For a discussion between CEO Jan van Eck, Portfolio Manager Shawn Reynolds and Deputy Portfolio Manager Charlie Cameron about our commodities outlook and the inflation trade, watch this webinar replay: Navigating the Markets: Inflation and the Risks to Goldilocks. The chart pack can be downloaded here.

As 2021 has taken shape, for many, the inflation debate has seemingly shifted from “how much” to “how long”. More recently, there have been a number of factors pointing towards inflation as a potential protracted risk to investors. Consideration of this risk is clearly being reflected in the price trends of natural resources and commodities, which historically have been a leading indicator of inflation as they sit at the intersections of supply/demand and consumer/producer.

The historic fiscal and monetary policy response to the COVID-19 crisis has reignited the urgency of inflation discussions as the global economy reopened. Meanwhile, commodity and resource supply has been constrained from the sharp drop in capital investment over the last several years. In simplified terms, there is more money in the system, increased government and consumer spending, and rising prices through consumption. Plus, with less supply of materials, higher input costs are felt by producers, and these end up being passed on at the register in the form of rising prices. These trends, along with increased manufacturing activity and the possibility of wage inflation, establish a sturdy price floor, thus contributing to a potential prolonged inflationary cycle.

Historically, natural resources and commodities broadly have acted as a viable hedge to inflation. More specifically, we believe companies in this areas, particularly within energy, industrials metals and gold, have healthy balance sheets, attractive valuations and the ability to generate significant free cash. Many companies also exhibit what we view as fascinating longer term growth profiles as direct inputs and beneficiaries of the resource transition movement fueled by technological advances and sustainability.

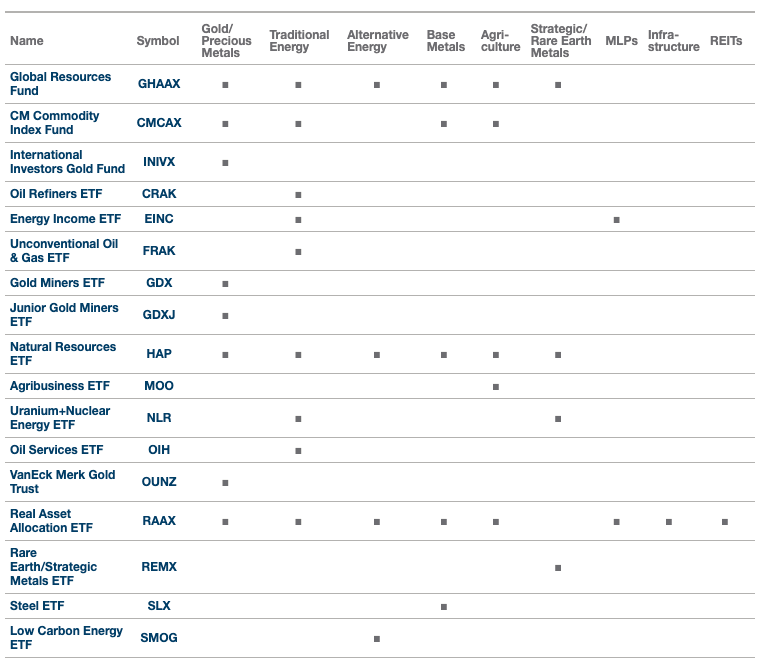

VanEck Inflation Sensitive Solutions

VanEck has a history of inflation sensitive investing in natural resources and commodities for over 50 years, offering investors actively and passively managed strategies, from physical commodities to natural resource equities. We offer specialized exposure to individual sectors and diversified solutions with broad exposure across sectors and industries.

More information including recent performance and current holdings can be found by clicking the fund names below:

Actively-managed approach to companies with unique competitive advantages associated with traditional commodities and those leading the development of emerging resource applications and technologies.

International Investors Gold Fund

Proven fundamental, bottom-up process emphasizes stock selection based on industry experience to access opportunities across the gold mining sector.

A passively managed fund that offers diversified commodities exposure by spreading its exposure across multiple maturities and maintaining a constant maturity per commodity to mitigate the impact of negative roll yield.

VanEck Vectors Oil Refiners ETF (CRAK)

Provides exposure to an industry that may generally benefit from lower oil prices, a segment that has historically interacted differently with oil prices and market dynamics than other energy segments.

VanEck Vectors Energy Income ETF (EINC)

Offers exposure to MLPs and energy infrastructure companies that have historically exhibited attractive yield characteristics without burdensome K-1 tax reporting.

VanEck Vectors Unconventional Oil & Gas ETF (FRAK)

Provides access to the unconventional oil and gas industry, an industry that has experienced rapid growth and transformative technology advancements.

VanEck Vectors Gold Miners ETF (GDX)

The nation's first ETF that offers direct exposure to the gold mining industry, which may provide leverage to rising gold prices.

VanEck Vectors Junior Gold Miners ETF (GDXJ)

Access to junior gold miners, including smaller exploratory or early development phase companies that are responsible for many gold reserve discoveries worldwide.

VanEck Vectors Natural Resources ETF (HAP)

Offers exposure to global companies involved in six natural resources segments (including agriculture, energy, metals and renewable energy).

VanEck Vectors Agribusiness ETF (MOO)

Positioned to meet growing demand as global population growth is driving increasing food demand and the need for efficient agricultural solutions.

VanEck Vectors Uranium+Nuclear Energy ETF (NLR)

Access to an important segment of the nuclear energy market, which is a significant clean energy source at an inflection point from increasing demand.

VanEck Vectors Oil Services ETF (OIH)

Invests in highly liquid companies in oil services industry, including both domestic and U.S. listed foreign companies allowing for enhanced industry representation.

Provides investors with a convenient and cost-efficient way to invest in gold through shares with the option to take physical delivery.

VanEck Vectors Real Asset Allocation ETF (RAAX)

Comprehensive allocation strategy that invests across real assets and seeks to reduce volatility by responding to changing market environments.

VanEck Vectors Rare Earth/Strategic Metals ETF (REMX)

Provides access to the rare earth or strategic metals industry, which supplies key inputs to many of the world’s most advanced technologies.

VanEck Vectors Steel ETF (SLX)

Access to the steel industry, an industry supporting global industrialization and economic expansion.

VanEck Vectors Low Carbon Energy ETF (SMOG)

Exposure to low carbon energy that includes not only solar, wind and hydro companies, but also in more recently developing areas of the market such as electric vehicles, battery tech, hydrogen and fuel cells.