Written by: Allison Lasley

New client onboardings are one of the most important activities for fast-growing wealth management firms, however, they’re also extremely cumbersome. The process today is slow and painful, taking on average 32 days to onboard a new client. With so many forms to fill out and third parties to correspond with, it can be a time-intensive process. As a result, advisors and their teams spend valuable time filling out forms instead of focusing on value-enhancing activities for the firm.

Research shows that advisors view account openings as the most cumbersome part of client onboarding. However, to provide an excellent client experience, this process should be as seamless and straightforward as possible. Fast-growing wealth management firms can achieve this with fully digital workflows that capture the required data, automatically fill in forms and then dispatch the documents for e-signatures. With this time saved, advisors and their teams spend less time doing paperwork and more time building relationships with prospects and giving great advice.

Here are three benefits of using digital account openings.

1. Simplify data capture

Client onboardings involve many processes; however, 37% of advisors consider account openings the most cumbersome part of client interactions with account maintenance close behind at 24%. Advisors aren’t the only ones who don’t like manual processes though; young investors also expect services delivered digitally, including financial advice. Nearly two-thirds of Generation Y and Z want Amazon or Uber-like experiences from their advisory firm. While this sounds like an ambitious goal, it can be achieved with automation and the right data.

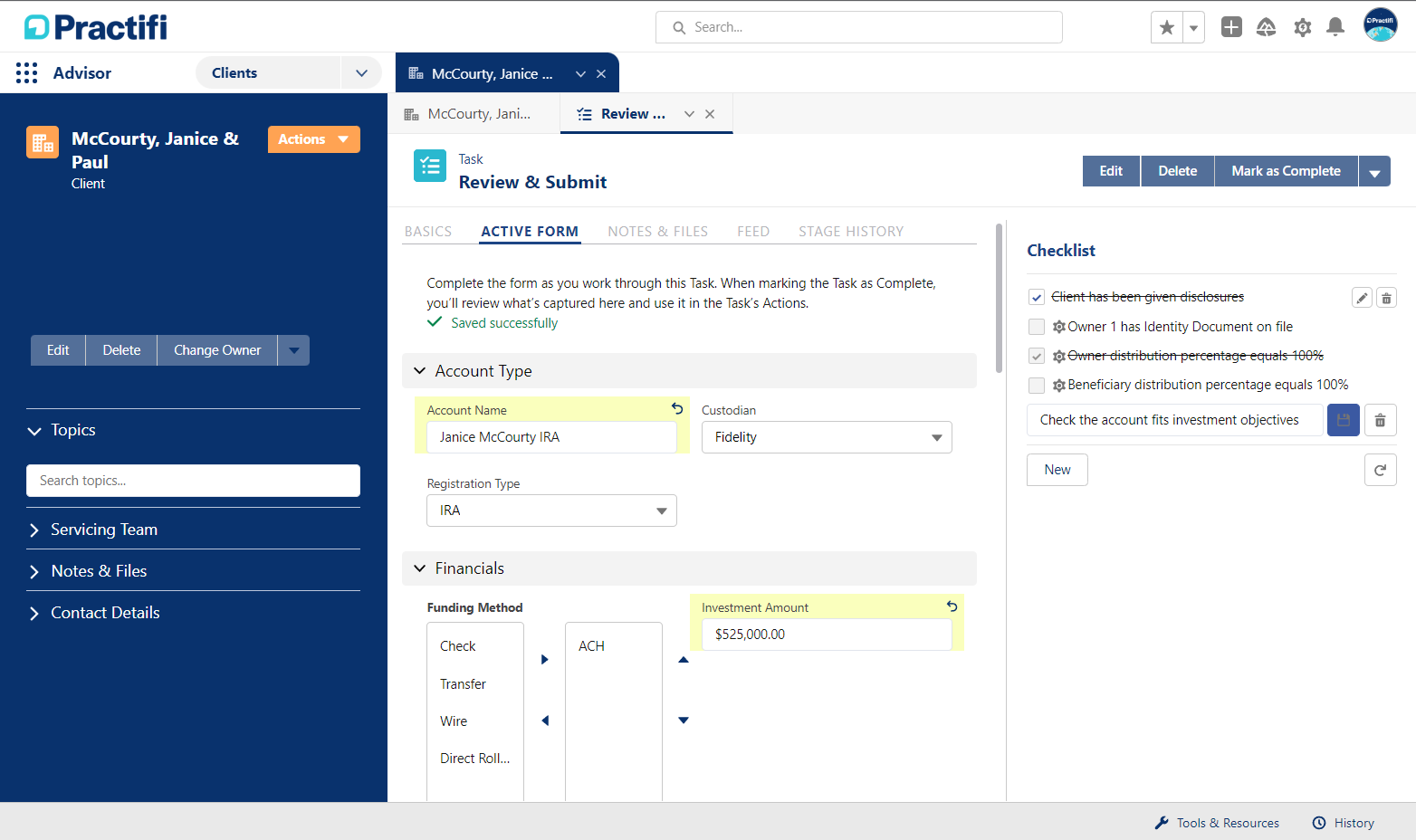

When working through a task, Practifi’s Active Forms make it easy to capture required contact and account data.

With Practifi’s workflow capabilities, advisory teams can capture data and automate common processes such as new account openings, move money requests, updating beneficiaries and more. Active Forms, customizable forms that appear in workflow tasks, ensure that all required data is captured. Once this data is stored in Practifi, it can be surfaced in proprietary forms or a third-party form library*. For example, Quik! has a repository of 3,000+ forms that can be leveraged. In addition, advisors can start multiple account opening and maintenance processes at once to help speed up the process.

2. Improve process transparency

With the average broker-dealer firm opening more than 100 new accounts weekly, it’s overwhelming to imagine how many tasks, emails and forms are being worked on in a given day. An average account opening process involves transferring assets, filling in multiple forms, activating accounts and collaborating between multiple parties. Unfortunately, nearly 25% of account openings result in “Not In Good Order” (NIGO) status due to missing client and account information.

To provide an excellent client experience, it’s imperative to deliver a smooth account opening process. However, without transparency into who’s responsible for each task and its current status, common onboarding processes can get very complicated. This significantly increases the chance of error and NIGO status.

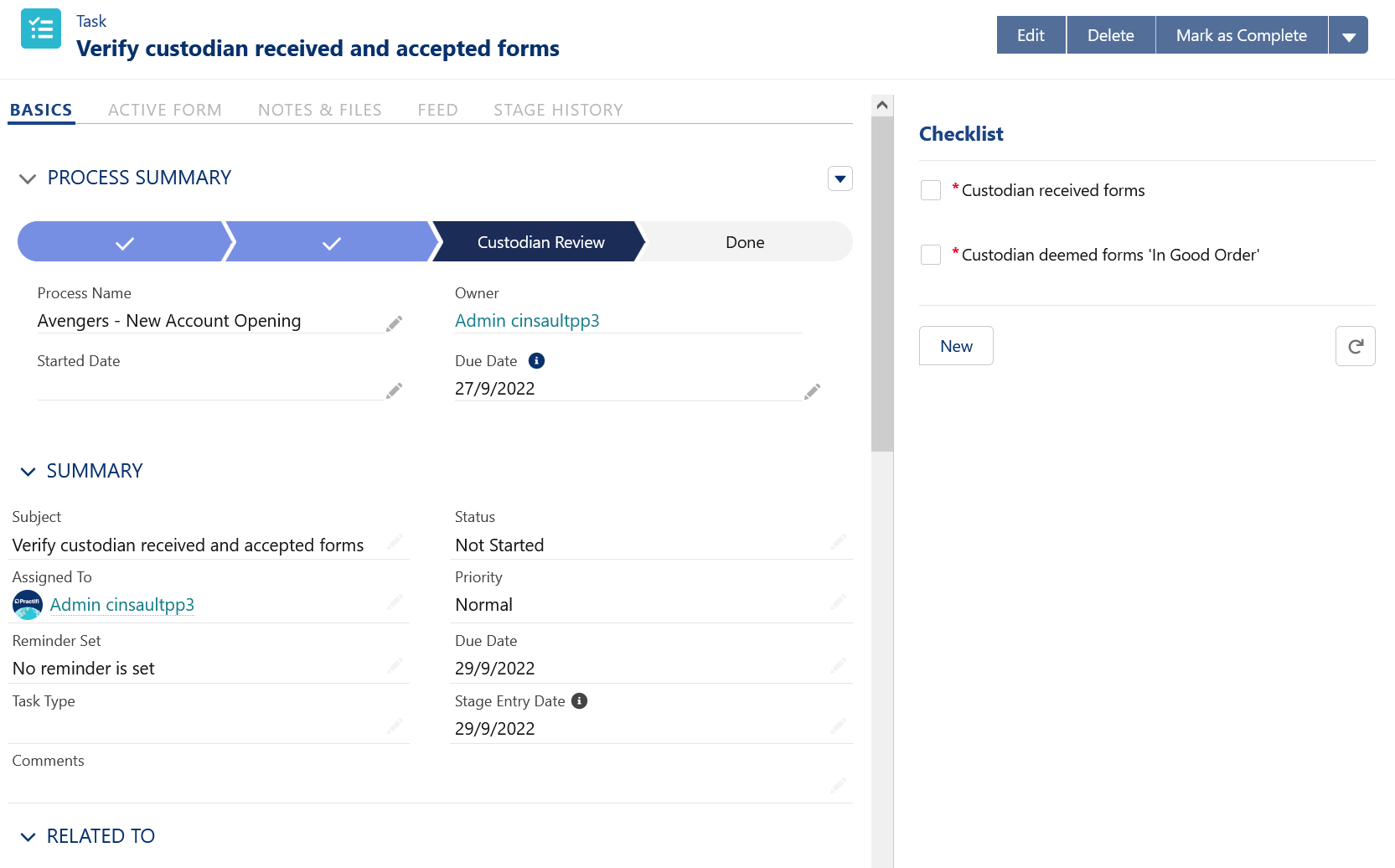

Process summaries and checklists make it easy to view progress, who is responsible for each task and ensure all steps are completed.

Digital workflows not only save time for advisory teams but also aid team collaboration by providing transparency into the status of each task. Within Practifi, teams can view the account opening process stage, whether or not the custodian deemed the forms “In Good Order,” and who is responsible for completing the task. With clear steps and required checklist items, digital workflows help teams significantly reduce the chance of error during account opening and maintenance processes.

3. Seamlessly adapt to new and updated forms

The wealth management industry is form-heavy and the layouts and required fields of each change regularly. While some changes may be minor, it’s difficult for advisors and client servicing teams firms to keep up with them. As a result, staff can easily miss important steps and overlook required fields. For home offices, it is crucial to use flexible and integrated technology to reduce account opening inefficiencies and encourage advisor satisfaction.

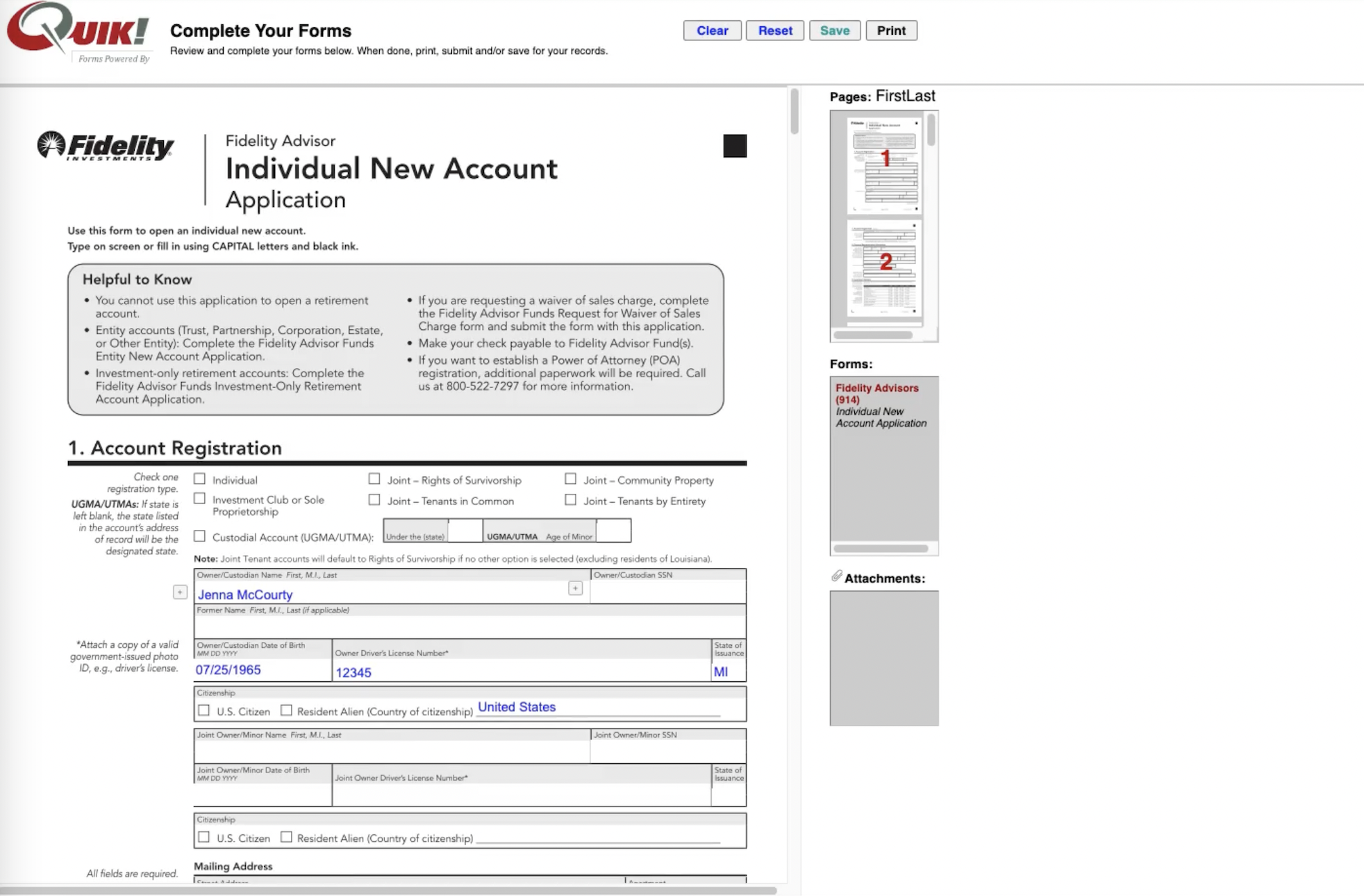

Map to any form and easily update required form fields with Practifi’s built-in form flexibility.

Practifi’s digital workflows can adapt easily to any related form changes — no coding required. Regardless of what form you map to, Active Form fields can be edited and added easily to ensure the right data is captured and synced across. As a result, advisors and client servicing teams don’t have to worry about forgetting new fields. They’ll simply become a part of the normal data capture process; ensuring all relevant fields are filled in Practifi and surfaced in the chosen form.

Digital transformation starts from the beginning

Given the volume of new accounts and the need to make positive first impressions on new clients, it’s no surprise that the account opening and onboarding experience is a top priority for many firms. Today, most firms handle these form-intensive processes manually which often leads to missing data, avoidable delays and frustration.

Fully digital processes—including account opening, transfer of assets, updating beneficiaries, etc.—are necessary to free up valuable time for advisors and provide a more satisfying client experience. Practifi’s workflow capabilities make this possible so advisors can spend more time on high-value activities for the firm.

Related: How Key Drivers of RIA Consolidation Are Affecting M&A