Advisors and clients are now into an extended timeframe in which they’ve heard about a strong valuation case and other supporting factors for small-cap stocks and all of those “goodies” have been met with slack performance.

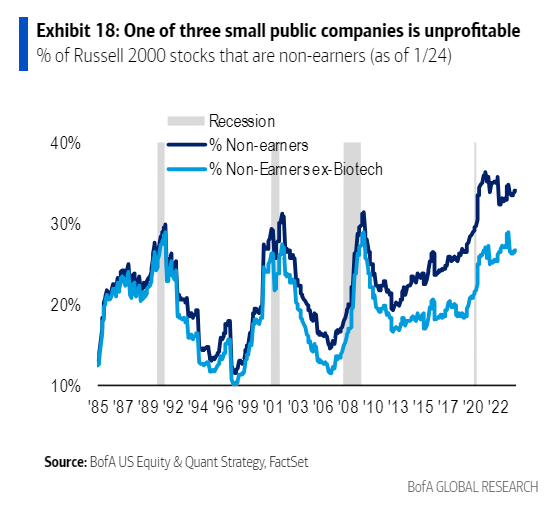

Some of the malaise is easy to explain. Smaller stocks are interest rate-sensitive and the Federal Reserve’s plans for cutting rates appears delayed at the moment. Add to that, as detailed in the chart below courtesy of Bank of America, a broad swath of stocks residing in major small-cap benchmarks are shares of money-losing companies.

However, that’s not an indictment of small-cap investing writ large. It’s merely a reminder that advisors need to be selective in this space.

VBR: Value in Small-Cap Value

In the large-cap space, it’s been tough to cozy up to value stocks, but there’s value in small-cap value. The venerable Vanguard Small Cap Value ETF (VBR) proves as much. VBR, which follows the CRSP US Small Cap Value Index, offers value on multiple fronts, though its 0.07% annual fee is a prime example and one sure to delight cost-conscious clients. That’s 106 basis points lower than the average fund in this category.

Of course, low fees are nice, but performance matters. VBR delivers on that count, too. Over the past three years, the Vanguard ETF outperformed both the Russell 2000 and the Russell 2000 Value indexes while sporting significantly lower annualized volatility than those gauges.

“Indeed, the exchange-traded fund share class, VBR, outpaced the category norm by 1.5 percentage points annualized since it started tracking its current index in April 2013 through January 2024,” notes Morningstar analyst Zachary Evens. “Its larger market-cap orientation helped the fund maintain a lower standard deviation of returns than the category average over this time, allowing it to expand on its risk-adjusted advantage.”

Indeed, the 856 stocks held by VBR have a medina market value of $6.1 billion, which is well into mid-cap territory. That likely explains the ETF’s reduced volatility profile.

More VBR Virtues

In addition to its low fee, VBR sports other familiar Vanguard virtues, including a diverse portfolio in which none of the components exceeds a weight of 0.74%.

That holdings-level diversification is important because just three sectors –industrials, financial services and consumer cyclical combine for over 61% of the fund’s weight.

“Despite some differences, the fund remains an excellent representative of the small-value category and should perform well when value stocks are in favor,” concludes Evens. “Superior diversification helps control risk in this volatile category, even if it may hold the fund back from time to time. Additionally, its low expense ratio presents a low hurdle for this fund to expand on its risk-adjusted advantage going forward.”

Related: The Argument for Investment in Innovation Remains Compelling