Written by: Ayush Babel & Jeremy Schwartz

Key Takeaways

-

In his third term as prime minister of India, Narendra Modi is expected to focus on increased manufacturing, trade agreements and economic growth while continuing to maintain fiscal prudence and root out corruption.

-

Modi’s government has implemented welfare schemes to reduce inequalities, provided defense sector backing and almost eradicated extreme poverty.

-

India’s equity markets have experienced strong growth and momentum, with rising incomes and political stability contributing to the country’s potential for accelerated growth.

Narendra Modi started the 2024 election campaign with an ambitious goal of exceeding the majority his party obtained in his prior two terms. The first exit polls suggested he would, but the reality turned out to be much slimmer. Yet Modi’s Bhartiya Janta Party (BJP) was still the single largest party with 240 seats. The BJP’s coalition, the National Democratic Alliance (NDA), scored 292 seats, thus comfortably beating the required majority of 272 seats to form a government. The opposing Indian National Congress (INC) won just 99 seats, making it a quite distant second.

It is clear the country voted largely for the incumbent government, even after two terms, a rare phenomenon in Indian politics.

Modi Brings Ambitious Economic Growth Goals

Over the last decade, India emerged from being a “fragile 5” economy to become the fifth-largest economy of the world, driven by a continuous focus on development, a range of structural reforms and anti-corruption initiatives.

In his victory speech, Modi promised even bolder reforms in his third term and pledged to grow India to the third-largest economy in the world by the end of this decade. He has plans to turn India into a developed economy by 2047—the 100-year anniversary of India’s founding.

We expect to see Modi policies emphasizing the following areas:

-

Increased focus on manufacturing: Modi’s first two terms focused on his Make in India initiative. India’s manufacturing sector has been gaining share in sectors like smartphones, defense and semiconductors more recently. Modi 3.0 has ambitious targets to increase India’s share in global manufacturing from under 3% to 5% by 2030 and to 10% by 2047. We shall see more focus on Make in India with subsidies, tax benefits and policy support. This is also aligned with a global trend of firms looking to bolster supply chain resiliency away from a dependency on China.

-

Trade agreements: In the last few years, India signed a free trade agreement (FTA) with the European Free Trade Association (EFTA) bloc made up of Iceland, Liechtenstein, Norway and Switzerland. A similar FTA was enacted with the United Arab Emirates and there’s a preliminary deal with Australia. India will continue to push for more FTAs.

-

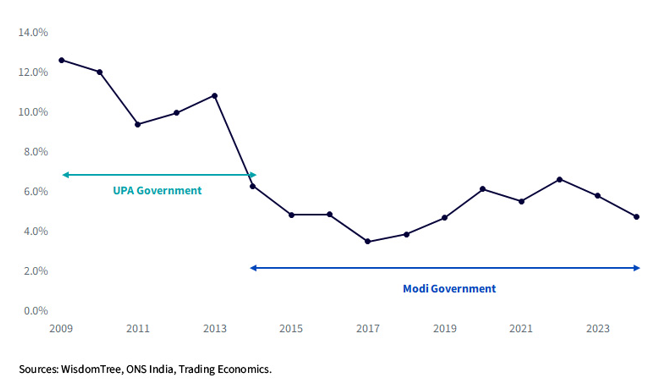

Economic growth and fiscal prudence: Modi will maintain a focus on high economic growth with increased spending on infrastructure to maintain the rapid pace of development over the last decade. Keeping inflation low will be critical as it has been a success point over the previous governments and a major factor in getting Modi re-elected for three consecutive terms (see figure 1).

One concern for the political compromise Modi must make to foster his new coalition government is to provide more fiscal support and spending, which bolsters consumption but could send bond yields higher. It is quite helpful that India will be a recipient of more passive flows to bonds as the country is being added to the JP Morgan global bond benchmark series in stages starting this June. After full inclusion over the next nine months, India’s weight is expected to reach 10% in the GBI-EM Global Diversified Index and 15% in the GBI-EM Global Diversified IG 15% Cap Index.

-

Labor reforms: To continue to make India attractive for businesses, labor reforms are expected to provide more flexibility to businesses in adjusting their workforces based on demand.

-

Rooting out corruption: While the government has not witnessed major scandals like its predecessor, corruption still exists. Modi’s second term started with punishing top bureaucrats involved in corruption and we expect further actions.

-

Welfare schemes: Modi brought the largest number of people out of poverty by implementing a number of welfare schemes to reduce inequalities. Modi built more than 20 million houses under PMAY (Pradhan Mantri Awas Yojana), provided 100 million LPG connections to economically weaker sections under PMUY (Pradhan Mantri Ujjwala Yojana), more than 110 million toilets under the Clean India drive, over 450 million bank accounts under the Pradhan Mantri Jan Dhan Yojana, and health insurance cover to more than 100 million poor and vulnerable families under the Ayushman Bharat initiative, among many others.

Modi rose to power from a relatively economic weaker background, and we expect continuation of these efforts to eradicate extreme poverty.

-

Defense expenditure: India has come a long way under Modi’s leadership to tackle the threat to cross-border terrorism and stand up to China’s territorial expansion in the region. In the last decade, India rapidly developed its lagging road infrastructure along the border and diversified its imports, along with boosting domestic manufacturing. India is now domestically producing modern defense equipment including lightweight fighter aircrafts, and has inked deals to export defense equipment to its partners in the region—a complete turnaround from 10 years ago. We expect continued backing to flow to the defense sector in Modi’s third term.

Figure 1: Year-on-Year Inflation Comparison with Previous Government

Conclusion

The markets experienced some volatility as the election results came in but recovered quickly as Modi’s party received letters of support from its alliance partners.

WisdomTree believes India remains one of the best growth stories of any major economy. Modi has ambitious growth targets, and we emphasize India would be one of our strategic over-weight allocations over the long term.

It is important to note that India has almost double the national road infrastructure than 10 years ago, has a booming technology industry that has supported the country’s digitization efforts and a much larger proportion of its population under the formal economy. Moreover, it has the best demographic profile of all major economies, with incomes set to catch up as it modernizes. India adapts some of the latest technologies to their advantage and one example is that around 50% of all digital transactions globally occur in India.1

We’ve seen India benefit from increased capital flows coming away from China, and supporting its equity markets could be rising incomes that get deployed into equity markets. Indian equity markets have delivered impressive returns since the Covid dip, rising almost three times (based on Sensex levels). With momentum on its side, India has a strong platform to accelerate growth on the back of political stability and geopolitical tailwinds (see figure 2).

WisdomTree has two solutions for India’s equity markets:

-

The WisdomTree India Earnings Fund (EPI): Our flagship India product. This was the first ETF made available in the U.S. to own underlying equity shares outright. It weights companies according to their earnings and provides the broadest exposure to the market, with over 470 companies included. Many of the popular benchmark tracking Indexes have closer to 50, 75 or 120 companies and are focused on large-cap companies that are more sensitive to global demand. The earnings weighting also helps lower the valuation for the market—something we believe is important for India, which is widely recognized as a strong growth story.

-

The WisdomTree India Equity Hedged Fund (INDH): We recently launched a currency-hedged ETF for those who worry about currency volatility. It was historically costly to hedge the rupee but, based on the convergence of interest rates, that cost has come down. Read our recent Fund launch blog post to learn more about INDH.

Figure 2: WisdomTree Index Earnings Index Performance Comparison, Last 10 Years

For definitions of indexes in the chart above, please visit the glossary.

1 Source: Babel, Ayush. “India for the Long Run.” WisdomTree, 21 Mar. 2024, www.wisdomtree.com/investments/blog/2024/03/21/india-for-the-long-run.

For more information about WisdomTree go to wisdomtree.com/investments.

Related: AlphaFold 3: The Future of AI in Biotechnology Is Here

Important Risks Related to this Article

EPI/INDH: There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in India, thereby increasing the impact of events and developments associated with the region which can adversely affect performance. Investments in emerging, offshore or frontier markets such as India are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. As this Fund has a high concentration in some sectors, the Fund can be adversely affected by changes in those sectors. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Past performance is not indicative of future results.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S.

This WisdomTree article is provided as part of a paid sponsorship.