Written by: Samuel Rines

Key Takeaways

- No, this is not another election piece.

- Yes, there are tailwinds and headwinds from the recent storms.

- With the myriad potential policies of reshoring manufacturing, these are underappreciated trends.

Hurricanes Helene and Milton cause widespread destruction. From homes to roads to bridges, the visuals were rather shocking. The consequences of these events are—typically—quickly shrugged aside by markets as one-off events with little long-term consequence. That is mostly correct. But not entirely so.

For some companies, the revenue and earnings hits are “unrecoverable.” For hotels and other leisure businesses, the two primary levers of revenues are occupancy and room rates. While you can raise room prices, you cannot create days. Those are simply lost. That is not the case for something like lab testing. Maybe those lab tests were delayed, but they are still necessary.

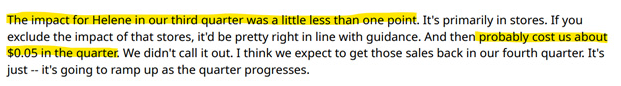

Ryman Hospitality

Source: Ryman Hospitality, as of 11/11/24 (emphasis added).

Quest Diagnostics

Source: Quest Diagnostics earnings call, as of 11/11/24 (emphasis added).

And then there is the commentary from others. These are the suppliers of roofing, paint and generators. These have much longer horizons to their commentary. Some had their production or sales temporarily impacted. But not only will these sales be “made up,” there will be—to borrow the common refrain from monetary policy—long and variable lags.

Beacon Roofing Supply

Source: Beacon Roofing Supply earnings call, as of 11/11/24 (emphasis added).

Owens Corning

Source: Owens Corning earnings call, as of 11/11/24 (emphasis added).

When it comes to roofing, the hurricanes were a mixed bag. Near term, there are headwinds. Owens Corning—which makes shingles, insulation and other construction products—saw some costs associated with the shutdown and restart of production. But it also sees some positives that should begin to come through—in 2025.

Beacon Roofing can be thought of as the middleman for the shingles made by companies like Owens Corning. And its commentary was similar. The demand for roofing products will extend over the next 18 months (six quarters) and constitutes 2% of annual shipments. That might not sound like much, but for a business that grows around the same as the GDP, it is a welcome tailwind.

Sherwin-Williams

Source: Sherwin-Williams earnings call, as of 11/11/24 (emphasis added).

Source: Sherwin-Williams earnings presentation, as of 11/11/24 (emphasis added).

On the paint side, it is a similar outlook. Sherwin-Williams is one of the better examples of how this dynamic is likely to play out with both a retail and a commercial distribution network. Stores were shuttered, and there were costs associated with those closures. But it is likely those sales will be recouped quickly as the stores reopen and demand for primer and paint begins to flow through the affected areas.

Generac

Source: Generac earnings call, as of 11/11/24 (emphasis added).

Then comes Generac. As one of the leaders in the business of providing whole home generators and similar power solutions, there is no better tailwind than extended periods of power loss. That is exactly what happened. The tailwind is unlikely to be short-lived, either. A large generator is not a small investment, and there is a lead time. The prolonged outages (not simply in Florida but also from Beryl in Texas) will be a positive for the foreseeable future. It was a similar story in the European market due to energy insecurity. And the war had been raging for more than a year. These are instantaneous shifts. They take time.

Superficially, these three probably seem connected by a singular, specific, one-off event. But that is only part of the story. Paint and roofing have a significant exposure to crude oil derivatives as an input. Following the installation of a generator, it is energy that is needed to power them.

And that is where the potential policy tailwinds come into play. Not as a tailwind to sales. But as a tailwind to the margin structure of the business. With the promise of lower regulations on energy production, the policy environment is likely to favor those with cost structures levered to the energy complex. Combine that with the push for more manufacturing and production in the U.S., and it is time to dig into those companies that can weather any storm.

Related: Navigating High-Yield Bonds: Opportunities, Risks and Fallen Angels

Important Risks Related to this Article

Past performance is not indicative of future results.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S.

This WisdomTree article is provided as part of a paid sponsorship