Written by: Andrew Okrongly, CFA & Brian Manby, CFA

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Key Takeaways

- Due to balance sheet concerns, the higher-for-longer interest rate environment has been a significant headwind for the relative performance of U.S. small-cap equities.

- The market’s expectation of a Fed rate-cutting cycle starting in September 2024 triggered a “catch-up” rotation into small caps in July 2024.

- Going forward, we think small caps can continue to benefit from gradually easing monetary policy, reasonable economic growth (i.e., avoiding a near-term recession) and attractive valuations.

- Within our Model Portfolios, we remain modestly over-weight in U.S. mid- and small-cap stocks relative to their larger counterparts.

Throughout 2023 and the first half of 2024, the returns on U.S. small-cap equities significantly lagged behind their larger peers. This performance gap can be attributed to several factors, but one key fundamental driver has been the higher-for-longer interest rate environment and the sensitivity of smaller companies to elevated short-term yields.

Smaller companies tend to utilize floating rate debt to a much greater extent than larger companies. As highlighted by our colleague Jeff Weniger in a recent piece, in 2023 roughly 30% of small-cap companies’ debt was variable rate, compared to less than 10% for large caps. We identified this risk several years ago, yet the market continuously punished these smaller companies due to concerns around this balance sheet dynamic.

This can be seen in the close relationship between small-cap performance and Fed policy expectations in recent years despite a relatively robust economic environment.

Changes in Fed Policy Expectations and Interest Rates Have Been Highly Correlated to the Relative Performance of U.S. Small Caps vs. Their Larger Counterparts

Sources: WisdomTree, Bloomberg, as of 8/20/24. “US Small Caps vs. Large Caps” represented by S&P 600 Index vs. S&P 500 Index. Past performance is not indicative of future results. You cannot invest directly in an index.

While it is up for debate whether this market action was justified based on the fundamental impact that higher interest costs had on small-cap companies’ bottom lines, going forward, we see several reasons for optimism.

First, the market is anticipating that a Fed easing cycle could begin as early as September of this year. This spurred a brief, albeit dramatic, rotation into small caps last month, which continued the trend of performance correlation with interest rate implications.

Excess Daily Return of the Russell 2000 Index over the Russell 1000 Index

Sources: WisdomTree, FTSE Russell, as of 8/26/24. Past performance is not indicative of future results. You cannot invest directly in an index. CPI = Consumer Price Index. ISM = Institute for Supply Management.

Looking ahead, we think this rotation may have legs, as small caps have historically outperformed larger companies in the 12-month period following the first Fed rate cut in a monetary policy easing cycle.

Relative Performance of U.S. Small Caps prior to and after the First Fed Rate Cut

Sources: FactSet, WisdomTree, as of 8/20/24. Based on relative performance of the Russell 2000 Index compared to the Russell 1000 Index.

Uses data from last three Fed rate-cutting cycles beginning in July 2019, September 2007 and January 2001. Past performance is not

indicative of future results. You cannot invest directly in an index.

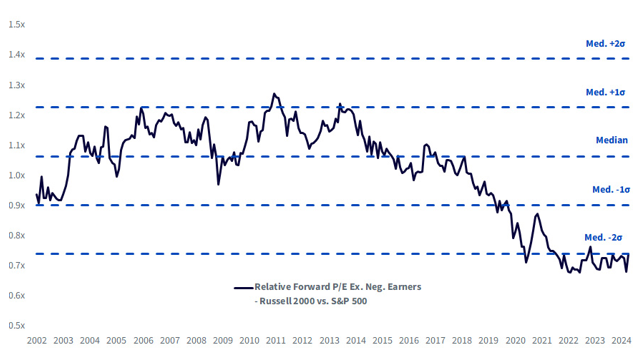

Lastly, prevailing valuations remain attractive. For virtually the entire post-pandemic environment, small-cap multiples hovered about two standard deviations below their historical median versus large caps and remain there today, providing an attractive entry point for those considering an allocation.

Relative Valuations of Small Caps Compared to Large Caps

Sources: WisdomTree, FactSet, Russell, S&P. Past performance is not indicative of future results. You cannot invest directly in an index.

Several factors are contributing to the valuation gap between large and small caps, including the aforementioned interest rate burden, AI enthusiasm—particularly within the large- and mega-cap space—and a residual fear of recession that continues to dissipate.

While the U.S. economy may be showing signs of weakening, small caps are arguably already priced for a recession. In this scenario, we anticipate that unexpected macroeconomic trouble would disproportionately afflict richly valued large caps more than already-discounted small caps.

Should the macro environment continue to signal a soft landing or simply stable economic conditions, small caps may finally enjoy a long overdue catch-up rally. In this scenario, even modest multiple expansion back toward their historical median versus large caps could produce significant gains for an asset class desperately in need of them. For a market that has historically been associated with sky-high multiples during periods of risk-on enthusiasm, today’s measures look surprisingly modest amid a backdrop of impressive large-cap gains.

With these factors in mind, we continue to tilt toward high-quality U.S. mid-caps and small caps within our Model Portfolios. We look to achieve this quality focus through strategies that use static and trend-based observations of return on equity (ROE) and return on assets (ROA) to identify companies that are more profitable and growing earnings faster than the broader universe.

Financial advisors can learn more about the WisdomTree lineup of equity and multi-asset Model Portfolios by visiting our Model Adoption Center.

For more information about WisdomTree go to wisdomtree.com/investments.

Related: Navigating Earnings Season: In the Middle of the Muddle

Important Risks Related to this Article

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

Past performance is not indicative of future results.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S.

This WisdomTree article is provided as part of a paid sponsorship.