Written by: Brian Manby

Key Takeaways

-

Corporate tax rate changes, like the 2017 TCJA, significantly boosted corporate earnings, especially for small-cap companies reliant on domestic revenue.

-

Sectors such as Communication Services and Information Technology have reduced their tax burdens since the TCJA, but small-cap sectors like Communication Services and Health Care could see double-digit earnings declines under a 28% tax rate.

-

A 25% corporate tax rate would lead to modest earnings declines, but a 28% rate would have a much larger negative impact, with small-cap companies particularly vulnerable due to their domestic focus.

Corporate tax rate policy is a routine hot-button issue during every presidential election cycle, and this year’s campaign is no different.

Shortly after the 2016 election, we attempted to model the impact of former President Trump’s flagship Tax Cuts and Jobs Act (TCJA) on corporate earnings. Unsurprisingly, we determined that reduced tax rates would provide a meaningful boost for corporate profits via reduced effective tax rates.

Our analysis also determined that small-cap companies inherently benefited more due to revenue source composition or, more simply, a “tax geography” effect. Moving down the size spectrum, smaller companies benefit more from reduced U.S. corporate tax rates due to greater reliability on domestic revenues than larger, multinational companies.

Eight years later, markets must contend with the possibility of an opposite, business-unfriendly scenario: the potential for corporate tax rate increases pledged by Democratic candidate and current Vice President Kamala Harris.

Harris is currently proposing a 28% federal corporate tax rate to replace the nominal 21% enacted by the 2017 TCJA. To demonstrate the impact this could have on earnings, we’ve updated our original 2016 model with 25% and 28% baseline assumptions to identify a range of potential outcomes for U.S. equity indexes.

Changes in U.S. Corporate Activity and Tax Environment since 2016

Prior to its passage, most U.S. companies paid about 25%–30% effective tax rates.

Today, however, that range has been meaningfully narrowed and reduced. The effective tax rate for large-, mid- and small-cap U.S. equity segments ranges between 18% and 22%, which is around or below the nominal rate of 21%.

Figure 1: Effective Tax Rates (Indexes)

Sources: WisdomTree, FactSet, as of 12/31/23. Effective Tax Rates are calculated as the sum of average income tax expense over the prior three fiscal years divided by the sum of average pre-tax income over the prior three fiscal years. You cannot invest directly in an index. Subject to change.

Effective tax rates at the sector level mostly coincide with the decline in rates at the index level as well. Communication Services, Consumer Discretionary, Financials and Industrials have all reduced their tax burdens over time. Information Technology, the largest sector by weight in the S&P 500 Index, remarkably pays less than 14% of its pretax income.

Small caps have benefited from the changing tax paradigm as well. Today, the Russell 2000 pays approximately the nominal 21% tax rate, down from about 31% in 2016, with a sector mix that resembles the trends in the large-cap space.

Figure 2: Effective Tax Rates (Sectors)

Sources: WisdomTree, FactSet, as of 12/31/23. Effective Tax Rates are calculated as the sum of average income tax expense over the prior three fiscal years divided by the sum of average pre-tax income over the prior three fiscal years. You cannot invest directly in an index. Subject to change.

One important caveat, however, relates to non-tax-related changes in the U.S. business environment that have indirectly assisted corporate efforts to avoid taxes since 2016.

The aggregate percentage of taxes paid domestically for the S&P 500 has shrunk to about 63%, down from about two-thirds, reflecting greater geographic revenue diversification among large-cap companies. Several sectors contributed to this shift with individual reductions greater than 10%, while other domestic-reliant groups, like Utilities and Financials, offset the declines with notable increases in their share of taxes paid domestically.

Figure 3: Percent of Taxes Paid Domestically

Sources: WisdomTree, FactSet, as of 12/31/23. Percentage of Taxes Paid Domestically calculated as the sum of average taxes paid domestically over the past three fiscal years divided by the sum of average domestic and foreign taxes paid over the past three years. You cannot invest directly in an index. Subject to change.

The net effect, however, is a declining domestic tax liability among U.S. large caps, which inherently reduces the sensitivity of their earnings to changes in corporate tax policy.

The same trend is evident, albeit less pronounced, within small caps. Unsurprisingly, the domestic tax shares are a bit noisier at the sector level, but the index-level decline coincides with the large-cap trend in a similar magnitude.

Though small caps still pay 75% of their taxes domestically, any continuation of this downward trend would be advantageous amid the possibility of higher corporate tax rates, as the negative impact on earnings may be mitigated.

Earnings Implications under a Higher Tax Regime

Using trailing three-year averages of effective tax rates and the portion of taxes paid domestically, we anticipate relatively modest impacts to corporate earnings under a 25% statute, with a more pronounced burden at 28%.

Under a 25% rate, we expect that the marginal increase in the effective tax rate would be between 2% and 3%, with small-cap companies faring worse than mid-caps and large caps. Using August price-to-earnings multiples and holding prices constant, we’d expect prevailing valuations to modestly expand, coinciding with a 3%–4% decline in earnings. Once again, large-cap earnings would likely fare better than small-cap earnings.

Figure 4: 25% Corporate Tax Rate

Sources: WisdomTree, FactSet, as of 8/31/24. You cannot invest directly in an index. Subject to change.

At the sector level, Communication Services would suffer the worst earnings declines, while Information Technology, Energy and Real Estate would be least affected. Declines for most other sectors are relatively in line with index-level forecasts.

Figure 5: Estimated Earnings Growth Under 25% Corporate Tax Rate

Sources: WisdomTree, FactSet, as of 8/31/24. Earnings Growth Estimates for S&P 600 sectors use trailing price-to-earnings (P/E) measures, excluding unprofitable companies, in their calculations. You cannot invest directly in an index. Subject to change.

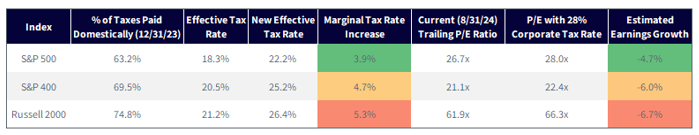

At 28%, however, the effects would be more significant. Under this scenario, we’d anticipate index earnings declines of 5%–7%, which become gradually worse as we move down the size spectrum. This is where smaller companies’ greater reliance on domestic business, compared to larger companies, could become a headwind in a tax hike environment.

Figure 6: 28% Corporate Tax Rate

Sources: WisdomTree, FactSet, as of 8/31/24. You cannot invest directly in an index. Subject to change.

An increase to 28% could increase the marginal effective tax rate by 4%–5% for the main U.S. equity indexes, which would likely sour equity sentiment as the burden becomes more challenging to overcome.

Figure 7: Estimated Earnings Growth Under 28% Corporate Tax Rate

Sources: WisdomTree, FactSet, as of 8/31/24. Earnings Growth Estimates for S&P 600 sectors use trailing price-to-earnings (P/E) measures, excluding unprofitable companies, in their calculations. You cannot invest directly in an index. Subject to change.

At the sector level, the effects are naturally greater under a 28% statute, with most large-cap sectors comfortably in our anticipated index-level range.

Small-cap sectors, however, illustrate the burden more clearly. We project that Communication Services and Health Care would hit double-digit earnings declines, while four other sectors would lose approximately 8% in profits. That means that about half of small-cap sectors would be expected to have earnings decline by 8% in this scenario.

Conclusion: 28% Is More Painful Than 25%

As markets wait for November’s election, they will constantly evaluate the potential for these tax proposals to come to fruition and the ensuing impact on earnings. As of now, it’s anyone’s guess as to what is likely, what is improbable and what is merely posturing and campaignspeak.

While an increase in the corporate tax rate to 25% would not be business-friendly, we do not think it would have a sizable negative impact on U.S. corporate activity and, therefore, equity market sentiment. A 28% rate, however, is the greater downside risk, in our view. In this scenario, it may force businesses to find creative ways to legally avoid tax liabilities or further globalize their revenue streams for tax advantages.

In the final two months before U.S. voters head to the polls, we will be eagerly watching market activity for tax policy insights and responses.

For more information about WisdomTree go to wisdomtree.com/investments.

Related: Siegel-WisdomTree ETF Model Portfolios: Income for the Long Run

Important Risks Related to this Article

Past performance is not indicative of future results.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S.

This WisdomTree article is provided as part of a paid sponsorship.