NOW its a party!

As a long time baseball fan, I know a lot of the classic expressions around that sport. One comes to mind when I look back at what has transpired in the stock market since last Thursday’s post. They say that every time you go to a ballgame, you see something you’ve never seen before. I have found that to be pretty accurate.

So too does this occur in the markets, stock, bond and commodity. Remember oil futures going negative? Bond rates flying up from near zero? The S&P 500 falling 33% in 5 weeks, but few remember it now? After all, it was all the way back in 2020.

Over the past week, I’ve seen something none of us have. QQQ falls down, falls some more, but as if there was some giant swap agreement from QQQ to small caps (IWM, IJR, CALF) and the Dow Jones Industrial Average (DIA), they moved practically in opposite directions.

There are some market “events” that can be blown off as merely part of the long-term investing process. I’m going to wait a bit before I chalk this up to another mini-meltdown, a la NVDA dropping 10% in a day last spring.

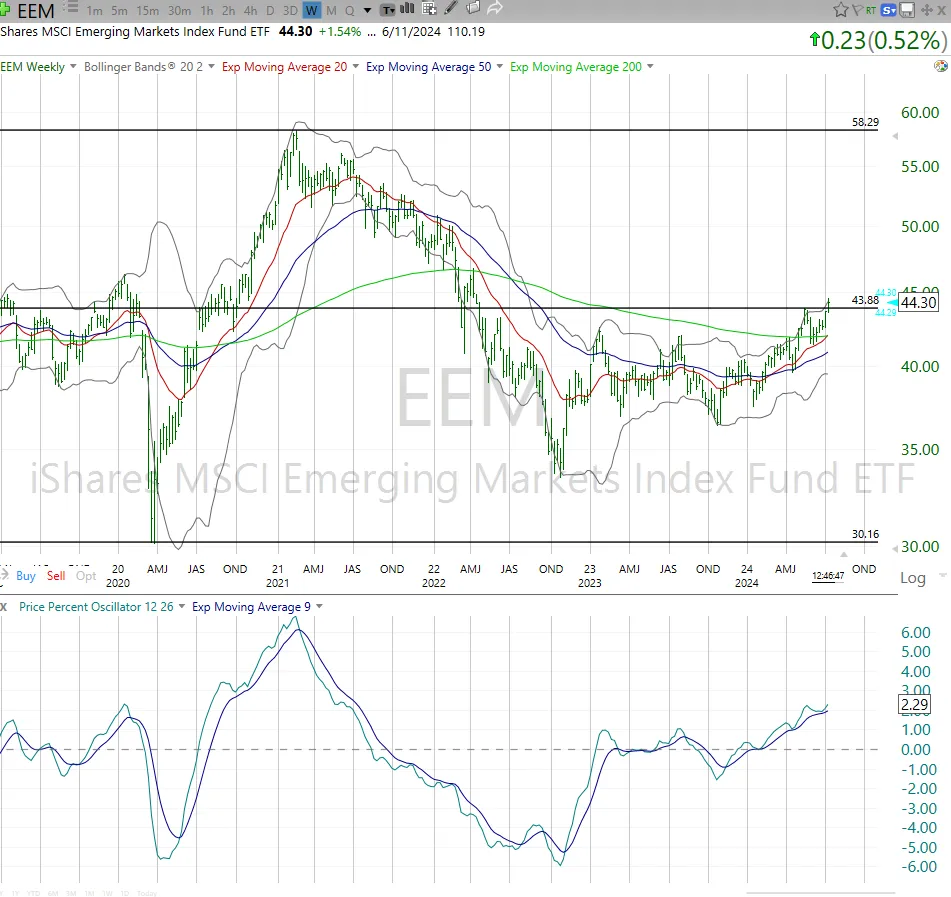

Last week here, I posted that the chart below (EEM, Emerging Market stocks), was “what a strong chart looks like.” My vision was out perhaps 6 months into the future. And, right on cue, EEM reminded me/us what markets are about these days. A lack of “sustainability” in up and down moves.

This is the chart from last week.

And here it is as of this writing. The difference below is that what looked like a potential “curling up” in the price of EEM did occur in DIA and elsewhere, but not here. There is still such a “home bias” by US investors, that when both presumptive US Presidential nominees speak about policy toward Asia, that can stop what looked like it might be a moving train.

This is just short-term trading stuff, the type of thing I take more seriously in my Macro Traxx portfolio at www.SungardenInvestment.com since that portfolio is a “swing trade” account with a heavy T-bill buffer to support it. Other than that, my work looks more to what hasn’t changed about EEM during this nutsy week we just had.

Specifically, while the strong breakout up through $44 has not yet occurred, the not-unusual-to-see pullback still puts EEM squarely in the middle of the up-trending set of lines I’ve drawn in. Think of this as a car staying in its lane, even if it is not going exactly straight. Frankly, it is too much to ask of nearly any ETF or stock to break out “cleanly” as this one looked poised to do.

Bottom line: charting ETFs and stocks is multi-faceted, and multi time framed (I look at 12 different time frames, depending on the purpose of the analysis). Every investor has to figure out for themselves to what extent which time frame matters. The longer we look out, the more margin for error we can grant ourselves, and the higher percentage chance things will work out.

PERFORMANCE THAT MATTERS

I am glad I decided to add the “Since 5/1/24” column last week. Because if we look at 4 of the 15 macro market measures I track here each Thursday, it tells a story.

-

Small Caps “crushed it” last week. Maybe a short squeeze, or maybe the fact that it doesn’t take much buying pressure to lift those 2,000 stocks (since just a handful of the largest US stocks combine to be bigger than those 2,000). We chartists don’t overthink things, we just do things.

-

So with IWM and SPYD rallying while QQQ, FNGS and SPY fell back, it makes that period since 5/1/24 look like a “normal” inclusive rally. FAANG stocks spike, small caps tag along, SPY is right behind IWM, and SPYD (the 80 highest-yielding S&P 500 stocks) comes in a respectable 4th, but still makes some darn good progress for less than 3 months.

-

This is more like what we market veterans are used to seeing. But it took an historic event (IWM up 4% one day, QQQ down 2% - never happened before) to right-size that column. And since the start of 2022 and the Fed rate hike cycle, small caps have done virtually nothing and dividend stocks have been severe laggards.

Let’s see which parts of this change in the weeks and months ahead. I still have it as a “most likely scenario” (famous last words) that July and August will be volatile but profitable in parts of the market, but that September and October will be a time for EVERYONE to learn how to hedge AND exploit rough markets.

Either way, I just do what I do, methodically, day after day. That’s a process, and that’s what we aim to teach at Sungarden.