[In any important endeavor, the proverbial rubber hits the road in its attempted execution. While “execution” per the dictionary has a primary definition of carrying out or putting into effect a plan or course of action; don’t doubt that we all get concerned with the secondary definition which connotes that the execution may be of ourselves… if we get it wrong. Getting this crucial step right makes all the difference and needs to be carefully planned.

To that end, this second interview with Steven Lewis, SVP of MarketBridge, is a deep dive into the precise steps that Financial Services firms can take to execute a competitive response to FinTech disruption. Specifically, how sales and marketing teams can respond in an agile fashion with improved customer experiences, strategic messaging, refined product/service offerings while management develops changes to the firm’s business model and larger scale innovation efforts.

Just like our first interview on properly identifying and diagnosing the nature of the challenge before us, then isolating firm strengths and opportunities, his firm’s recommendations are pulled from their extensive research report on developing a response strategy and execution plan to industry disruption - Fintech Disruption Go-To-Market Toolkit .

As a marketing and research firm with 25 years of experience in helping businesses develop and implement innovative go-to-market strategies, MarketBridge analyzed over 100 financial services and fintech companies and surveyed 1,500 consumers across banking and payments, insurance, and investments to identify best practices which can promote strategic advantage.

This measured approach to effective execution provides a roadmap, mindset and process allowing you to marshal the right resources and activities to strategically respond to industry disruptions and create ongoing new value to customers in our new operating environment of accelerating change.]

Hortz: In our previous interview, we discussed how sales and marketing go-to-market pathways can be altered to respond to Fintech disruption while bigger firm innovations take place. Can you specifically explain these opportunities?

Lewis: To quickly rehash what was said in our prior article, established Financial Services firms may be unaware that their disruption responses are often hindered by internal bias or superficial analysis. That is, Fintechs may not be completely redefining an industry, product or experience, but rather innovating in certain areas of high-perceived customer value:

- CX innovation – ease of use and/or reducing friction or increasing speed of the purchase process

- Product innovation – editing product features or modifications or reducing cost

- Market innovation – creating entirely new experiences or approaches for solving customer issues

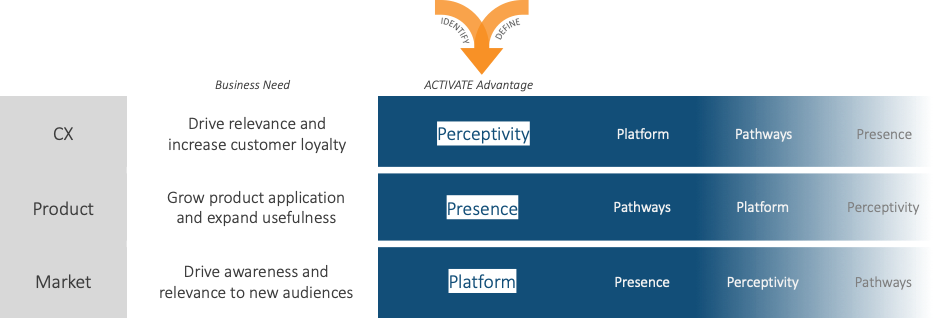

Incumbent opportunity lies in first identifying which one of those areas competitors are innovating on and then applying one of the key Advantage Factors we uncovered in our research that incumbents have:

-

- Pathways Advantage: Their large customer based and established position.

- Perceptivity Advantage: Their expansive historical customer data and insights

- Presence Advantage: Their greater presence of customer support and physical locations

- Platform Advantage: Their existing awareness and marketplace experience

These four advantages are specific to incumbent firms and we have practical strategies to leverage these strengths in executing an effective disruption response.

Hortz: How would you suggest incumbent firms begin mapping out a response and execution plan?

Lewis: Diagnosing the disruption, as mentioned, is key to response. Competitive CX Innovation will affect customer perceptions and encourage switching – making customer retention more difficult. Whereas Product Innovation inflicts price and margin pressure for incumbent firms and make acquisition harder. Market Innovation is the most difficult as it can be both around the experience or the product/solution and, in-time, change the entire market.

While (disclaimer) there is no one perfect means to approach disruption, incumbent Advantage Factors provide a good guide when plotted against the type of disruption and incumbent business needs

These also help prioritize the advantages that are leveraged initially, and those which may require more effort or investment to deploy at the execution or, what we call, the activate advantage stage.

Hortz: Let’s dig into each of these execution strategies a bit more. Your report notes that 40% of survey respondents stated they would consider switching providers for a more personalized experience, which is CX Innovation/Disruption. Can you explain how incumbents would leverage their Perceptivity Advantage?

Lewis: The Perceptivity Advantage refers to the advantage over entrants that incumbents have in understandings their buyer audiences. Unfortunately, as we note in the report, there are often organizational barriers that prevent incumbent firms from tapping into this rich source of data and taking full advantage of it. The main ways to leverage Perceptivity in your execution strategies are to actively manage perceptions, fully leverage and activate insights, and to focus on the whole customer experience. Practical ways to do this are:

- Feedback –Ensure customer feedback is collected, leverage and demonstrate action based on this input – across the buyer journey

- Personalization – Connect better with customers and prospect buy providing them and experience tailored to their individual preferences

- Segmentation – Incumbent firms have established segmentation models of customers, care must be taken to ensure ongoing relevance and actionability

Hortz: Your study also talks about the Presence Advantage. Given general consumer trends and the overwhelming shift to digital due to COVID-19, does this hold true and how are companies able to leverage it?

Lewis: While the shift to digital has been amplified by COVID-19, consumers told us very recently they very much still desire human interaction. Our work highlights that presence does not have to mean face-to-face. Rather, it is about the ability of incumbent firms to deliver better omnichannel experiences that leverage the bevy of means to connect with customers. While entrants often only focus on digital, incumbents have a real advantage to deliver better service and humanize the experience – that entrants just cannot match.

90% of consumers expect a cohesive omnichannel experience and only establishes incumbent firms can deliver on these. Tactic means of doing this are:

- Customer Journey – Ensure customer journey work is up-to-date, accurate and accounts for all channels and interaction

- Consistency – Align messaging and leverage available data to make every customer contact amplify the value of the omnichannel experience

- Coordination – Along with understanding the customer journey, communications must be coordinated to elevate the experience across channels

Hortz: It is curious that you state the Platform Advantage was poorly executed on by incumbents – do they just take it for granted?

Lewis: Not at all, I think the reality is incumbent firms don’t always see their Platform as the asset that it is. When looking at large global enterprise, brand becomes a beast of its own and disconnected from shorter-term efforts or initiatives. We see this brand become even less of a focus when faced with disruption and the scramble to maintain share. What is sometimes forgotten is the power of the built-in awareness of an established firm – and the trust that comes along with it. While there is always brand baggage, it is a lot easier to work with something established than to start over. In our study, we call out several cases where established firms were able to leverage their existing Platform for continued success. The ways they did this were:

- Brand Activation – Directly connect brand assets to ongoing customer marketing activities – connecting on an emotional level with consumers

- Full-Service Focus – Emphasize the simplicity and seamlessness of being with a full-service provider vs. disjointed ad hoc services

- Partnership – More actively leaning into existing brand associations and partnerships that enhance customer engagement and loyalty

Hortz: We didn’t notice the Pathway Advantage as a first action in any of the disruption responses. Why is that?

Lewis: It’s really about prioritization. Incumbent firms are not generally faced with a revenue cliff early on in disruption – which, in itself, is an advantage. Further, it soon becomes vital to best leverage revenue streams from existing customers. Driving loyalty with existing customers as well as expanding these relationships can help cement long-term financial success and deliver better customer experiences. Companies can take advantage of their Pathway Advantage immediately through:

- Becoming a Trusted Partner – Change the provider nature of the financial services relations to be an active advisor

- Loyalty Programs – Revisit existing loyalty efforts to ensure they are driving the customer, and business, value prescribed

- Cross-Sell – Going back to the Perceptivity Advantage, activate customer insights and segmentation to create valuable baskets of offerings for customers

Hortz: Thank you for explaining and sharing this with us. Any closing thought or recommendations?

Lewis: We believe disruption threats will not wait for long-term innovation strategies to come online – especially for large firms, facing many threats. Marketing and sales teams have a vital, superhero role to play to help the firm keep ahead of competitive pressures, so the organization can thrive while longer-term innovation is happening. Companies must act now, and our research validated the power of a front-line go-to-market response. Feel free to access our full report here.

Related: Developing Your Immediate Response to FinTech Disruption