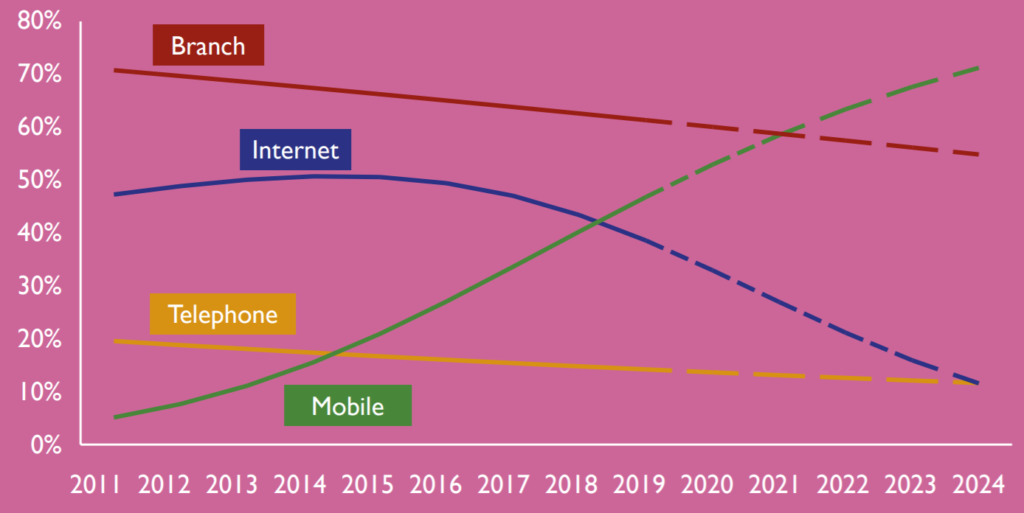

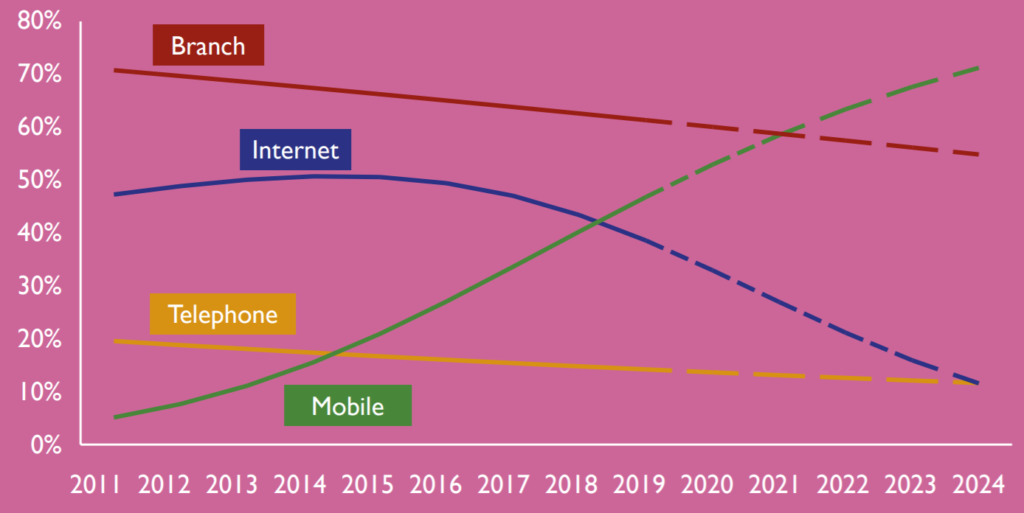

adoption of digital change.In fact, it may surprise some to hear that UK consumers don’t particularly like mobile banking today, with only 41% using such services in 2018, up from 35% two years ago. Even internet and online banking is shunned by almost a third of UK users, with only 71% accessing via such services, up from 66% two years ago.So, that means that even today three out of five people don’t want mobile banking and three out of ten don’t want online banking. Why? Because they think it’s risky. They feel insecure.This is a major barrier to adoption of any new financial technologies, whether in the corporate or consumer world. Not only must it be intuitive and easy to understand and accept, but it must feel like it has bulletproof security. Now, I have a conversation about bulletproof security with banks on a regular basis, as I urge them to offer it, but no bank wants to go down this route as they believe they will look stupid when they get hacked. When, not if.I say that they can lock down any leaks fast, if they have a real-time network, and that bulletproof does not necessarily mean they will never get hacked. Just a guarantee to the customer that if that ever happened, they would immediately get any money losses reimbursed. Bank of America did this in the early days of online banking and saw a surge in people moving online for that reason. They guaranteed it was secure and, if any customer had any issues, they would get their money back within 24 hours. That shifts people’s thinking.Anyways, back to this major media coverage of the research by CACI, the forecast is that the proportion of customers using mobile apps will draw level with those going to branches at 59% by 2021. By 2024, they think that will rise to 71% of customers, whilst those visiting branches will fall to 55%.You can

download the full report here, which begins:Back in 2014, when CACI first began collating this research, about one in six customers used mobile banking apps in one way or another. This placed mobile banking in fourth place (just behind telephone banking) in terms of preference in the UK.But in the years since, adoption of mobile technology and migration to banking apps has sky-rocketed – to the point where there are now 25 million users. That means today, in 2019, half of current account holders are using apps to manage their account. Each day there are more than five million mobile log-ins – a number that is almost four times greater than five years ago. And already there are more customers using mobile banking apps than there are using traditional internet banking.And it is followed by this chart showing customer preferences for bank access:

… which is quite useful for seeing the trends in access to the bank.Related:

The Logic of Digital ChangeNevertheless, it’s all a bit of a no-brainer and I hate the fact they use the word channel throughout the report. Anyone who is a regular reader here knows that I hate the words channel, multichannel and omnichannel. In fact, just writing that last sentence brought up a bit of bile in my throat so I had to go to the toilet.I mean I wonder where the internet of things will impact all these access points and structures. When my car, television, refrigerator, jewelery and more can restock, replenish and reorder anything I need, what will they call it then? The digital devices channel? Garbage. It’s all about

access to a digital core, one of my regular mantras.Banks with a digital core have their foundations built on the internet and their services offered through multiple access forms via the network. Their foundations are not built on brick and mortar branches, where channels were overlaid on top of them. That’s what we used to do. Banks built on the internet don’t think this way, and a bank with a digital first strategy has reinvented its systems, structures, organisation, culture, objectives, management … everything to be digital first, which means built on the internet with the network at its core.Anyways, it’s always useful to have some facts and stats around on trends in bank access, so thanks for that bit CACI.

… which is quite useful for seeing the trends in access to the bank.Related: The Logic of Digital ChangeNevertheless, it’s all a bit of a no-brainer and I hate the fact they use the word channel throughout the report. Anyone who is a regular reader here knows that I hate the words channel, multichannel and omnichannel. In fact, just writing that last sentence brought up a bit of bile in my throat so I had to go to the toilet.I mean I wonder where the internet of things will impact all these access points and structures. When my car, television, refrigerator, jewelery and more can restock, replenish and reorder anything I need, what will they call it then? The digital devices channel? Garbage. It’s all about access to a digital core, one of my regular mantras.Banks with a digital core have their foundations built on the internet and their services offered through multiple access forms via the network. Their foundations are not built on brick and mortar branches, where channels were overlaid on top of them. That’s what we used to do. Banks built on the internet don’t think this way, and a bank with a digital first strategy has reinvented its systems, structures, organisation, culture, objectives, management … everything to be digital first, which means built on the internet with the network at its core.Anyways, it’s always useful to have some facts and stats around on trends in bank access, so thanks for that bit CACI.

… which is quite useful for seeing the trends in access to the bank.Related: The Logic of Digital ChangeNevertheless, it’s all a bit of a no-brainer and I hate the fact they use the word channel throughout the report. Anyone who is a regular reader here knows that I hate the words channel, multichannel and omnichannel. In fact, just writing that last sentence brought up a bit of bile in my throat so I had to go to the toilet.I mean I wonder where the internet of things will impact all these access points and structures. When my car, television, refrigerator, jewelery and more can restock, replenish and reorder anything I need, what will they call it then? The digital devices channel? Garbage. It’s all about access to a digital core, one of my regular mantras.Banks with a digital core have their foundations built on the internet and their services offered through multiple access forms via the network. Their foundations are not built on brick and mortar branches, where channels were overlaid on top of them. That’s what we used to do. Banks built on the internet don’t think this way, and a bank with a digital first strategy has reinvented its systems, structures, organisation, culture, objectives, management … everything to be digital first, which means built on the internet with the network at its core.Anyways, it’s always useful to have some facts and stats around on trends in bank access, so thanks for that bit CACI.