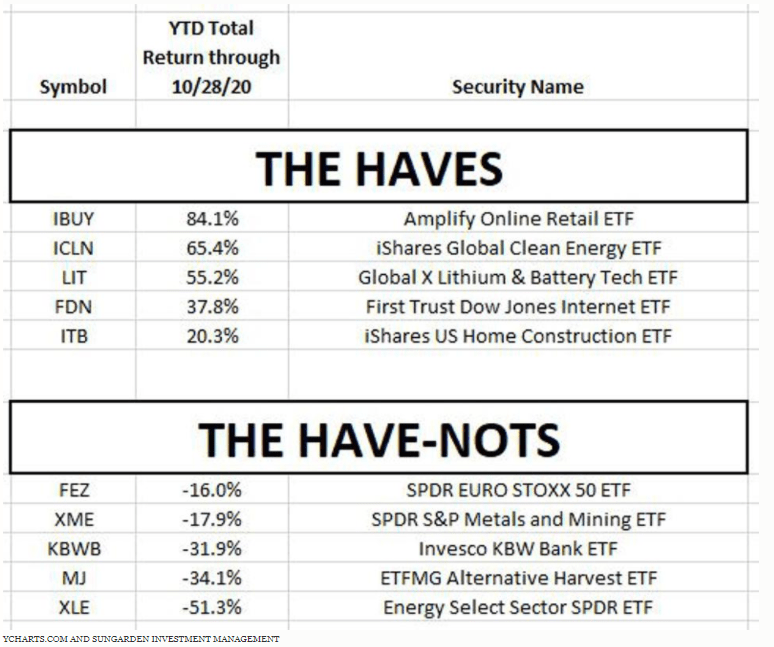

This list of ETF Haves and Have-Nots tells the story of a strange 2020 in the markets.

It is clear that the first 10 months of the year have changed the way the economy functions. This is not like other recessions.

This time around, it has not been even-handed. Layoffs, business closures and altered work schedules were not uniform across the board, as it often is. The financial markets have reflected this. And, while we don’t know what’s around the corner regarding the pandemic, the election or the economic decline we just saw, we can try to learn from what just happened.

At several market inflection points during my career (2000, 2008 and now), I created and published a list of what I call the “haves” and the “have-nots.” These are small groups of market styles or segments that I culled from all of the securities I follow. The goal is to translate market performance into the “story” of what the market is telling us.

In this case, I poured through the working watchlist of 100 ETFs that my team and I consider for inclusion in our portfolios at any point in time. This is NOT a recommended list to buy or sell. This shows their performance for the year-to-date through last Wednesday. Below, I offer some brief comments, from seeing many investment cycles over the decades.

Observations about this table

1: It’s a market of stocks, not a stock market!

As is often the case, the haves and have-nots show a very wide difference in their performance over the past 10 months. Conclusion: the “headline” indexes like the S&P 500 and the Nasdaq NDAQ +4.8% blind us to the fact that the market is a jigsaw puzzle of many pieces. Fitting those pieces together is the key to long-term performance.

2: The haves list tells the story of what investors see as the impact of the pandemic on our lives, and the economy as a whole

Given how everyday life has changed, and the way investors are handicapping the U.S. Presidential and Congressional elections, the list of strong performers makes sense. Online retail has never been stronger. Clean energy replacing fossil fuel was a drumbeat for years, but is now getting louder. Lithium powers electric car batteries. FAANG stocks (which FDN is loaded with) have carried the market. And homes are in high demand, as people start to consider whether their home is going to be more of a life-hub than it has been in generations.

3: The have-nots show how “cheap” investments can get cheaper, and how a robust economic activity is still a long-shot

Europe’s economy was in turmoil before the pandemic. Metals are part of a broader weak-commodity investment environment this year. Banks are under pressure for a variety of reasons, and traditional oil and gas stocks of all sizes are suffering from weak demand, and financial trouble. As for the Cannabis stocks (symbol MJ) ETF making this have-nots list, that’s a combination of things, not the least of which is coming down from, shall we say, the “high” earnings and revenue multiples assigned to that group of stocks earlier in this market cycle.

4: These things have a habit of reversing themselves…but when?

Naturally, you and I don’t know which of these trends are early-stage, about to reverse, or somewhere in between. I do believe that there is as much to be gained as an investor from analyzing one group as there is analyzing another. This is a reminder that past investment performance is not an indicator of future performance. But it does get you a step closer to determining what the market is telling us.

After all, as we look forward, we can wax poetic about what we think is happening. But the only thing that ultimately matters is what security prices actually do. That’s the market’s story, and it is a never-ending one.