Written by: ProShares | ProShares

The Paradox of Dividends in Today’s Markets

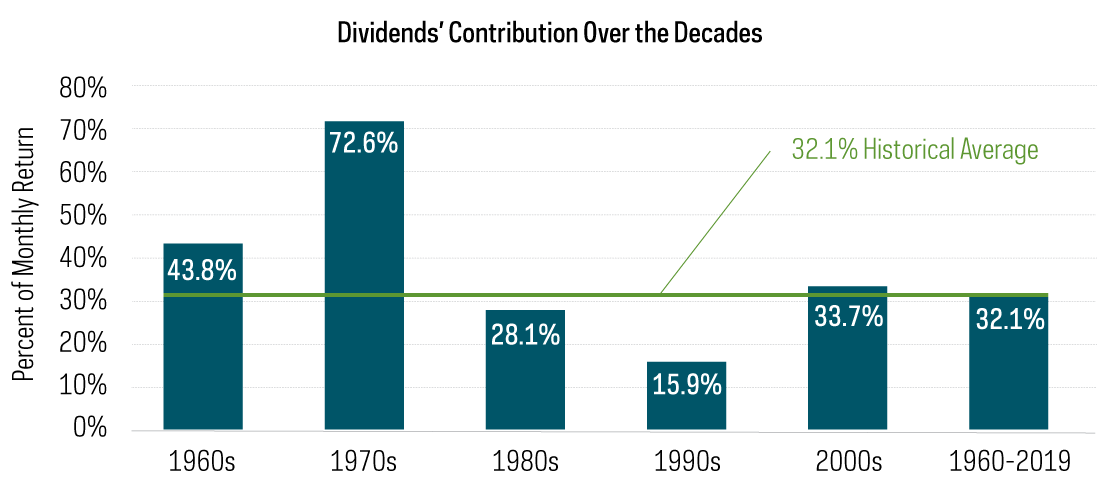

The pandemic-driven shutdown of much of the global economy—and the uncertain path to recovery—are weighing on nearly every aspect of the investment landscape. Of particular concern to many investors is the question of what will happen with dividends. It’s a fair question, when you consider that dividends have contributed approximately 32% of the S&P 500’s total return since 1960.

Source: Morningstar, 1/1/60-12/31/19. Past performance is no guarantee of future results. Chart is provided for illustrative purposes.

Paradoxically, if we are in for a period of muted equity returns—an environment where at least some companies’ dividends may be at risk—dividends may have increased importance. During the return-challenged 1970s, dividends accounted for nearly three-quarters of S&P 500 returns. It wasn’t an entirely lost decade. Investors earned a cumulative total return of 77% from the S&P 500 in that decade. The catch, however, was that 60% of that 77% was from dividends.

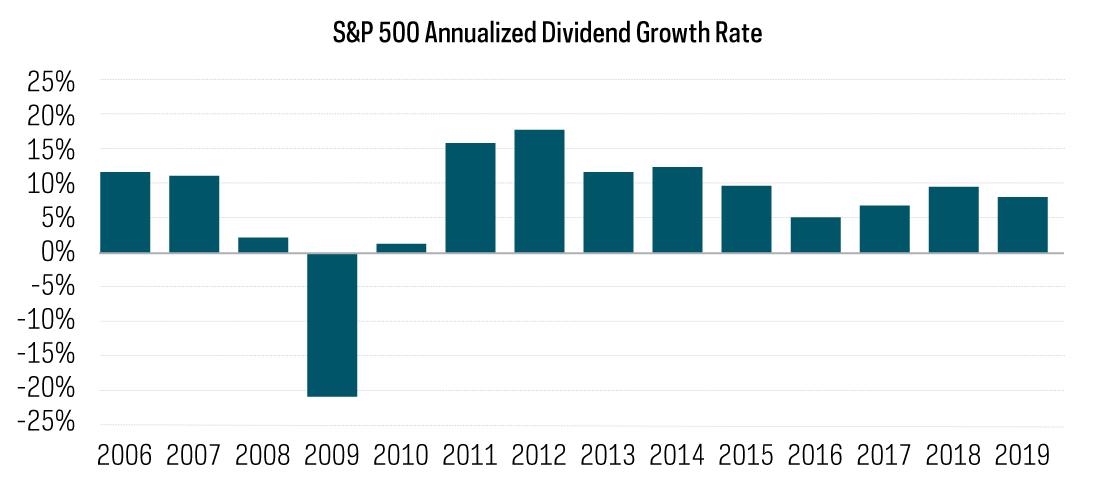

The Economic and Legislative Risk

Dividends are what is left over after a company looks at its income and determines how much is needed to reinvest in the business and what should be saved for a rainy day. The remainder can be distributed to investors in the form of dividends. In times of economic risk, not only can that income shrink, but many companies increase their savings. Reductions in investment are often not enough to offset these challenges. Still, in most historical environments, dividends have increased for the S&P 500. The glaring exception is 2009, which saw a substantial decrease of over 20%. Given the significant impact of the current global shutdown and the implications for the potential path to recovery, it is a data point that should be considered relevant.

In addition to the economic risk to dividends, investors have also become understandably concerned regarding the current legislative risks to dividends. In the United States, the CARES Act stimulus bill specifies that companies receiving federal assistance will, among other restrictions, be prohibited from paying a dividend for a period of time. The key to keeping this legislative risk in perspective is to remember that only companies that receive federal assistance will be subject to these restrictions. The legislative risk to dividends in the United States can be thought of as being encompassed by the broader economic risk, but not necessarily exacerbating it.

In contrast, European regulators have been discussing restrictions on paying dividends that are not contingent on receiving government assistance. The discussions have been limited to companies in the financial sector so far. There could, however, be a modest risk that some firms in Europe would be financially able to pay or raise their dividends, but could be legislatively prohibited from doing so.

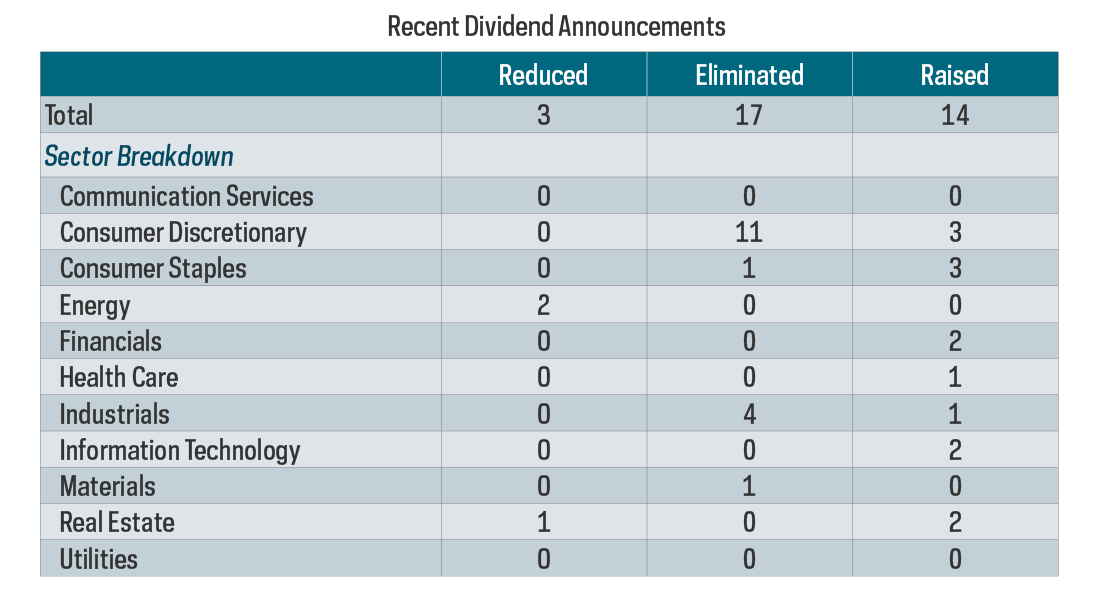

The Current Dividend Scorecard

The announcements of dividend cuts and eliminations—and surprise, some increases—have already begun. Here is a rundown on dividends thus far:

Source: ProShares and Bloomberg. Based on DPS announcements from 3/1/20-4/16/20.

Related: Health Care ETFs: Winners and Losers