Ah, Labor Day has passed, college football is off and running, the NFL is ready to crank it up, and the stock market is angry. Like the proverbial “old man returning soup in a deli,” as quoted by George Costanza on the Seinfeld TV show, when describing a rough sea.

The seas were rough today, but haven’t we seen this movie before? And it always ends with our hero, NVDA, and its super-friends, who together make up the “Magnificent 7” (Marvel Comics, if you’re listening) saving the day. Maybe it will this time, and maybe it won’t. My job in overseeing my own portfolio is to do 2 things, which are especially relevant in September and October most years:

Realize that market emotion is very often more powerful than fundamentals or what “should be.” All I care about it what IS. And right now, what is happening in markets does not require predictions about whether this will be another market “fall” or just a quiet autumn.

Investing in modern markets requires: AWARENESS OF WHERE THE RISKS ARE. Only then can each investor account for them and operate around them in whatever way suits them.

For me, autumn has been the “scene” of some of my best times as an investor. When you built your entire investment process around “avoid big loss, then make as much as you can” instead of “try to make a lot of money and think about risk when it happens,” market volatility is a blessing, not an annoyance.

This September starts with a continuation of what started on July 16. The stock market’s leadership tops out, but other parts of the market start to ascend. This is very “year 2000” to me, where consumer staples, healthcare, utilities and REITs have the momentum, while whatever spiked higher the past 12 months starts spiking lower.

So yeah, there’s risk out there. There always is. Now, what am I doing about it? ATTACKING IT, that’s what. And using my charts to guide me.

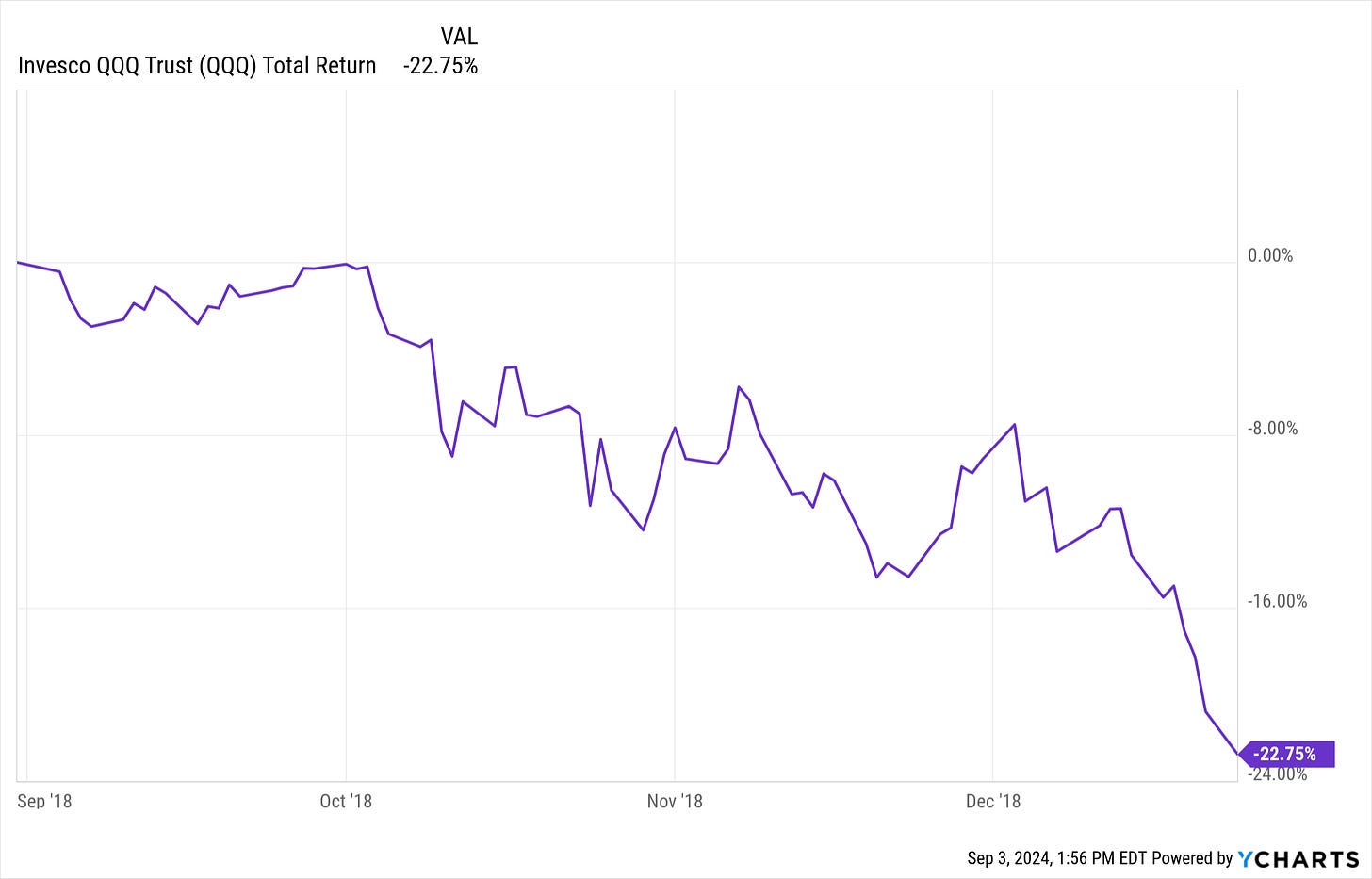

It certainly helped in 2018, when this happened:

And in 2008 when this happened:

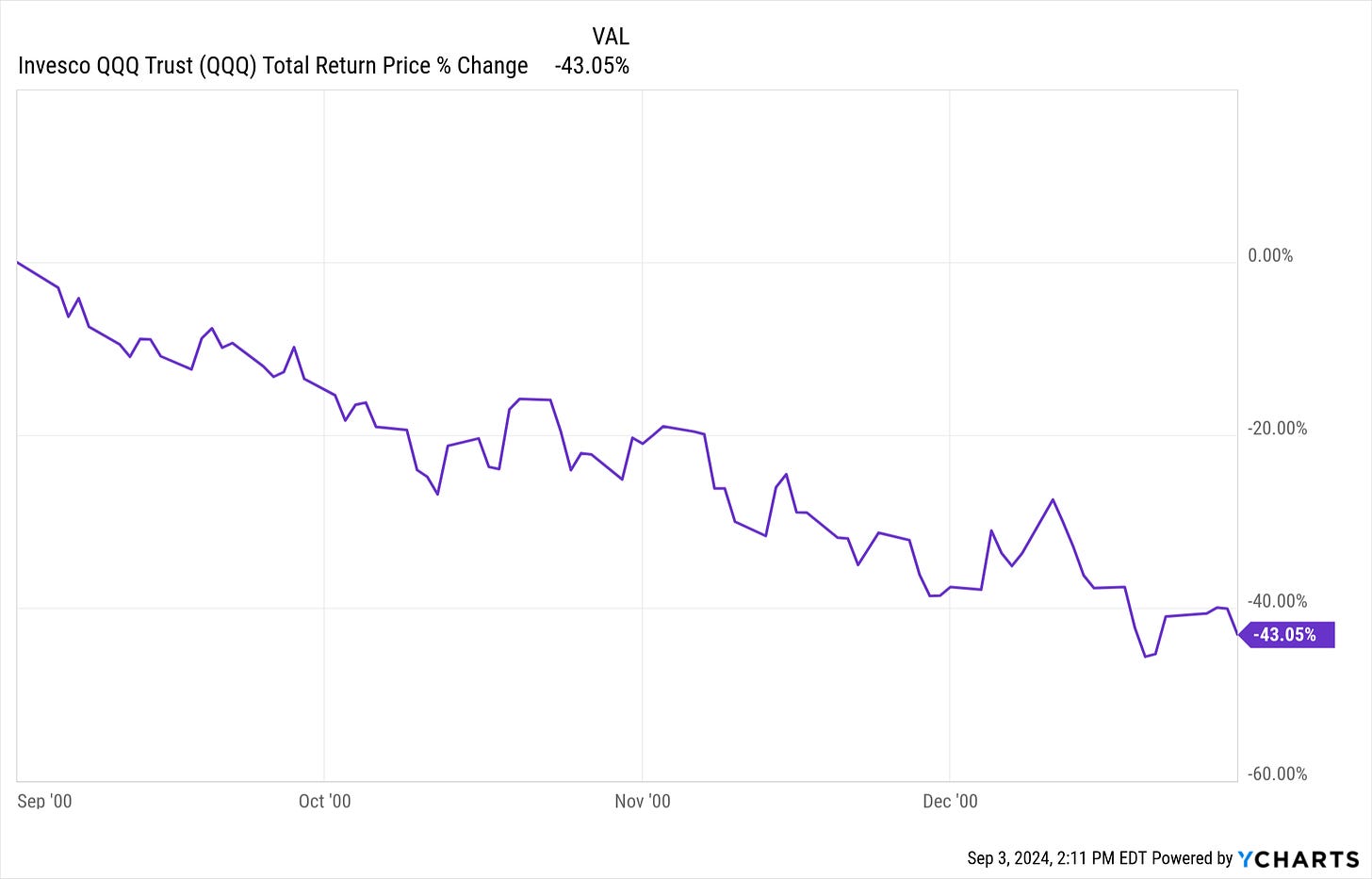

And in 2000 when this happened:

If you are wondering why I used QQQ instead of SPY or the S&P 500 Index above, there’s a very good reason. QQQ’s biggest components have historically led the market up, and up and up, and eventually, led it down. Hard. And quickly.

I don’t know if this is one of those times, but I’m already positioned for it. That does not mean I am “market timing” by exiting the stock market. Nor am I buying “the dip” furiously. There’s a wide, wide world of opportunity between those 2 over-simplified extremes.

Everything in my investment process comes down to this:

PLAY OFFENSE AND DEFENSE AT THE SAME TIME

USE A RANGE OF MODERN MARKET TOOLS AVAILABLE TO EVERY INVESTOR…even if many don’t bother to learn how to use them

Last chart for today, and again it is QQQ, but it is as of this afternoon, right from my screen. Bottom line: we’ve seen days like today followed immediately by new rallies…that poop out like the last one did. 5% down from here would not change a darn thing, since the uptrend would be intact (top section of chart).

But it is that bottom section I’m looking at most closely. I circled that threatening “crossover,” or as I call it a few months too early, a “candy cane” pattern. If that goes below the zero line, it could portend a 10% QQQ drop from here, and get the animal spirits working in the opposite direction (down) than newer investors have become used to.

I’ll have more on that in my private blog as this story develops. And this year, as in many in the past, it didn’t take long for September to scream out for attention.

SUNGARDEN: SEPTMEBER ENHANCEMENTS

As we noted in several posts last month, we have officially “turned the corner” into an updated version of our subscription services, based on what we have learned and been told by subscribers over the past 12 months.

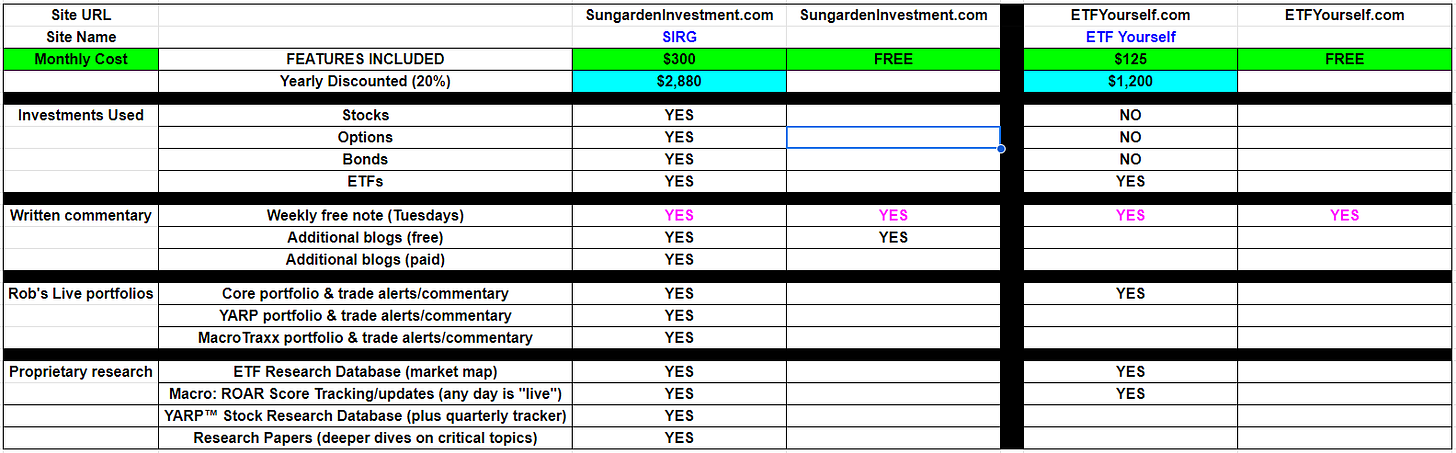

We like to be as transparent as possible around here, unlike the masses in this business. So here is our internal table to track who gets what going forward. As a reminder, ETF Yourself (CORE portfolio and ETF research) is essentially now a “subset” of the full SIRG service (all 3 portfolios, including YARP Dividend stock and MacroTraxx). But we are offering a deeply discounted look this month for existing subscribers, who are currently paying $40 a month for a service that in about a month will up its price. But for which the new features are currently available at the old price.

In the next week or so, subscribers can expect the following to be fully built-out:

-

ETF research deck (all paid subscribers)- new and improved, easier to navigate, something we expect subscribers will feel is an essential tool to visit at least once a week, perhaps much more often.

-

YARP Dividend stock research deck (SIRG paid subscribers only)- this process is so methodical, we figured the best thing we could do is to put as much of the methodology right in the research deck as we can. That’s under construction, but not for long.

-

A new report we are affectionately calling “the 3’s report.” (free to all subscribers, paid and free) A very creative name (not) to describe a 1-pager that we’ll post each Tuesday. It will essentially be a high level snapshot of my “talking points” on global markets, such as:

-

3 biggest market positives

-

3 biggest market risks

-

3 charts worth highlighting (technical price charts and/or non-price trends)

-

More…

-

-

The idea of the “3’s report” is that some of it won’t change very often, but some will change weekly. Because investing in modern markets requires us to have a longer-term framework, an intermediate term view, and a set of short-term observations that are worth following, as they might become more important later on.

-

The 3’s report will be the extent of our free offering going forward. Once a week, for all to see. Paid subscribers will receive my ongoing and as necessary, timeliest commentary, along with additional detail on the items contained in the 3s’ report.

PLEASE NOTE, AFTER SEPTEMBER THE COMMENTARY WILL ONLY BE POSTED ON Sungarden Investment Publishing so please make sure to sign up for free if you haven’t already.