Written by: Anand Sheth | Pulse360

Having interacted with thousands of clients during my time as an advisor, I have gained a deep understanding of how we serve them and how they view us. This has allowed me to hone a few key strategies you can use to effectively communicate the value you create for clients.

Here are four that you can easily implement right now:

1. Write a Great Value Proposition Statement

As mentioned earlier, most investors have a hard time telling the differences between financial advisors. This is because we all tend to make similar promises about our “experienced investment managers” or “tailored solutions.”

While we need to make those promises, we also need to add something unique and avoid certain common mistakes. Here are a few tips to get you started on revising your value proposition in a way that opens up a conversation about the real value you create:

- Tailor your message. To be effective, a value proposition has to sound like it’s talking directly to the prospect. How do you do that with something that will be read by countless eyes? One way is to craft an imaginary ideal client. Give them financial goals and constraints. You might even draft an outline of the ideal client’s investment policy or personal life goals. Write your proposition for this person. How would your services benefit this ideal client?

- Identify what makes you and your firm unique. Give concrete attributes like years of experience, areas of specialization, and notable achievements.

- Prioritize trust. One pervasive complaint among investors is the lack of focus on trust. Investors often turn to advisors for guidance and reassurance while navigating the market. They need to know they can trust you. What do you do as a financial advisor to build that trust?

- Avoid industry jargon. When you’re on the verge of using investment jargon, pause to think of a plain English alternative (that doesn’t sound condescending).

For more tips on putting together a strong value proposition, check out this step-by-step guide.

2. Use Visualizations

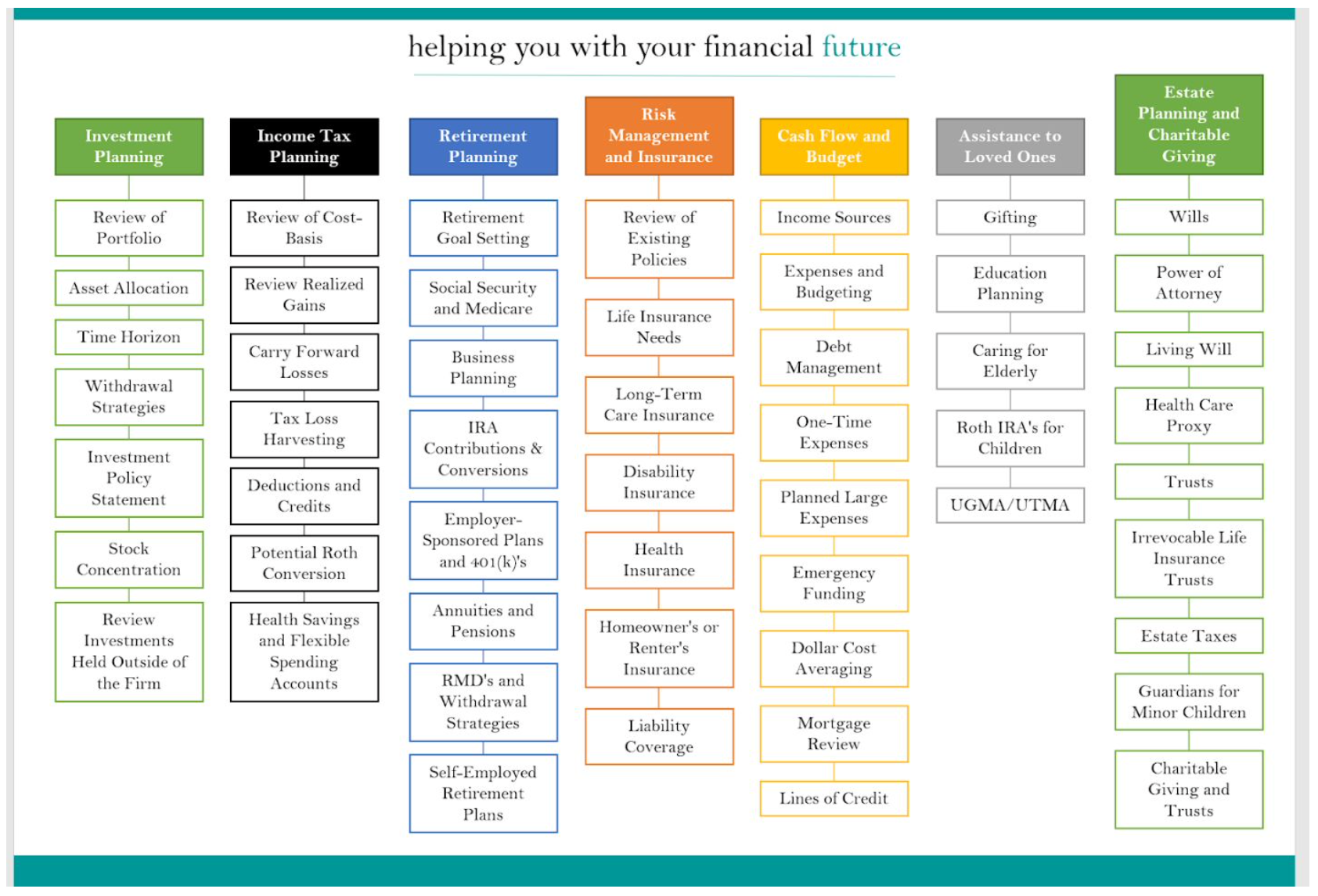

Keep some visualizations on hand that you can show to clients and prospects during your conversation about value. For example, you can use a flow chart like this one to clarify the range of services you can provide for your client:

The advantage of visuals like this is that it makes it easier for your client to understand what they’re paying for.

It helps demonstrate that financial advisors are not just problem solvers. That is, once you solve this current problem, you can continue to create value for your clients in other ways as well.

Use this and other visualizations to open up a conversation into this client’s long-term goals and priorities. Get them talking about what they want to achieve. As they talk about their personal goals, you can talk about where your services fit in and how you can help them achieve those goals.

3. Quantify Your Future Value

Quantifying your future value helps you show your clients, in concrete terms, what they’re paying for. In exchange for those advisor fees, you’re creating a meaningful impact not only on their finances but on their long-term life goals. You need to express that impact in real numbers and make a point of showing clients that difference.

4. Send Written Summaries

When you’re sitting down with a client, discussing a specific problem, and explaining your recommendations, your value as an advisor becomes clear. In that moment, there’s a concrete problem and you’re providing real and specific insights into solutions that this client was unable to see on their own.

The result of those meetings is a sense of confidence both in your expertise and in their financial future. This is exactly what you want to achieve.

The challenge, though, is making that feeling stick.

As soon as your meeting with a client is over, that client is quickly going to forget what you did for them. As they return to their normal routine, your advice fades to the back of their mind and that sense of confidence fades along with it.

To ensure clients remember your advice and, by extension, the value you’re creating, follow up each meeting with a written summary of the recommendations you provided, the reasoning behind them, and their expected future value.

Doing this doesn’t have to eat up hours of your day, either. Using a documentation software like Pulse360, you can generate written summaries from your meeting notes in a matter of seconds.

In a series of blog posts, I will highlight the phenomenal value that is typically created by financial advisors. While I will use examples from my own career, I will change identity details to protect the privacy of my clients. However, these details are not the point. Instead, I hope to use the experiences to help shift the conversation from fees to value—phenomenal value that is.