People (and by that I mean investment research and media editors) often ask me, “how do you come up with so many ideas to write about?” The answer starts with 120,000+ hours investment work since 1986, and ends with a relentless desire to translate this complex language of investing to anyone who is willing to be a “serial learner” with me.

That effort starts with the willingness to be uncomfortable as an investor. I say that because for decades, a famous quote from a renowned early 20th century investor named Bernard Baruch has been one I rely on. This is especially the case during market cycles like the one we are in now. The quote:

'Something that everyone knows isn't worth anything'

Case in point: every investor can figure out what they want to buy, and then explain to you why they own it. Same with when and why they sold an ETF or a stock. But there’s something missing from 95% of those discussions, whether they are on TV, in print or in a bar or restaurant.

What’s the missing piece? THE WEIGHTING. Not as in Tom Petty’s “the waiting is the hardest part,” but in a similar way, it is easy (and I’d argue dangerous) to simply go out and buy a security without also convincing yourself of why you bought the amount that you did.

For instance, if you had $100,000 to invest and bought an ETF you liked “because it has done well in the past” (a dangerous investing rationale I still see way too much of), that is NOT the most important factor in your success. Ultimately, investment results have much more to do with how much you own as a portion of your portfolio than what is inside that portfolio.

Portfolio management versus a “collection of investments”

The corollary to this is if you don’t know what you own, you are prone to hidden but avoidable risks. Case in point: in my work on Seeking Alpha, I have had many discussions in the comments section where someone voluntarily lists the ETFs they own. I think to myself, “do they realize they essentially own the same stuff, but in multiple packages?” I call this a “collection of investments” and here, we aim to teach techniques around portfolio management.

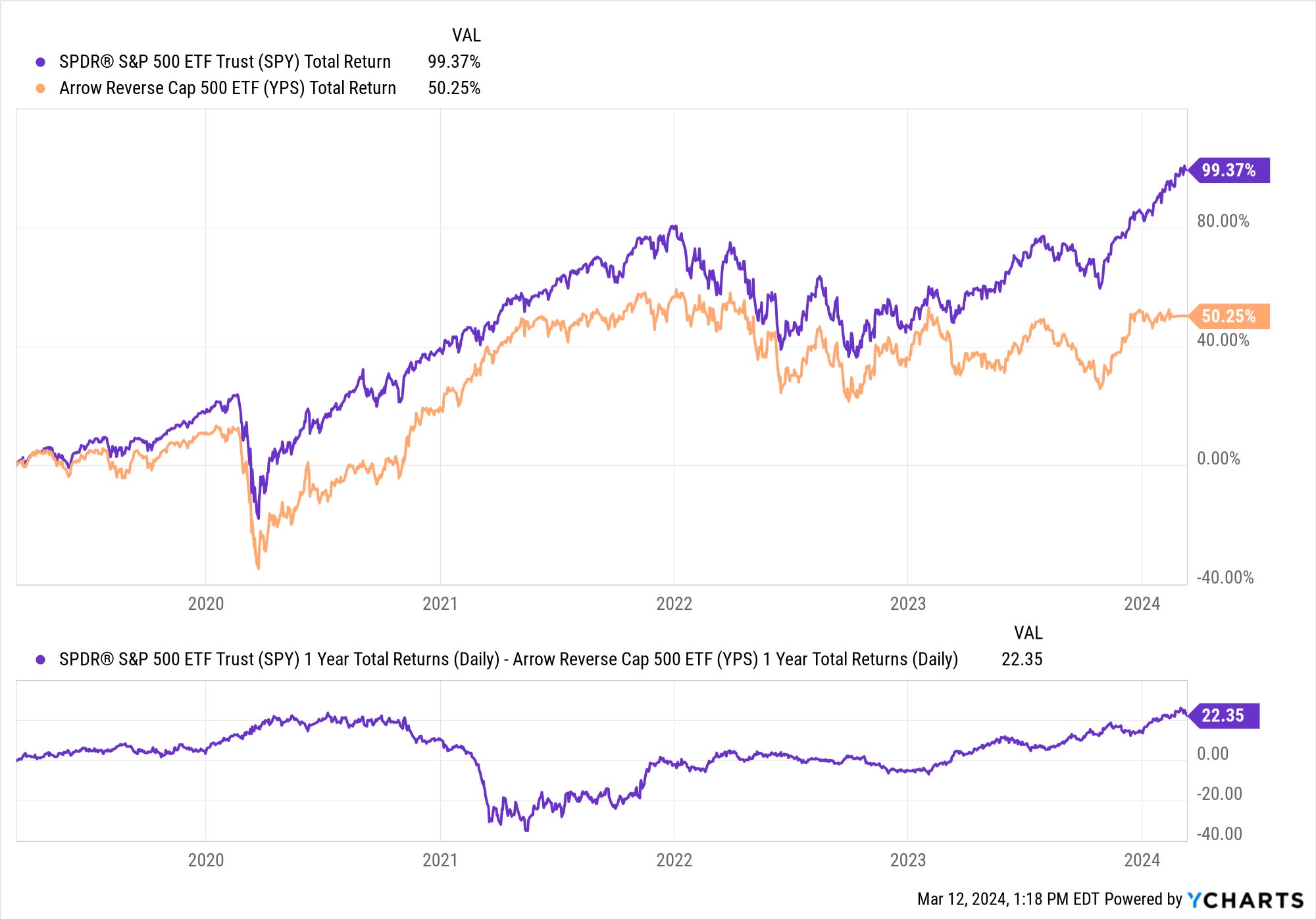

And that brings me to today’s chart, which I think ties all of the above together. The purple line is the S&P 500, and the orange line is the S&P 500. That’s not a misprint!

Purple is SPY, the “regular” S&P 500 index tracker, which weights 500 stocks according to how large they are market capitalization, which is: (# of outstanding shares) x (stock price per share)

So AAPL, MSFT, NVDA and the gang account for a huge percentage of SPY, and those stocks have risen by so much versus the other 490+ stocks in the index, the total 5-year SPY return is nearly 100%, despite the pandemic crash and the 2022 decline.

The orange line is also the S&P 500, and if the ETF name doesn’t give it away, the ticker symbol might. YPS is “SPY” backwards, and this tiny ETF weights the 500 stocks in reverse, so that the Magnificent 7 are the lowest weightings, not the highest. As we see, that has cut the success of SPY in half, as YPS is up “only” 50% the past 5 years.

How much does weighting matter? YPS, that reverse-weighted ETF shown in orange above? Notice how it flatlined very recently. It was shuttered and liquidated 11 days ago, due to lack of interest. So I figured I’d grab it for this weighty lesson before it vanishes from my ETF database too.

When it comes to investing by ourselves, I think it helps to have some “pro tips” to help prevent doing ourselves in, if you will. Position weighting and building portfolios is as important a process to learn as any I know in this business.

So take it on faith, and take it to the heart. The weighting is the hardest part!

Related: Navigating Market Bubbles: Strategies for Charting and Effective Management