Written by: Rebecca Smith

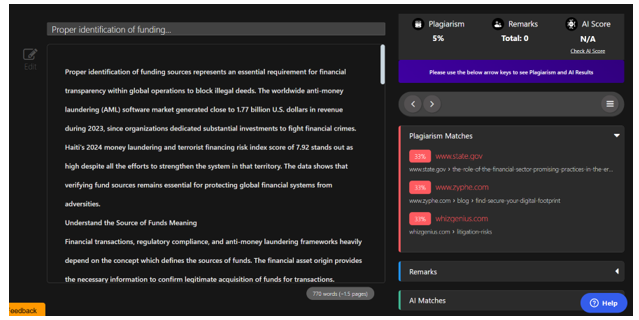

Proper identification of funding sources represents an essential requirement for financial transparency within global operations to block illegal deeds. The worldwide anti-money laundering (AML) software market generated close to 1.77 billion U.S. dollars in revenue during 2023, since organizations dedicated substantial investments to fight financial crimes.

Haiti's 2024 money laundering and terrorist financing risk index score of 7.92 stands out as high despite all the efforts to strengthen the system in that territory.

The data shows that verifying fund sources remains essential for protecting global financial systems from adversities.

Understand the Source of Funds Meaning

Financial transactions, regulatory compliance, and anti-money laundering frameworks heavily depend on the concept which defines the sources of funds. The financial asset origin provides the necessary information to confirm legitimate acquisition of funds for transactions. Financial institutions together with all organizations need this principle to stop criminal finance operations and maintain financial transparency.

The implementation of financial resource legitimacy checks is mandated by authorities, which businesses and financial institutions must perform in their high-value transactions. The comprehension of funds origination helps organizations stop financial offenses including money laundering along with fraud and terrorism financing. Businesses operating without proper financial source evaluation expose themselves to dangerous legal consequences, together with financial losses and brand damage.

Working Frameworks of Source of Funds

Regulatory frameworks worldwide emphasize AML source of funds verification as a fundamental compliance measure. Financial institutions and designated non-financial businesses are obligated to perform due diligence when assessing financial transactions. This process ensures that funds entering the financial system stem from lawful endeavors.

Regulatory Compliance and Verification Procedures

Know Your Customer (KYC) protocols play a pivotal role in determining the origin of financial resources. Institutions must obtain verifiable documentation that substantiates the source of an individual’s or entity’s wealth. This scrutiny applies particularly to high-net-worth individuals, politically exposed persons (PEPs), and entities engaging in substantial monetary transfers.

Government bodies such as the Financial Action Task Force (FATF) and regulatory authorities impose stringent compliance measures to curb financial malpractices. Businesses must integrate robust monitoring mechanisms and risk-based approaches to identify potential red flags. Any inconsistencies in financial documentation may prompt enhanced due diligence procedures, reinforcing a transparent financial ecosystem.

Enhanced Due Diligence (EDD) and Risk Assessment

When regular checks aren't enough, stronger checks are used called enhanced due diligence (EDD). EDD involves deeper scrutiny of financial transactions, including continuous monitoring, source of wealth verification, and cross-referencing financial records with third-party data sources. High-risk clients, such as those engaged in complex business structures or transactions in high-risk jurisdictions, are subject to stringent evaluation.

Financial Intelligence and Reporting Obligations

These institutions that are regulated must submit reports on suspicious activities regarding finances to designated agencies, using SARs or STRs. These reports assist law enforcement factions in probing for laundering activities and other criminal financial operations. Failure to adhere to these reporting requirements can lead to harsh fines, legal punitive measures, and damage to one’s reputation.

Potential Source of Funds Examples

The legitimacy of financial assets can be validated through various means, depending on the nature of the transaction and the individual’s financial background. Some common sources of funds examples include:

-

Salaries and Business Revenues – Individuals earning wages from verified employers or businesses generating legitimate income provide clear evidence of lawful earnings.

-

Investment Returns – Profits accrued from investments in stocks, bonds, real estate, or other assets contribute to an individual’s financial portfolio.

-

Inheritance and Gifts – Monetary gifts from family members or inherited wealth are widely accepted as valid sources of funds, provided they are legally documented.

-

Property Sales – Revenue generated from real estate transactions or asset liquidation is frequently used for significant financial dealings.

-

Loan Disbursements – Funds obtained through financial institutions in the form of loans, mortgages, or credit lines are considered legitimate sources of capital.

In each scenario, individuals and businesses must present credible documentation such as pay slips, tax returns, bank statements, investment reports, or legal agreements to validate the authenticity of their financial resources.

Concluding Remarks

Make financial transactions clear and visible so that it’s easy to see where money is coming from and going. Even if some industries raise questions, they should be watched and investigated when necessary. By verifying the source of funds, it contributes significantly to promoting financial integrity, safeguarding institutions from risks associated with financial crime, and ensuring compliance with regulations. Strict compliance ensures the protection of businesses while promoting a stable financial environment. Leveraging these insights from fund origination allows financial agencies and regulators to minimize illicit activities, strengthen due diligence practices, and foster a robust and reliable economic ecosystem.